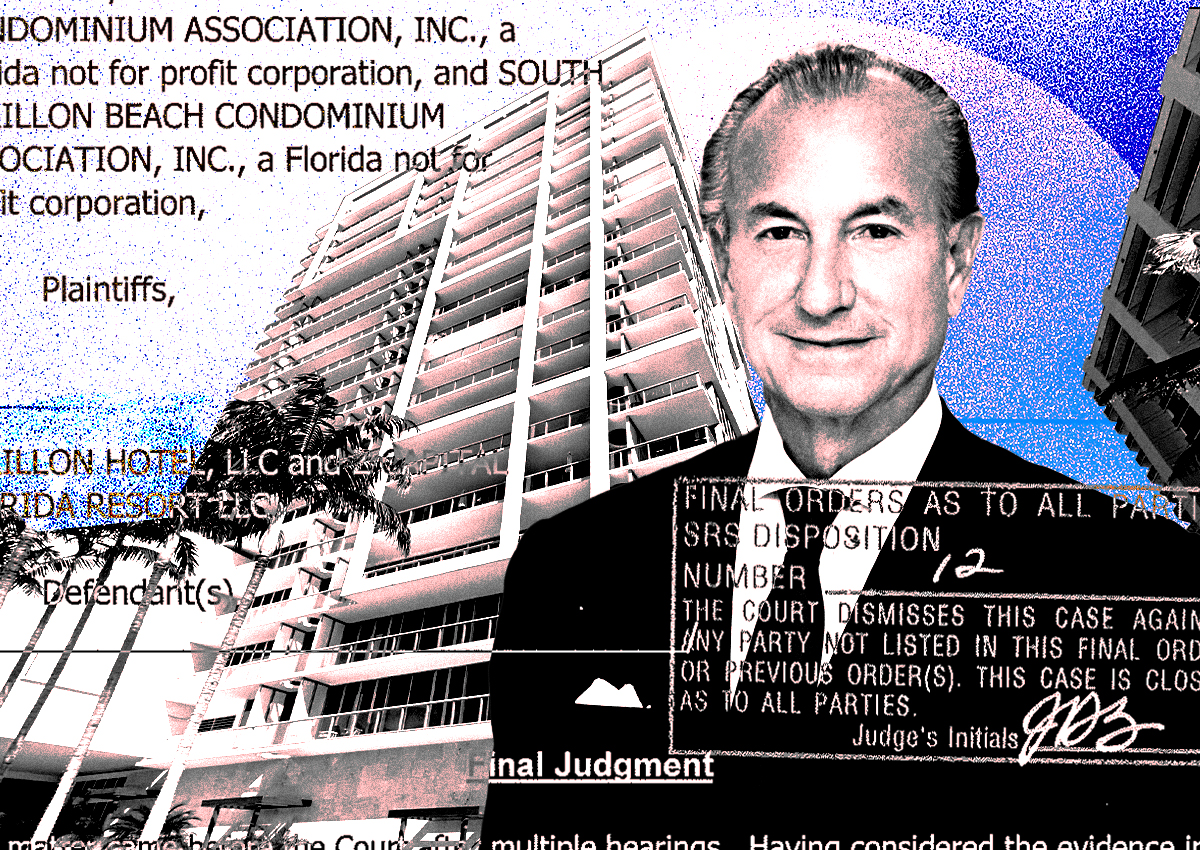

Inside the Final Ruling in the Carillon Miami Beach Lawsuit

The Carillon Miami Wellness Resort condo associations lost their legal battle to purchase the spa, pools and other portions of the oceanfront mixed-use complex.

Judge Jennifer Bailey issued a final judgment on a lawsuit at the Carillon condo-hotel in Miami Beach that has pitted unit owners against New York-based Z Capital Group for the past seven years. The order addressed numerous disputes, including the associations’ bid to purchase the spa and pools from Z Capital. In the end, Bailey delivered wins and losses to both sides.

The 580-unit Carillon, at 6801 Collins Avenue, consists of the North and South condo towers and the Central Tower, which includes hotel rooms. Z Capital owns roughly 70 hotel keys and most of the complex with the exception of the unit interiors.

In 2016, the associations sued Z Capital. While court filings outline numerous issues, the tiff boils down to residents taking issue with Z Capital’s unilateral power at the complex to own and manage most of the property, as well as to levy assessments for maintenance, operation and renovation of the common areas and recreational facilities.

While unit owners argue that Z Capital’s level of control is illegal under the Florida Condominium Act, Z Capital has pushed back that it is well within its rights because its powers are spelled out in the Carillon master declaration and not in the state statute.

In her 19-page order issued on Friday, Bailey dove into the complex governing structure that’s common at condo-hotels in general.

