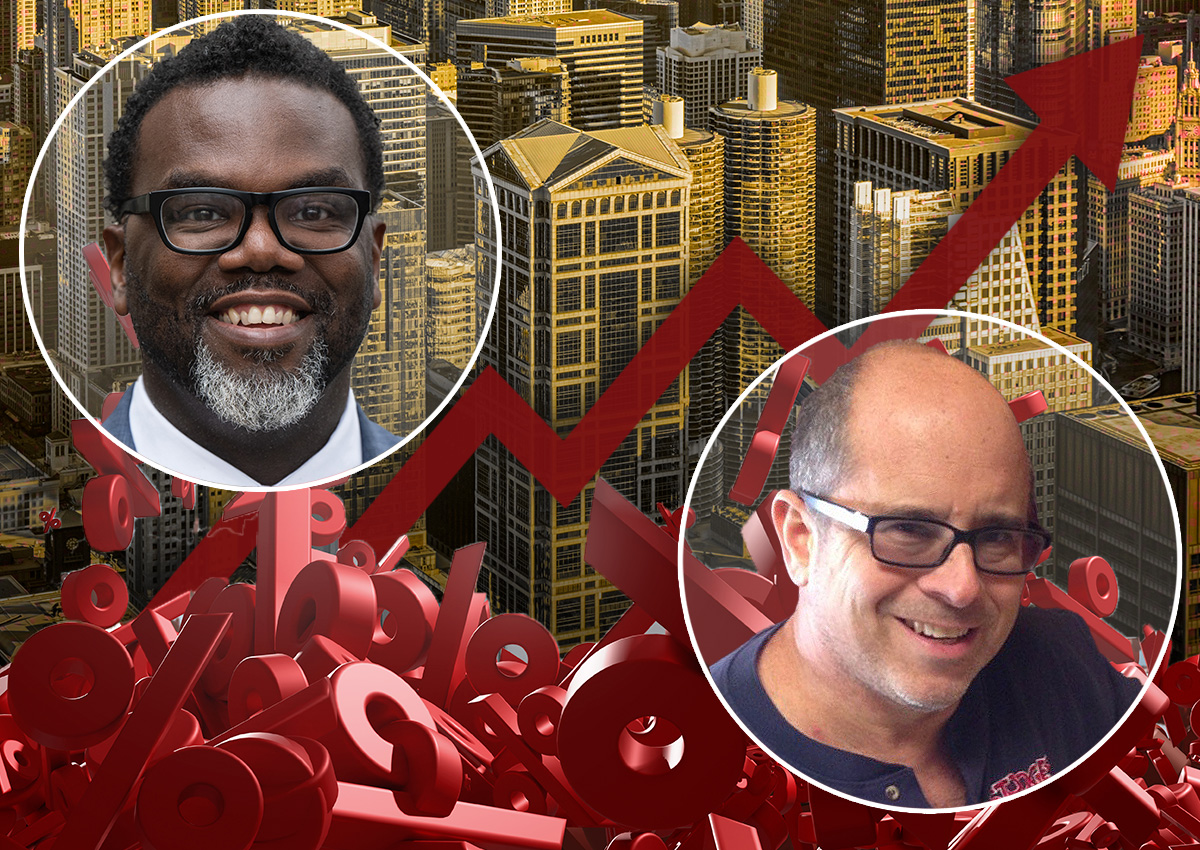

Landlords Say They’d Raise Rents If Transfer Tax Hike Occurs

Chicago landlords are being up front and saying they’d move to raise rents if Mayor Brandon Johnson’s proposed transfer tax increase passes into law.

To compensate for the added tax costs, Chicago multifamily landlords could raise rents by as much as $100 per month in newly sold apartment buildings, Crain’s reported, citing a survey conducted by the Neighborhood Building Owners Alliance and commercial property brokerage Kiser Group.

Of the 250 surveyed Chicago apartment owners, approximately 74 of them expressed intentions to increase rents to offset the tax burden.

Under Johnson’s proposal, the transfer rate would rise to 2 percent of the property’s sale for commercial and residential property sales valued between $1 million and $1.5 million, and it would jump to 3 percent for transactions greater than $1.5 million. However, the rate would drop to 0.6 percent for sales less than $1 million. Johnson’s goal is to use the extra tax revenue to fund more affordable housing projects and anti-homelessness initiatives.

While landlords may be impacted most directly by this policy, Chicago renters could bear the brunt of it too, although many “don’t understand at all that this would affect them,” Tracii Randolph, who owns a rental building in Bronzeville, told the outlet.

For example, buying a property at $1.5 million would result in a $16,000 transfer tax under Johnson’s plan, compared to $11,250 at the current rate. This added cost could force landlords to raise rents significantly, according to the NBOA’s report.

“People who say, ‘Oh, 3%. What’s the big deal?’ don’t understand what it costs” to operate apartments, NBOA President Mike Glasser told the outlet. “Three percent could be your whole return on investment in the first year.”

Johnson’s proposal to curb homelessness has won over a number of Chicagoans, but it has garnered strong resistance from the real estate industry. Illinois Realtors recently initiated a postcard campaign attacking the tax increase, and the NBOA’s report adds to the mounting opposition.

The proposed transfer tax hike has sparked fears that the downtown real estate market’s sluggish recovery from the pandemic may lead to larger tax burdens on neighborhood properties. Because commercial properties are taxed at a higher rate than homes, every $1 in assessed value that comes off commercial buildings equates to $2.50 in taxable residential value.

With Chicago awaiting a City Council decision on whether to send a transfer tax referendum to voters for the March election, the fight against the proposal is playing out on two fronts, as the real estate industry attempts to sway both aldermen and voters to resist the proposal.

— Quinn Donoghue