How Inter Miami’s plan to cash in on Messi’s global popularity is coming together

The day before Inter Miami opens its 2024 MLS season, one that will come with heavy expectations due to a roster built around Lionel Messi and a trio of other former Barcelona stars, team executives stood on a stage overlooking the club’s home field and unveiled the venue’s new title sponsor.

Inter Miami and Messi’s home is now Chase Stadium, part of a multi-year partnership with JP Morgan Chase, a big jump from the charitable arm of Autonation. That the naming rights of the temporary stadium in Fort Lauderdale was up for renewal in 2024 was no mistake, but rather down to a commercial plan that was centered around the work owner Jorge Mas was doing behind the scenes to lure Messi to South Florida when his contract with Paris Saint-Germain ended last summer.

“We were prepared,” Inter Miami chief business officer Xavier Asensi said Monday in an interview inside a suite at the stadium. “We were willing to embrace and were ready to understand how we can capitalize on these things, knowing that it would be big.”

Most conspicuously ahead of the 2023 season, Inter Miami left the No. 10 jersey open and unassigned. But behind the scenes, Asensi, who joined Inter Miami in 2021 after a decade at Barcelona, where he spent several years building out the Spanish superclub’s operation in Asia and eventually rose to chief commercial officer, laid the groundwork for the potential that Messi, who many consider to be the greatest player of all time, would opt to sign in MLS.

Contracts with sponsors and partners included escalators and bonuses if Inter Miami signed a player with five or more Ballon d’Or awards — only Messi and Cristiano Ronaldo have as many; Messi won his record eighth this year. Other sponsorship deals were timed for renewal to take full advantage if Messi became a Miami player.

Messi did sign, of course, and that built-in nimbleness has allowed Miami to reap the commercial benefits. Inter Miami earlier this year unveiled a new jersey sponsor, Royal Caribbean, replacing crypto company XBTO, in a deal that the team says is the “largest partnership in MLS history.” Notably, that jersey sponsorship with Royal Caribbean extends beyond Messi’s playing contract. The stadium naming rights brought in yet another major global partnership.

This preseason, Inter Miami further capitalized on Messi’s commercial appeal by going on a global tour that included friendlies in El Salvador, Saudi Arabia, Hong Kong and Japan. Miami had requests to play in countries around the world, but arranged a tour that they felt balanced the sporting side with the commercial. The tour also provided a chance to meet with companies and potential partners beyond just one-off games. That elevated the business value of the tour beyond just fees for the games.

“It is a melting pot that you put everything together,” Asensi said. “It has to align with the sporting side, then you have to decide if what you want is to maximize the revenue, together with increasing the brand exposure and the brand equity, as well.”

Some lambasted the tour for going sideways. Inter Miami won just one of seven games across the 23,000-plus miles it flew to play games. On top of that, an international incident was spurred when Messi did not play in Hong Kong due to an adductor injury. (His absence was decried by the Hong Kong government and eventually caused two Argentina friendlies in China to be canceled. Just this week, Messi put out a video statement on Weibo, the Chinese social media platform, to explain again why he did not play.)

The commercial side, however, was undoubtedly a success.

While Asensi did not comment on exact figures, he said Inter Miami generated revenue greater than preseason figures for some of the biggest clubs in the world, including Manchester United, Real Madrid and FC Barcelona. (Estimates have put preseason revenue for those teams around $15 to $20 million for the most recent U.S. preseason tours.)

“That’s mind-blowing to me,” Asensi said. “Because that’s an MLS team that did that.”

Messi’s arrival in MLS has presented opportunities not seen in MLS since David Beckham signed with the LA Galaxy in 2007. The Galaxy, like Inter Miami, went on multiple international tours to capitalize on Beckham’s global appeal, including trips to Indonesia, the Philippines, China, Hong Kong, Korea, Australia and New Zealand. At the time, the Galaxy, like Miami, were paid fees bigger than nearly any other team in the world, according to former Galaxy president of business operations Tom Payne. At a time when most MLS teams were losing money, the Galaxy were making $1 million net per game on the international tours.

But Payne, like Asensi, said the benefits extended beyond appearance fees.

“A lot of it had to do with branding and getting the Galaxy brand out there,” Payne said. “I would still argue, maybe not this current day because the Messi thing is so hot, but the Galaxy brand is still bigger around the world than pretty much any brand in Major League Soccer, and that has a lot to do with those tours.”

Miami certainly saw those periphery benefits first-hand during their tour. Adidas stores in Hong Kong had Inter Miami displays right at the entrance. The crowds in Saudi Arabia, Hong Kong and Japan were notably filled with the distinctive pink of Inter Miami’s jersey. Google searches around the team and Messi spiked in the respective countries around game day. A recent SSRS Sports Poll showed that Messi is the first soccer player to rank as Americans’ favorite athlete for a quarter of a year in the 30-year history of the poll, coming in first in the fourth quarter of 2023. Inter Miami, meanwhile, ranked as the fourth-favorite soccer club behind the “Big 3” of Real Madrid, Barcelona and Manchester United.

