‘I absolutely love debt,’ but you need a strategy for it – NBC 6 South Florida

This story is part of CNBC Make It’s Millennial Money series, which details how people around the world earn, spend and save their money.

Just a year after graduating from college, Karun Vij turned his dream of owning property into a reality. It started with an “aha moment.”

While earning an engineering degree at McMaster University in Hamilton, Ontario, Canada, Vij noticed that rental units near the school charged by the room, rather than the whole house. Things just clicked: He realized catering to students could be more profitable than renting out properties to families, and decided he wanted to try his hand at it.

It took a few years to save up, but by 2016, the year he graduated, he had saved enough money to afford a home near McMaster’s campus.

“I knew the area, I liked the area — not too expensive or too cheap,” Vij tells CNBC Make It. Plus, “it’s like a top five university in all of Canada. It was solid.”

At 26, Vij made a 20% down payment of around $64,781 for a Hamilton home worth $323,904, and rented it out to seven college students. (Conversions from CAD to USD were done using the OANDA conversion rate of 1 CAD to 0.73116 USD on Oct 3, 2023. All amounts are rounded to the nearest dollar.)

Karun Vij at home.

However, he didn’t plan to be a landlord full-time. After graduating, Vij worked as an application engineer, and later an account manager, at a global workplace automation firm in nearby Cambridge. With his rental earnings and increased salary, Vij was able to buy more rental properties in southern Ontario.

Now 33, Vij lives with his wife and daughter in Chicago, where he earns just over $183,000 and owns four Canadian rental properties worth a total of about $2.3 million.

“When I bought my first property, it was the most exciting and nerve-wracking time of my life,” he says. “I had no idea what it would take to be a landlord, but I knew in my mind this was my business.”

Saving up to buy his first home

Growing up in Brampton, Ontario, part of the greater Toronto area, Vij says he was raised in a “traditional family,” where he was encouraged to “go to school, get a job — engineer, doctor, lawyer — and buy one or two houses.”

Vij “worked [his] ass off” doing “whatever it took to make money,” he says. That included mowing lawns, delivering groceries, and eventually, a door-to-door sales job selling vacuums.

“In every situation, I do try to be my best,” he says of his competitive nature. “If I didn’t come up No. 1, I’d go back to the drawing board and I would try to learn from my mistakes.”

Karun Vij with his family.

While at McMaster, Vij was selected by a Fortune 500 company to take part in a paid co-op program for two years. During that time, he earned about $45,000 while living in a rent-free apartment provided by the company, which helped him save money for future down payments.

After graduating with a bachelor’s degree in electrical and biomedical engineering, Vij was hired full-time by the company to work as an application engineer.

Investing in rental properties

Vij’s first rental property was a two-story detached home with seven rentable rooms, two miles away from McMaster’s main campus.

As a first-time landlord, Vij was initially surprised by the number of calls he got from tenants about everything from fixing door locks to changing light bulbs.

“I was picking up calls at three in the morning,” he says. “I had to quickly learn to put things into perspective and prioritize the major concerns.”

For non-urgent requests, Vij learned that good communication and follow-through actually mattered more to tenants than him being available “100% of the day.”

“If you say you’re going to fix something in five days, get it done in five days,” he says.

In 2017, Vij put down a deposit of a “few thousand dollars” down on a pre-construction condo in Mississauga, a city near Toronto, that he intended to live in.

Otherwise, whatever money Vij made from his job and rental property went straight into savings for more rental properties. In 2018, he put 20% down on another house in Hamilton, worth $316,227. And in 2021, he purchased an adjacent third property for $403,042. He also put 5% down on a pre-construction condo in Milton, Ontario.

In 2022, Vij accepted a more senior role with his company in Chicago. Knowing that he had to move out of Canada, he hired a property manager and sold the condo he bought in 2017 for roughly $519,000 — more than double the purchase price.

With that money, he was able to pay down debts, including his student loans, and put a $50,000 down payment on a property in Windsor, Ontario.

All told, Vij has 28 rentable rooms across four properties as of October 2023. He has no interest in cashing out, even though his properties are currently worth about $2.3 million.

Karun Vij outside his home in Chicago.

“I don’t care what the price is because I’m never going to sell, that’s my mentality,” says Vij. “I want to own as many assets as possible that generate cash flow and use any extra cash to buy more assets.”

In 2023, Vij broke even on his rental properties. He doesn’t mind that he’s not turning a profit yet because he expects recently purchased properties to have higher upfront costs for furnishings and renovations in the first couple years of ownership.

All told, his expenses, including utilities, repairs and property management fees, come to about $11,000 a month. He typically brings in that much from his tenants as well, but any profit he makes in a given month is either used to pay down lines of credit or put into his savings account.

“I absolutely love debt,” Vij says. “But I’ll say I only like good debt,” such as mortgages and lines of credit, he adds. “Good debt is debt that you have a strategy for. My long-term strategy is to buy up as much real estate as possible.”

