Rexford Industrial Realty Posts 48% Jump in Profit

Rexford Industrial Realty’s multi-billion-dollar buying spree over the last few years seems to be paying off.

The Los Angeles-based industrial REIT reported a $61.8 million profit in the third quarter, up 48 percent from the same three months last year, and roughly 9 percent from the prior period, according to an earnings release on Wednesday.

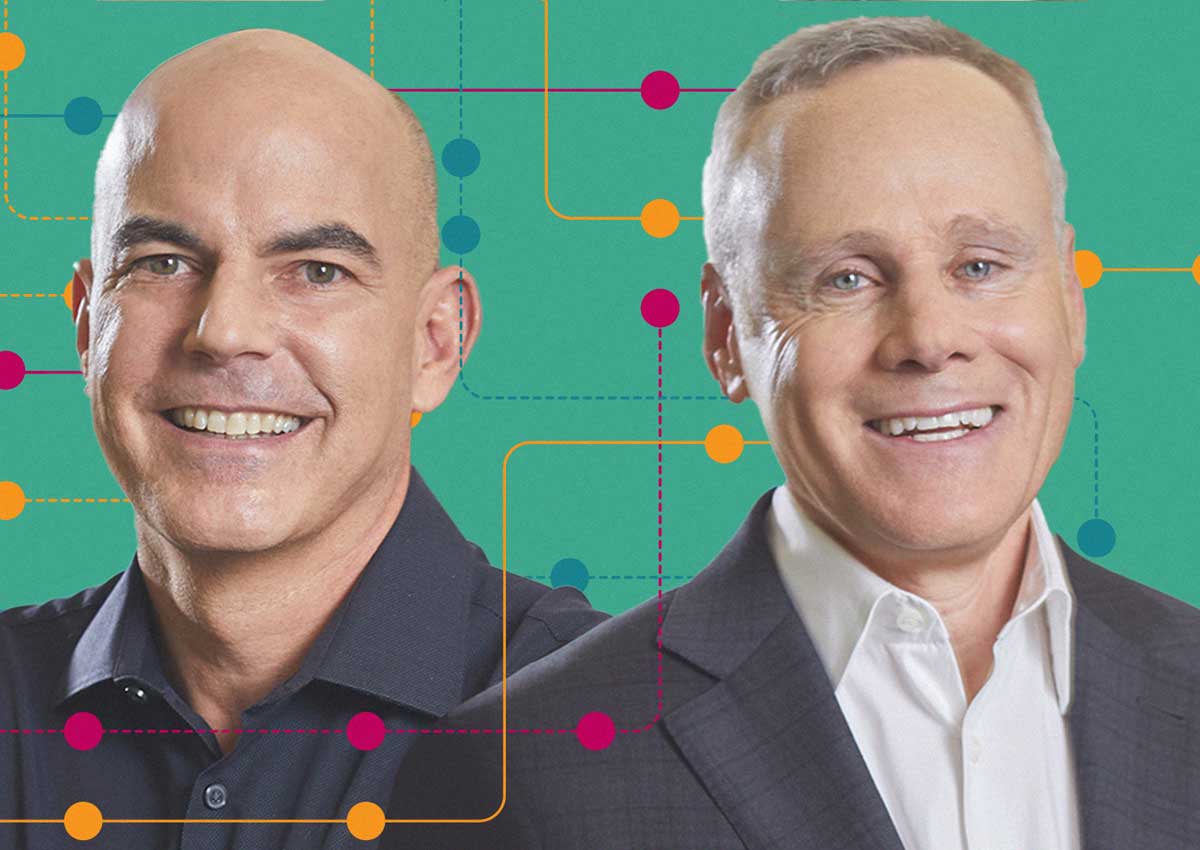

Rexford’s co-CEOs Michael Frankel and Howard Schwimmer credited “long-term tenant demand” across major Southern California industrial markets, where Rexford holds almost all of its properties, as reason for the firm’s profits, according to the release.

Rexford ended the third quarter with $204.2 million in revenues, up 25 percent year-over-year and 5 percent from the second quarter.

About 94 percent of Rexford’s portfolio — including properties slated for redevelopment — was leased at the end of the third quarter, according to the earnings release.

On an earnings call Thursday, Rexford Chief Financial Officer Laura Clark acknowledged that some timelines for redevelopment projects had been pushed back because of permitting delays and leasing timelines.

Before the pandemic, a completed project was leased up in “typically about six months,” according to Clark. From 2020 through 2022, as online shopping demand spurred tenants to snatch up more distribution space, that leasing timeline shrunk “significantly,” Clark said.

In the future, leasing timelines for new projects are expected to be more in sync with pre-Covid levels, Clark added.

Despite Rexford meeting estimates for funds from operations — 56 cents per share — according to Zacks Equity Research, the firm’s stock dropped on the earnings news. Rexford’s share price closed at $44.57 Wednesday, down 5.4 percent from the market open.

Rexford saw a dip in cash on hand in the third quarter. It ended September with $83.3 million, compared to $136.3 million at the end of the second quarter. The REIT still has $1 billion available under a revolving credit facility.