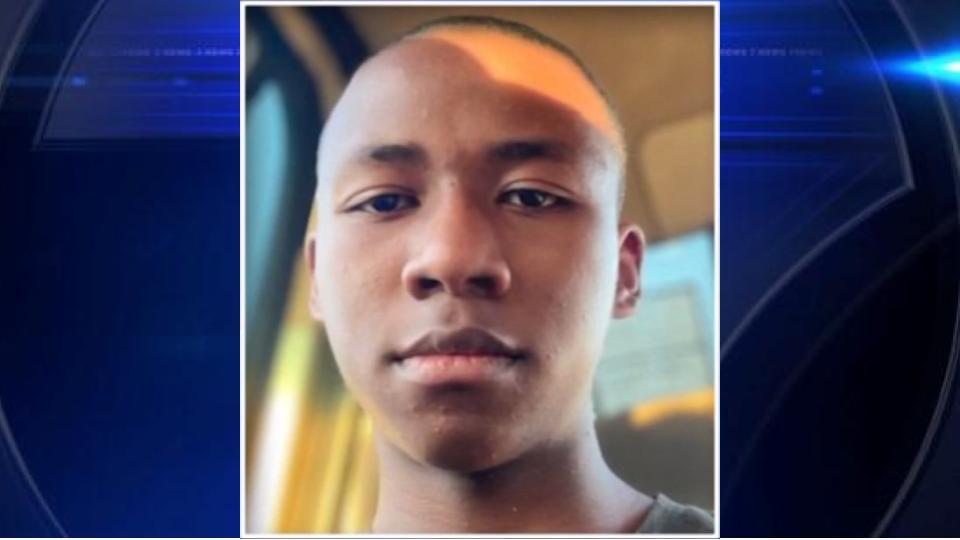

Fans cheer for Messi during an Inter Miami training session in Hong Kong. (Photo: PETER PARKS/AFP via Getty Images)

Payne noted another major similarity between Beckham’s Galaxy and Messi’s Miami: the teams’ ability to pull MLS along with them into new eras of growth. Beckham’s arrival ushered in the designated player era of MLS, which brought global superstars to the league for the first time since its very early days. Messi’s arrival could introduce similar growth, though the league is still studying how it can maximize the Argentine’s presence.

Messi’s partnership with Apple, which holds MLS’ broadcast rights for 10 years, is indicative of the symbiotic relationship that exists. And the international preseason tour was another example of Miami increasing MLS’ visibility in the global soccer market.

“The more we can have greater visibility outside of our region, the better from a commercial standpoint,” said Camilo Durana, executive vice president of the Apple partnership, properties, and events at Major League Soccer and Soccer United Marketing. “Clearly the greater exposure, the greater coverage is going to drive the value of our sponsorships, greater consumer product sales, heightened traffic on our owned and operated channels, like our site, and that has a tremendous impact on our business.”

Durana pointed to coverage of Inter Miami as a whole as a factor that has a “cascading effect” on the rest of MLS.

“The energy and the exposure that players like Messi, and a club like Inter Miami, is generating right now at a global level, that’s momentum that’ll carry over to the start of our season,” Durana said. “It’s already been reported, and we’re continuing to see, the impact of those Inter Miami games on season ticket sales across the league, expected ticket sales for those matches, as well. So all that momentum has a cascading effect. And we’re very focused on working closely with our clubs to make sure that we’re capitalizing on it.”

But while Beckham, the founder and co-owner of Inter Miami, set a massive precedent, the reality for Inter Miami is playing out on a much grander scale.

Sportico recently valued Inter Miami at $1.02 billion, up 74 percent from 2022. Forbes made Inter Miami its second MLS club to reach the billion-dollar valuation at $1.03 billion, a 72 percent bump from 2023. Asensi said the club will make north of $200 million in revenue in 2024, far beyond the team’s revenue figures in 2022, which was reported to be between $50 and $60 million. He pointed to the fact that Messi arrived in Miami off of a World Cup win with Argentina in 2022, at a time when soccer’s popularity is growing in the U.S. and with the 2024 Copa America, 2025 Club World Cup and 2026 World Cup being played here, as well as potentially the Women’s World Cup in 2027.

Messi’s presence provides a bigger runway to capitalize on those moments.

“We are talking about the greatest of all time in the world’s biggest sport, in a moment that the world is more interconnected than ever and that we have more technology than ever,” Asensi said. “So put all this together and it’s atomic, it’s massive.”

(Top photo: Megan Briggs/Getty Images)