Kimco Acquires RPT Realty in $2B Stock Deal

Kimco Realty is expanding its shopping center empire, acquiring another owner and operator of American shopping centers.

The company announced an agreement Monday to acquire RPT Realty in an all-stock deal valued at $2 billion. The deal is expected to raise Kimo’s pro forma equity market capitalization to $13 billion and its total enterprise value to $22 billion.

RPT shareholders will receive 0.6049 of new Kimco shares for each share of RPT they held. That represents approximately $11.34 per RPT share based on Kimco’s closing price on Friday, a 19 percent premium on RPT’s closing price at the end of last week.

Kimco will add 56 open-air shopping centers to its portfolio, most of which are wholly owned (the others are part of a joint venture). The gross leasable area of that portfolio is 13.3 million square feet. Kimco will also add RPT’s 6 percent stake in a 49-property net lease joint venture.

The merger is expected to close in the first quarter of next year. RPT stock rallied by nearly 15 percent in premarket trading on Monday; Kimco stock began surging when the markets opened on Monday, though its stock is down more than 11 percent year-to-date.

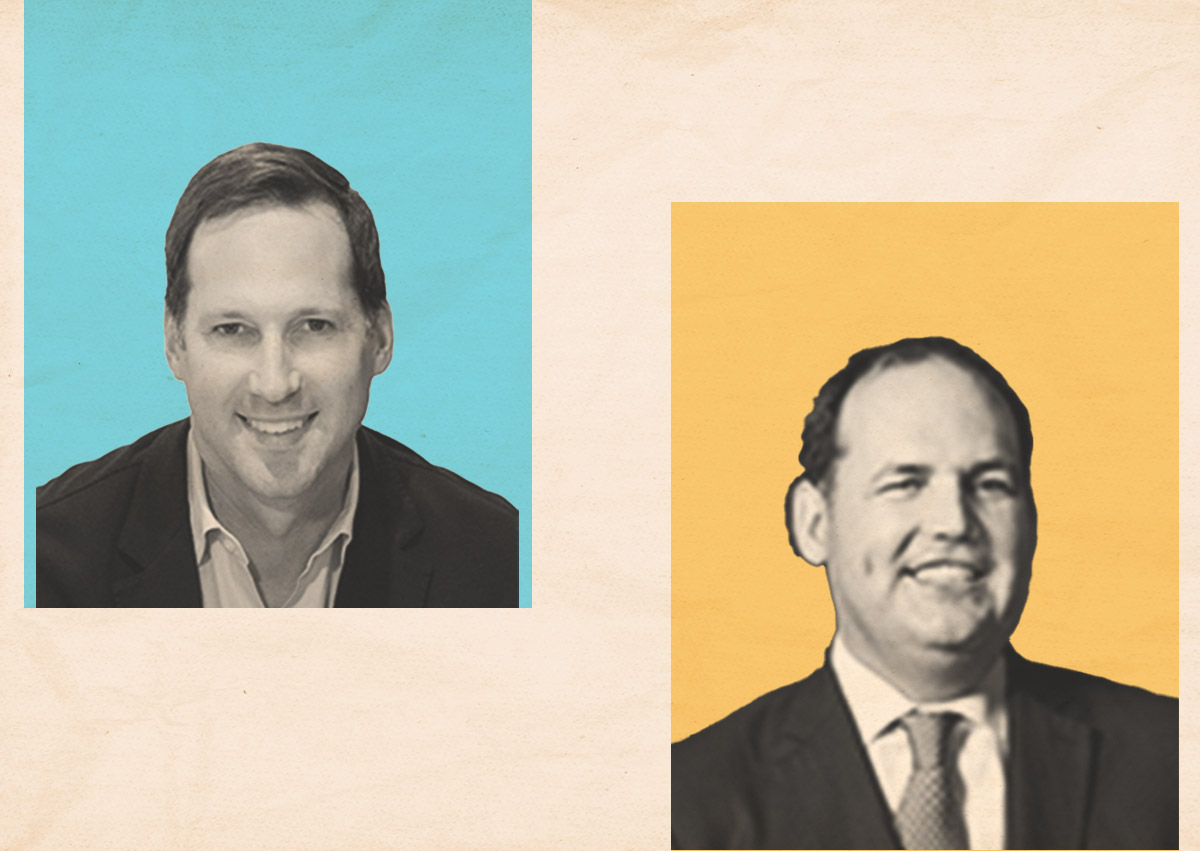

Kimco CEO Conor Flynn noted in a statement the acquisition will give the company a deeper presence in coastal and Sun Belt Markets. RPT chief executive Brian Harper added that it was in the company’s best interest to align with a grocery-anchored shopping center provider like Kimco.

Open-air properties are a highlight for the retail sector, luring in tenants who are seeking a high-quality space. Grocery-anchored shopping centers are also a bright spot, as supermarkets are a consistent driver of foot traffic.

Both firms involved in the transaction have been behind big deals in recent months. Last July, New York-based RPT purchased the Shops at Mary Brickell Village in Miami from Rockpoint for $216 million. Months later, Jericho-based Kimco bought an eight-asset portfolio spread throughout Nassau County from Kabro Associates for $376 million.