Florida ranks high for most overvalued home prices in new report

Week in Review: Rental prices, homicide victim, Palm Beach County Sheriff’s budget and tax revenue

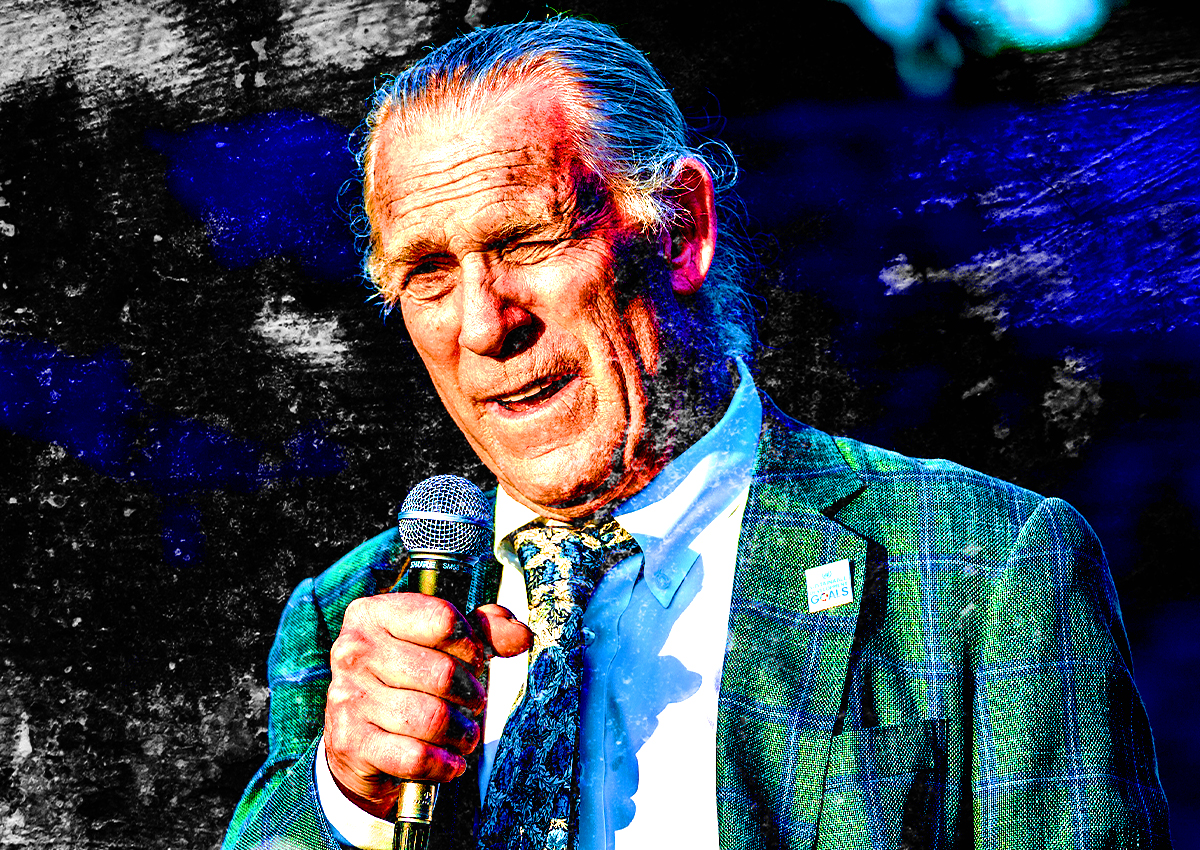

Not yet a subscriber? Palm Beach Post’s Rob Landers brings you some of the stories you might have missed this week.

Rob Landers, Palm Beach Post

Economic challenges are pressuring home sales across the country but 99% of the top 100 markets still sizzled in May, with South Florida climbing the list of most overvalued regions in the nation.

The Miami metro area, which includes Palm Beach, Broward and Miami-Dade counties, ranked 42nd nationally, with buyers paying 33% more than what they should based on historical trends, according to a joint study released this week by Florida Atlantic University and Florida International University.