How he spends his money

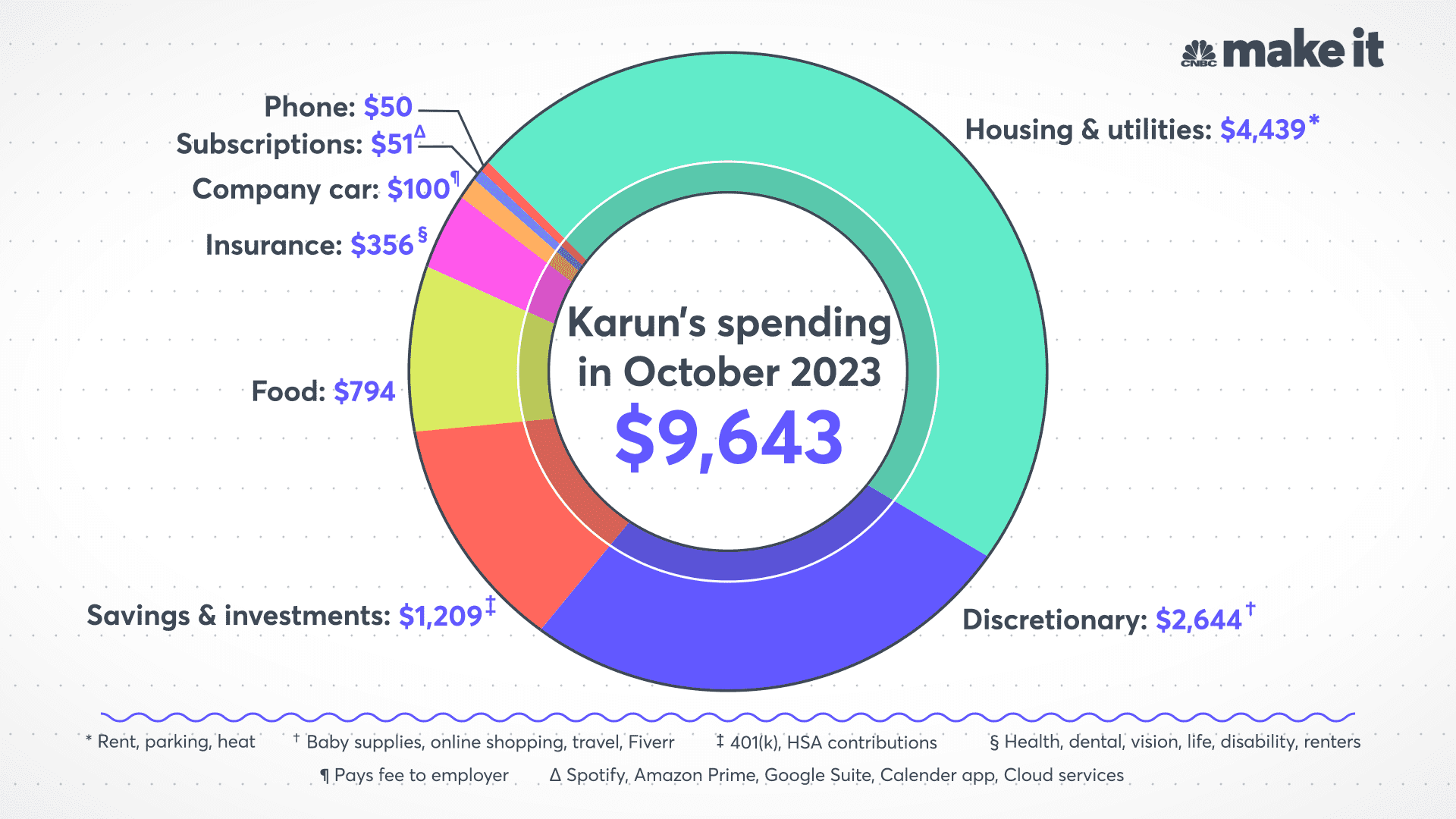

As the sole earner in the household, Vij covers all of the family’s expenses with his income. Here’s how he spent his money in October 2023.

- Housing and utilities: $4,439 for rent on a two-bedroom condo, parking and heat

- Discretionary: $2,644 for baby supplies, online shopping, travel and Fiverr

- Savings and investments: $1,209, including $1,076 to his 401(k) and $133 to his health savings account

- Food: $794

- Insurance: $356 for health, dental, vision, life, disability and renters insurance

- Company car: $100 fee paid to employer

- Subscriptions and memberships: $51 for Spotify, Amazon Prime, Google Suite, calendar app and Cloud services

- Phone: $50 for his wife’s phone

In August, Vij and his wife Seema welcomed a newborn daughter, so a significant portion of their discretionary expenses go toward baby stuff, like bedding and clothing.

In addition to typical benefits, like health and dental insurance, Vij gets a few nice perks through his employer. For $100 a month, he’s able to rent a company car, including gas. Likewise, his phone is paid for through work, so he and Seema only spend $50 a month on her phone.

Karun Vij and his wife Seema at Walt Disney World.

Vij owes around $18,700 in credit card debt. That amount is unusually high because of the newborn, as well as some unexpected dental expenses, he says. He’s also making a strategic choice to not pay it off right away: “I’m using the money to buy more assets.”

Vij also has four lines of credit that he uses exclusively to finance his properties, two of which have outstanding balances totaling $9,798.

As of October 2023, he has more than $100,000 in investments, including index funds, company stock and an inactive company-sponsored pension from when he worked in Canada. Vij also has just over $73,000 in savings earmarked for another property in Windsor, Ontario.

Plans for the future

Vij wants to keep investing in rental properties, even though 25-year fixed mortgage rates, which are common in Canada, have nearly tripled since 2022. He actually sees it as a good time to buy since home prices in southern Ontario have dropped in the past year.

He’s also working on plans to convert his two adjacent Hamilton homes into a much larger condo, pending some changes to local rezoning laws.

“Having a newborn has sparked even more motivation and drive in my life,” says Vij. “I want to build a life that we love for my family and show my daughter that anything in life is possible if you put the work into it.”

What’s your budget breakdown? Share your story with us for a chance to be featured in a future installment.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 best piece of advice for regular investors, do’s and don’ts, and three key investing principles into a clear and simple guidebook.