For years, buyers have purchased units at condo-hotels, knowingly giving up control over the common areas and amenities to a private company in exchange for that company to run the complexes as high-end resorts. Under this governing structure, the private companies need to have near-unilateral control in order to maintain the complexes in line with luxury hotel standards.

“This is a dictatorship –– whether abusive or benevolent –– not a democracy, and its residents volunteered to live under this system,” Bailey wrote. “There is a solution for every individual unit owner: sell their unit.”

In a blow to the associations, she shot down their push to void portions of the master declaration and their argument that they can purchase the spa, pools, gyms, garage and ingress and egress to the beach. Z Capital’s control of these areas qualifies as a leasehold interest under the condo act, which triggers a clause in the law that allows the unit owners to purchase these facilities, the associations argued in court.

The issue with this is that the Carillon master declaration governs the complex and it doesn’t include the condo act’s provisions that would qualify Z Capital’s ownership as a leasehold, Bailey wrote. In fact, she added, unit owners agreed to this governing structure when Z Capital bought the Carillon out of bankruptcy in 2014 for $21.6 million. At the time, the associations had taken up issue with the sale but that was resolved in bankruptcy court with the approval of a term sheet that spelled out Z Capital’s powers. The associations also received $2.6 million in the sale.

In response to the order, the associations’ attorney Stevan Pardo said the bankruptcy court order doesn’t preclude lawsuits over the applicability of the condo act.

Eugene Stearns, also an attorney for the associations, said the order is “internally inconsistent”.

In the order, Bailey wrote that even though portions of the Carillon master declaration are at odds with the condo act, the court will let the master declaration stand as it cannot rewrite it. “The master declaration here allows charges [that] would be illegal under the statute,” she said in a footnote.

“She essentially read the statute out of existence by saying, ‘Because they didn’t comply with the statute [in the master declaration], the statute does not apply to them,’” Stearns said.

Bailey picked up the Carillon case after former Judge Michael Hanzman, who had presided over the suit, stepped down from the bench in March. In her order, she took several of his previous decisions past the finish line.

In January, Hanzman ruled that Z Capital’s control of common areas such as hallways, elevators and roofs amounted to “overreach” and is illegal. Bailey took the decision a step further, listing 13 common areas that are to revert to the associations’ control. They include utility and electrical equipment, trash rooms, exterior walls, roofs, landscaping, lights, balconies, lobbies, hallways, and heating, ventilation and air conditioning systems.

The Carillon, or the entity that operates the hotel and commercial properties at the complex, took issue with this decision. In her order, Bailey says she is implementing Hanzman’s January ruling, but his order “does not direct the Carillon Hotel to convey any property to the associations,” a spokesperson said in a statement.

“The common elements claim will go nowhere,” the spokesperson added.

In July, the court asked both sides to submit a list of the common areas that are to revert to the associations’ control, but Z Capital didn’t file anything and “instead chose to continue to object to the principle” of this property going to the associations, Bailey wrote.

Bailey also solidified two past wins that the associations scored.

Last year, Hanzman had ruled against Z Capital’s push to levy a $7.7 million assessments on unit owners to cover legal fees and costs it had accrued in the lawsuit. Bailey shot down Z Capital’s push for a new hearing on the issue.

“Given the comprehensiveness of the original presentation, the court was mystified as to what would be gained by having another evidentiary hearing on the same issue,’ Bailey wrote, adding that Z Capital’s court filing this year “fails to identify any additional evidence.”

Bailey also agreed with a December jury verdict that found Z Capital overcharged unit owners by $16.3 million for electricity, spa and hotel assessments from 2015 to last year. The associations asked Bailey to also award them prejudgment interest. But she shot down that claim, only awarding them postjudgment interest of $1.1 million, leaving Z Capital on the hook for a total of $17.4 million.

In past rulings, Hanzman late last year sided with Z Capital by striking the associations’ push for more than $400 million in damages due to alleged “diminution in value” of the complex. The associations have claimed Z Capital has failed to run the Carillon on par with luxury standards.

In a letter to residents sent after Bailey’s order, the Carillon said the property’s value has skyrocketed by $470 million since it took over management in 2015 and cited numerous publications that have mentioned the Carillon as a top destination.

“We thank the Court for finally moving these cases to conclusion. … It’s time to end this,” the letter says. “We always believed the plaintiffs’ claims were without merit and shared residents’ frustration.”

But attorneys say the battle isn’t over.

“Even Judge Bailey found this declaration would be illegal under” the condo act, Pardo said. “But she believed she could not do anything to change it. And we certainly have issues with that order.”

Added Stearns: “You can only go to appeal if it’s a final order. The question is is it a final order? It’s debatable. That’s one of the things that we will be addressing.”

In her order, Bailey expressed skepticism that the squabble will end.

“The court has zero expectation that the rendition of this judgment will slow the pace of litigation,” she wrote. The “associations continue to object what they believe to be their subjugation and indenture to an abusive commercial enterprise.”