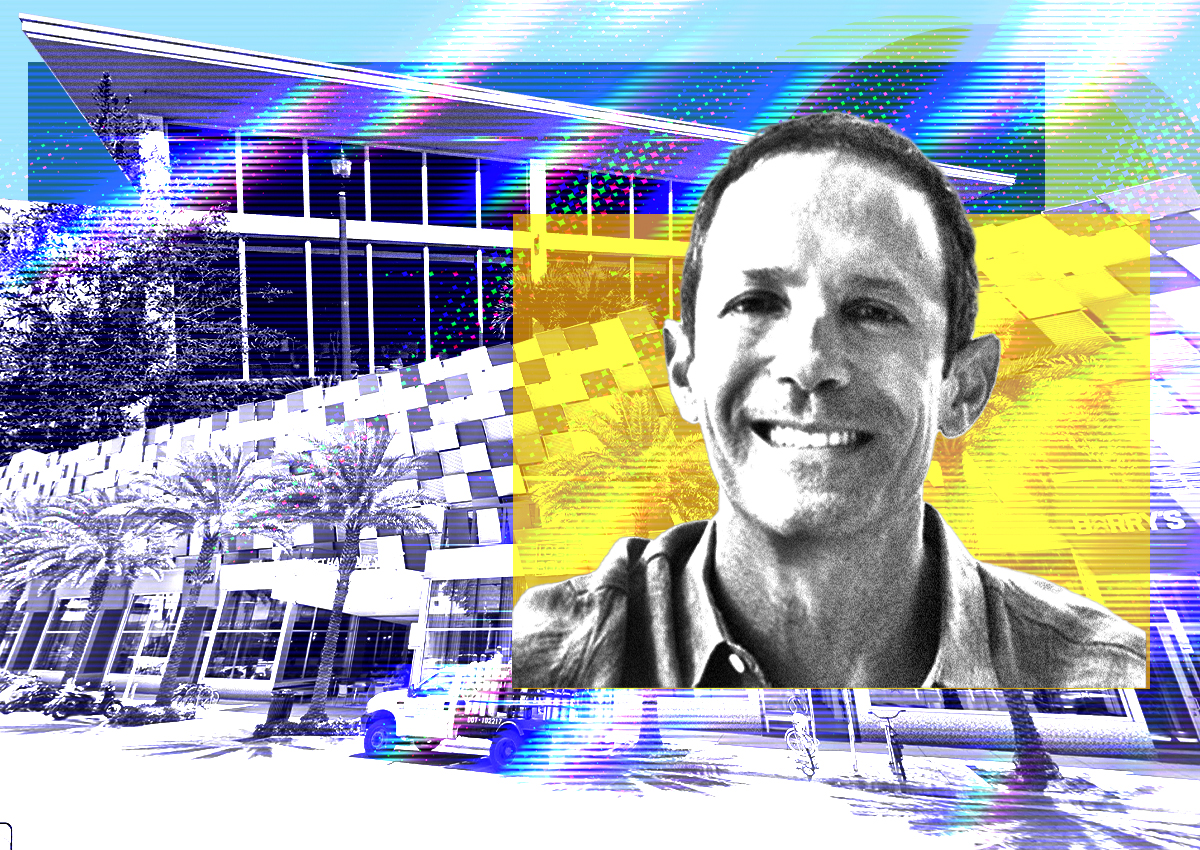

Robert Siegmann’s Icebox Cafe Files for Bankruptcy

Icebox Cafe filed for Chapter 11 bankruptcy, listing $18.2 million in liabilities.

Icebox, a health-conscious eatery founded by Robert Siegmann in 1998, offers chef-curated meals at restaurants and vending machines. Siegmann, a former caterer in New York, opened the first Icebox Cafe in Miami Beach, expanding it to multiple outposts in Florida and airports outside the state, according to media reports.

Entities tied to four Icebox restaurants and three of its affiliated commissaries, or outposts that ship products to vending machines and concession stands, filed for bankruptcy reorganization on Oct. 18, according to the filing and Peter Shapiro, the debtors’ attorney.

In a declaration filed to the court, Siegmann wrote that “harsh operational losses” caused by the pandemic were then “exacerbated by several loans [by] aggressive lenders, including some merchant cash advance lenders.”

The bankruptcy filing pertains to the Icebox Cafe restaurants at 219 Northeast Third Street in Hallandale Beach, 1855 Purdy Avenue in Miami Beach and Terminal D at Miami International airport. It also is for the affiliated Fig & Fennel restaurant at MIA’s Terminal D, as well as for commissaries in Atlanta, the University of Central Florida and at the Hallandale Beach restaurant, according to Shapiro.

All of the outposts remain in operation, according to court filings. It’s “business as usual,” Shapiro said.

One of the biggest creditors to Icebox is an affiliate of publicly traded, Boca Raton-based NewtekOne, which has over $4 million in small business debt issued to Icebox affiliates, court filings show. In his declaration, Siegmann said Icebox will negotiate with Newtek.

Other creditors include TD Bank, which holds a $246,600 line of credit, and Minnesota-based Channel Partners Capital, which holds $121,150 in debt.

While the Icebox affiliates filed for bankruptcy separately, the cases were consolidated last week.

In his declaration, Siegmann wrote that when business was profitable, Icebox and Fig had “the most successful locations, due in part to being located at Miami International Airport.”

The Icebox reorganization filing marks the latest fallout from the pandemic. Although Florida lifted the lockdown earlier than other states, some business owners still borrowed additional debt to cover lost revenue.

Read more

The high borrowing costs, due to the Federal Reserve’s aggressive interest rate hikes since last year, as well as a general economic slowdown and inflation also have impacted some businesses.

In March, the Palm Beach Resort & Beach Club at 3031 South Ocean Boulevard in Palm Beach sold out of bankruptcy for $9.8 million to Copperline Partners. The condo association for the property had filed for bankruptcy in 2021.

Last month, a partnership led by New York developer Yair Levy was slapped with a foreclosure over allegedly failing to make payments on a $27.2 million debt. Lender City National Bank of Florida filed the foreclosure suit over the loan, which was intended for the renovation of the Time Century Jewelry Center at 1 Northeast First Street in downtown Miami.