While the tri-county area’s spot is near the middle of the pricing barometer, it’s a jump from this time last year when southeast Florida homes were overvalued by just 13%, ranking it 74th.

7 Florida markets in top 25 most overvalued

Seven areas in Florida made it into the top 25 most overvalued markets, with Fort Myers ranking the highest statewide and sixth place nationally. Homebuyers there paid 60% more in May than they would in a normal market.

Lakeland, Tampa, Bradenton-Sarasota, Melbourne, Daytona Beach and Orlando were also in the top 25.

“There are plenty of reports that mortgage applications and home showings are falling as interest rates rise,” said FAU real estate economist Ken H. Johnson in a press release. “We expect prices eventually will level off as well, particularly if a recession occurs and lending rates remain high. But so far prices continue to rise in the vast majority of markets.”

On Thursday, interest rates on a 30-year mortgage averaged 5.67%, according to Bankrate.com. That’s down from 5.83% last week.

Boise, Idaho, was the only U.S. housing market that saw a slip in prices. The pandemic-born boom town still took the top spot for most overvalued at 70% but that was down from April’s 71%.

Condos hurting after Surfside: Insurance hikes are just first hit in a costly legacy for this condo’s owners after Surfside

Market favors sellers: Can’t find a home? Home sales report shows another hike in prices, drop in inventory

Tips to buying a home in hot real estate market: Strategy and cash, not love letters

Some Realtors said the study isn’t taking into account current factors in a mercurial market where inventory, buying power and the stock market can cause major shifts in a matter of weeks.

“May sales went under contract in March so you are looking at numbers too far in the past,” said Jeff Lichtenstein, president of Echo Fine Properties. “It’s still a seller’s market, but it’s not where it was.”

One leading indicator that the market may be moderating is a recent increase in inventory, Lichtenstein said. At PGA National in Palm Beach Gardens there haven’t been more than 24 homes at a time to choose from over the past two years, but it was up to 50 homes this month.

A similar increase was seen in West Palm Beach, where homes in communities that hug the Lake Worth Lagoon increased from fewer than 40 for sale to about 70 in the past two months, said Burt Minkoff, senior director of luxury sales for Douglas Elliman.

“There’s no need to rush and reduce prices, but you are seeing price reductions on a regular basis,” he said. “You are starting to see a reluctance on the part of sellers to accept that prices may be taking a turn, but at the same time, we don’t really know given that everyone is away.”

For the first time in two years, Palm Beach County home sales are hitting a traditional summer slump as people feel comfortable traveling again, Minkoff said. Also, younger clients aren’t working on a strict seasonal clock like the long-established trends of snowbirds. That lends an added uncertainty to a market already fretting about interest rates, inflation, high gas prices and the stock market.

Top dollar for beachfront: Palm Beach’s extravagant real estate prices ooze into the restrained Town of Gulf Stream

New Florida residents buying up homes: Realtors hunt for homes amid low-inventory as high-demand buyers keep moving to Florida

Shifting market: Good news for sellers and buyers: Palm Beach County home prices top record; more homes listed

“A lot of people are moving down but they aren’t doing it on our timetable,” Minkoff said. “Demand is going to continue. It just may not be what we normally expect.”

An increase in inventory doesn’t mean it’s back to a healthy amount. In May, about 1.7 months’ supply of single-family homes were available for sale in Palm Beach County. A balanced market that favors neither the buyer nor seller has 5.5 months of inventory, according to the Florida Realtors.

Areas where May home sales were closer to historical norms included Baltimore, which was 3% overvalued; Honolulu, which was 3.5% overvalued; and Washington, D.C., which was 4.3% overvalued.

New York City ranked 97th of the top 100 markets at just 4.5% overvalued.

The housing report emphasizes that researchers expect housing market downturns to look different depending on the state and region. Markets with increasing populations and persistent inventory shortages won’t see major price cuts, the report noted.

Significant price declines, however, are expected in areas with stagnant population growth and higher inventory.

“We’re still doing plenty of business,” Lichtenstein said. “But the whole fairytale of not doing any work and being totally one-sided and telling the buyer to go pound salt is over.”