Foreign investment floods into Miami real estate after pandemic dip

International investment in Miami’s real estate market has spiked over the last year after dipping during the pandemic.

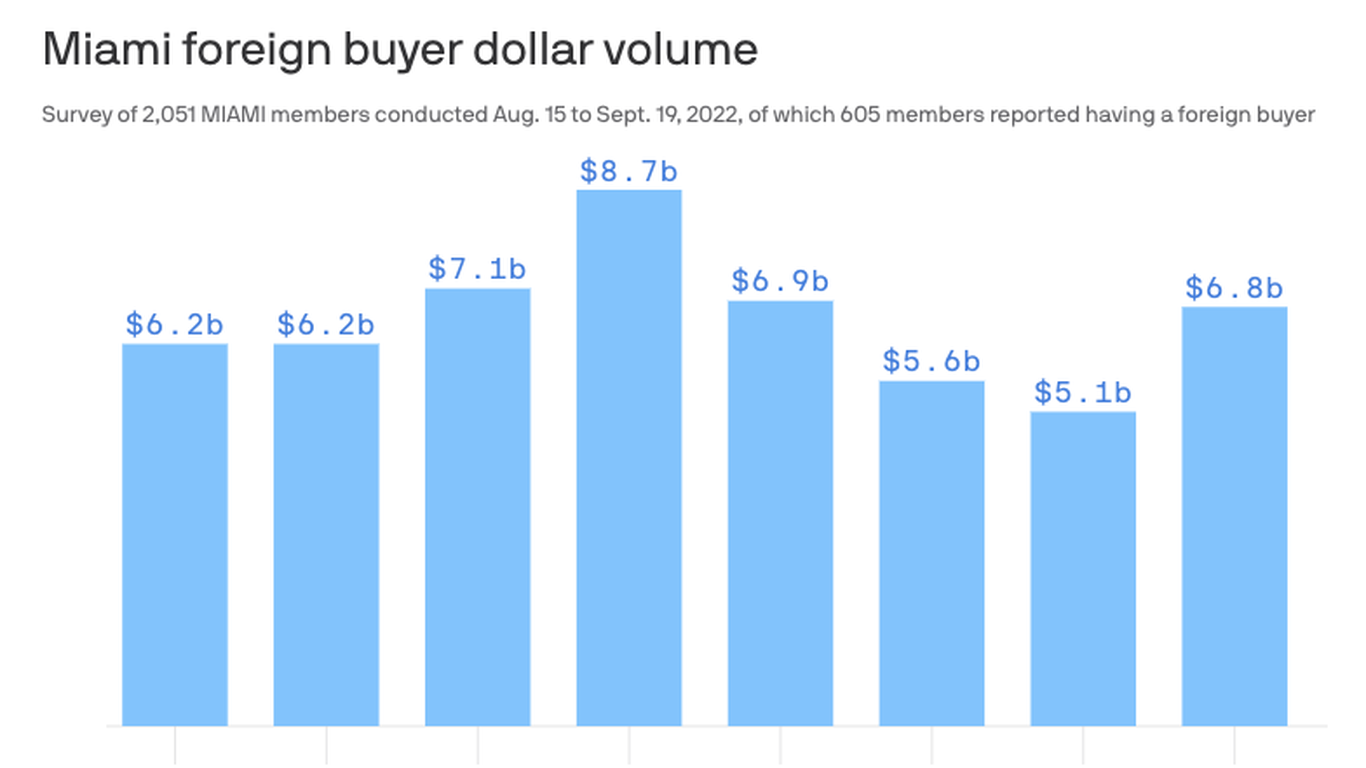

Driving the news: Foreign buyers picked up $6.8 billion of South Florida residential real estate between August 2021 and July 2022, according to a new report from the Miami Association of Realtors.

- That’s a 34% increase from the sales volume the year prior.

Why it matters: Miami’s real estate market has long been a haven for foreign buyers, differentiating us from the rest of the country.

The big picture: Sales to foreign buyers are on the rise nationwide. The dollar volume of foreign buyer purchases increased 8.5% nationally between August 2021 and July 2022, per the report.

By the numbers: Foreign buyers made up 17% of home sales in Miami over this period, and the median price of homes they bought was $500,000. The majority, 66%, made all-cash purchases.

- Of those buying, nearly 40% said they would use the property as a residential rental, while around 20% would make it their primary residence.

- Buyers came from 54 countries, with Argentina leading the way (16%), followed by Colombia (13%) and Canada (8%).

What they’re saying: “Colombia and Argentina, like other Latin American countries, look to the U.S. for financial stability,” Ines Hegedus-Garcia, the association’s board chairperson, told Axios.

- “Miami continues to be the global conduit because of our diversity, and although many complain about so-called ‘unrest,’ our political environment continues to be more stable than many,” she added.

What we’re watching: The association tracks global web searches for Miami real estate and found people from Colombia searched the most last month.

- Brazil quickly rose the ranks in December, going from 12th in November to 7th in web searches, a jump the Realtors’ group attributed to political turmoil and a recent shift in government.