Market Shifts Push Franchise Brands to Adapt Real Estate Strategies | Franchise Operations

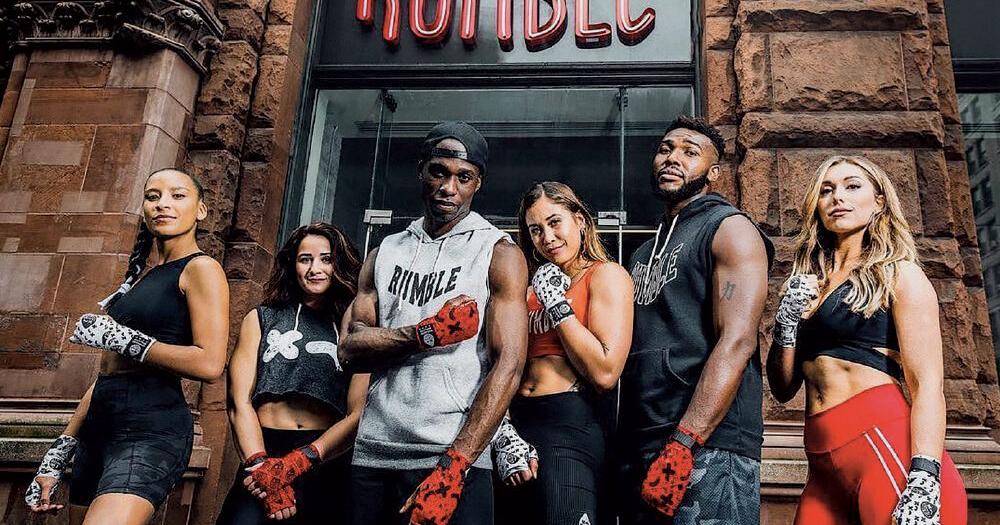

Xponential Fitness doesn’t shy away from urban locations for its Rumble boxing concept.

More than two years after the onset of the COVID-19 pandemic, franchises are still trying to figure out how to plan location strategies in a marketplace working through disruptive change that has shifted population, traffic patterns and customer behavior.

The daytime population in many areas of the country scattered during the pandemic as people moved en masse to working from home. The return to the office has been slow, and for some, remote work or hybrid schedules is likely permanent. Those market shifts are forcing franchisors to reevaluate real estate strategies.

“Where brands have to adapt is in following their customer, and their customer is going to set the tone for any changes,” said Heather Hargraves, vice president, retail tenant representation at Colliers International in Atlanta. While urban areas and town centers still have significant density, “secondary and tertiary markets are seeing just as much activity.”

Questions that are top-of-mind for franchise groups across categories are: Where do we focus regional growth? What markets do we prioritize? What types of locations make the most sense given changes that have occurred?

“I don’t think COVID has necessarily changed our strategic growth plan. I think it just gave us more conviction that we had the right plan,” said Nicolas Henrich, head of franchising, development and finance for Tim Hortons USA. Founded in Canada, Tim Hortons has more than 630 locations in the U.S. and its new franchisee recruitment pipeline is at an all-time high.

Geographically, the company is focused on growing in states where it already has a presence: Michigan, Ohio and New York. Following a 2020 analysis, the firm also is expanding in southern states with a particular focus on Texas, Georgia and Florida. “The Sun Belt is definitely hot, and we want to participate in that growth,” said Henrich.

Emily Durham

Sun Belt attracts growth

More brands are setting their sights on the Sun Belt and its population and job growth. The 18 states that comprise the Sun Belt region are now home to more than half the country’s population. COVID-19 propelled even more migration, corporate relocation and jobs to this fast-growing region. According to JLL, markets such as Atlanta, Denver, Dallas, Miami, Austin, Texas, Nashville, Tennessee, and Charlotte and Raleigh, North Carolina experienced 10-year population growth from 2010-2020 ranging between 10 and 30 percent, well ahead of the U.S. average growth rate of 7.1 percent.

