Miami Dev Site Sales Volume Cools In 2023’s First Half

With vacant land primed for development scarce in Miami’s Brickell neighborhood, owners of a 14-unit townhome complex are betting they can land a bulk buyer willing to pay $20 million or more for their community.

The site has city of Miami approval to be redeveloped into a five-story boutique condominium, according to an offering.

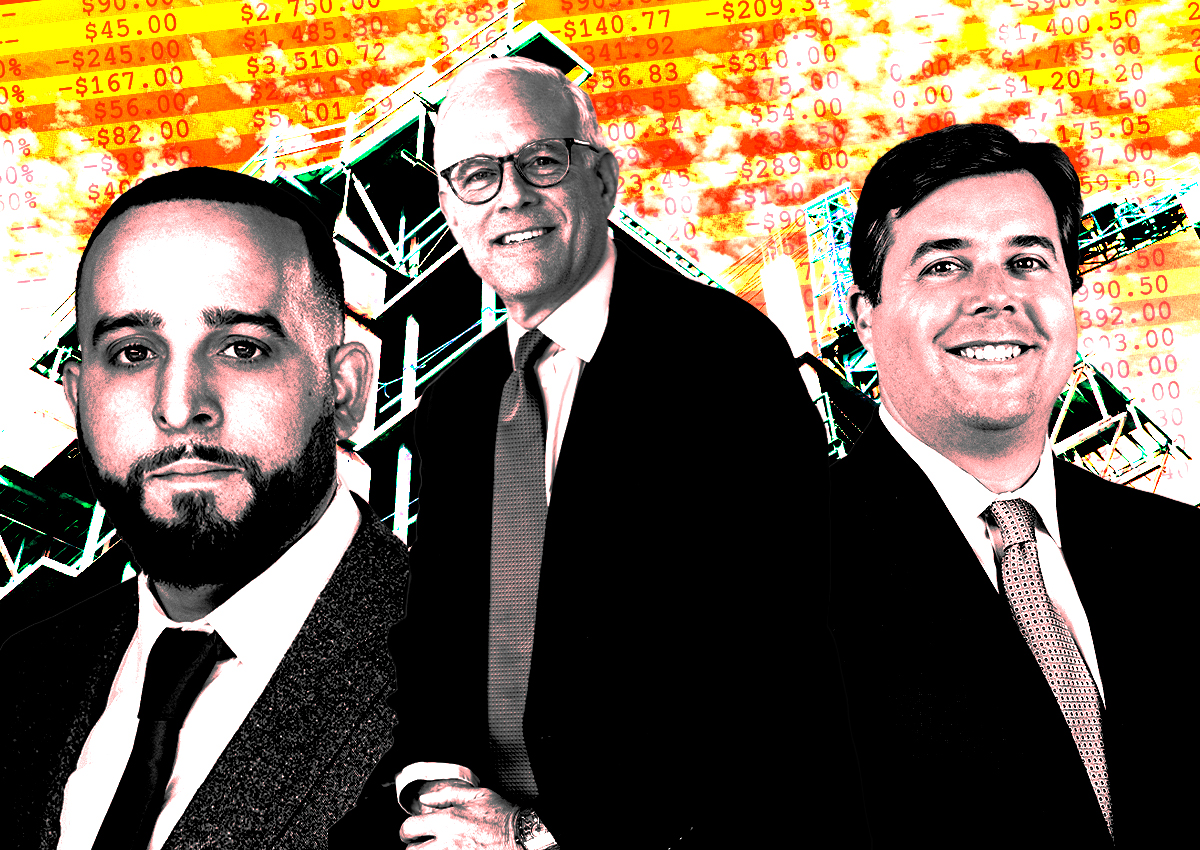

But since Brickell Woods hit the market a few weeks ago, a few foreign investment groups eyeing the 0.8-acre property at 2180 Brickell Avenue are offering below the guiding price of $20 million, said Virgilio Fernandez of Colliers, which is marketing the townhome community.

“We have a gap to bridge there,” Fernandez said. “In general, we are still seeing a lot of appetite for new development in South Florida. But [developers and investors] are a little more cautious, and are making sure the numbers check out. They are not just blindly paying high prices.”

In Brickell and other booming Miami submarkets like the Arts & Entertainment District, downtown Miami, Edgewater, and Wynwood, developers and investors are pumping the brakes on land deals. In the first half of this year, land sales have slowed considerably like a traffic snarl on I-95, compared to the high-octane deal pace during the same period of 2022.

Disconnected sellers

Real Capital Analytics data that Colliers provided to The Real Deal shows that land sales volume in Miami’s urban core — which includes the aforementioned neighborhoods — hit $103.8 million between January and June, compared to $808.8 million during the same six-month period last year. The downward trend began in the second half of 2022, when Miami’s urban core recorded $427.7 million in land sales volume, according to Colliers.

The number of land trades also downshifted, with only seven sites sold in the first half of this year, compared with 21 sites sold during the same period of 2022.

A major factor in the slowdown is a disconnect in pricing between sellers and buyers, even though land has gotten cheaper, Fernandez and other real estate experts told TRD.

In the second quarter, the price per acre dropped to $32 million, compared to $40 million per acre during the same period of last year, the Colliers data shows.

With the overall rising cost of high-rise construction in the past year, multifamily and condo developers and investors are reluctant to pay the prices sellers want, Fernandez and others said.

“Even if the land is free, I don’t think it is possible to build a product above eight stories, due to construction costs and rent projections,” Fernandez said. “It just doesn’t pencil. So a lot of groups are on the sidelines.”

Developers are seeing a potentially diminished return on profits, so they need to find price breaks somewhere, said Luis Flores, a partner with the law firm Saul Ewing.

“You have more selectivity taking place,” Flores said. “And the cost of construction debt is so expensive that it is shrinking the number of developers saying it makes sense to put a new project on the street.”

Sellers are having a hard time accepting reality because they read headlines that Miami is still booming, as other major U.S. cities are experiencing construction slowdowns, Flores added.

“Sellers see that glimmer,” Flores said. “They don’t realize they can still make a hefty profit, but not at the windfall prices we saw 18 to 24 months ago.”

Headwinds slow sale traffic

On the financing side, lenders are being more picky about which land deals to underwrite with mortgages, said Brett Forman, managing partner of Boynton Beach-based Forman Capital.

“We are trying to work with stronger borrowers,” Forman said. “And we are recognizing that the land is probably not worth what it was worth a year ago, and that it may be worth even less a year from now.”

There’s a need for reduction in land prices when it doesn’t appear that interest rates will go down quickly or that rents will continue to climb, Forman said. In South Florida, the apartment occupancy rate dropped in the second quarter, resulting in landlords giving new tenants more concessions, according to a recent Berkadia report.

“With so much new multifamily development contemplated [in South Florida], it is hard to make the numbers work,” Forman said. “The land is more expensive. The brick and mortar costs are more expensive. Property taxes and insurance rates are also going up. But the rents can’t keep going up. The only variable is for land prices to come down.”

Colliers’ Fernandez, who’s worked on 10 land deals in the past 12 months across Miami-Dade County, not just Miami, said developers are getting mortgage quotes with an interest rate averaging 11 percent.

“Now, that’s a lot higher than two years ago when interest rates were at 6 [percent], 7 percent,” he said. “Insurance has also increased about twofold in South Florida. Those are major headwinds.”

Still, Fernandez is banking on other potential bidders for Brickell Woods emerging with offers north of $20 million in the coming months.

“It is summer, so activity does go down a bit,” he said. “I expect after September we will have a lot of interest again. Hopefully, we can get to that number.”