“In the restaurant space and the coffee shop space, it almost feels like it is a race to the Sun Belt. Who is going to plant their flag as the dominant brand?” said Henrich. Beyond population and economic activity, Tim Hortons also likes the market dynamics for out-of-home coffee sales.

Franchise groups also are taking note of major employer announcements in the region. For example, Google opened a new 500,000-square-foot office in Midtown Atlanta and Rivian is proposing a large electric vehicle manufacturing plant in nearby Covington. “As we continue to have major employers landing in our market, that is going to create synergy around both urban and suburban markets,” said Hargraves.

Although geographic expansion for many brands is driven by franchise sales, cost is a major factor in evaluating locations and prioritizing growth markets in the current high inflation market. Some franchisees are choosing to locate in markets where second generation space is more readily available versus paying the higher cost for new construction, noted Emily Durham, senior vice president of Food and Beverage Advisory with JLL’s retail brokerage team in Houston.

Some franchise groups are gravitating toward states that don’t require franchise filing or registration, which include fees and can add more time to the process to get stores up and running. “That registration can be a non-starter for some people just because of the added cost and expense in the current environment where franchisees are battling rising costs and challenges to keep projects on schedule,” Durham said.

Urban vs suburban locations

Remote working and a slow return to the office is continuing to take a toll on many central business districts across the country. According to data from the Kastle Systems Back to Work Barometer, the average daily occupancy of office buildings in the 10 major metros the firm tracks was still hovering at about 44 percent at the end of July. Cities that reported the lowest vacancies were San Jose, California, San Francisco and Philadelphia—all with average occupancies between 34 and 38 percent. “Nobody really knows how many people are going to return to an office and when. So, that creates a big challenge for everyone,” said Durham.

Some franchise groups continue to see opportunities in downtowns and city centers. “A lot of those decisions depend on the urban population of those CBDs or urban areas,” said Durham. Houston, for example, does not have a large residential population downtown, which is different from downtown Los Angeles or Manhattan. People who live in a downtown still need their coffee places, restaurants, fitness studios and other retail and service businesses.

“We’re using the data to see who is doing what where before we make any decisions. We’re looking at things like traffic and how neighboring restaurants are doing and basically doing the math, and that’s what franchises are doing as well,” she said.

Xponential Fitness acquired boxing concept Rumble last year and has a robust pipeline of franchise sales fueling new location growth. At the end of July, the company had 22 studios open and about 240 in development.

Even before COVID, aging millennials were starting to shift to the suburbs. As people leave urban centers, it has provided an opportunity for Rumble to follow those customers who are already familiar with the brand to suburban locations. However, Rumble is not shying away from urban centers. For example, the brand has a new location opening soon in the North Loop neighborhood of Minneapolis.

In both urban and suburban locations, Rumble prefers to locate its gyms in mixed-use “live-work-play” environments. In an urban neighborhood, an ideal location might be in the ground floor retail space of a condo or apartment building.

“We see a real opportunity there to become an amenity for the building with potential members that are literally above your head,” said Adam Pennington, executive vice president of real estate & business development for Xponential.

Those same live-work-play trends also are moving more into the suburbs, and Rumble is looking for similar criteria in its suburban locations. Hybrid or flexible working is pushing people further out into the suburbs, but they still want some of the same amenities in that one-stop shop whether it is a mixed-use development or lifestyle center, he added.

Franchise brands also are adapting to new hybrid and flexible work schedules. For example, Xponential offers members an “X Pass” that allows them to visit any of the company’s 10 fitness brands, among them Pure Barre, Club Pilates and Cyclebar. “That gives us an opportunity to cluster our brands in certain geographies in both urban and suburban locations,” he said.

It’s really about following that core customer, added Pennington. Where is the influx of people? Where is the spend? Where is the daytime population and what is the make-up of that daytime population? “We spend a lot of time understanding our core customer potential,” he said. “We won’t even go to a market unless we know there is a demographic that fits the model.”