‘Wall Street South’: A NYC-Miami move can save you up to $200K

Canva

‘Wall Street South’: A NYC-Miami move can save you up to $200K

Close view of downtown Miami.

With cost of living increases and high tax rates in cities like New York City, Chicago and San Francisco, high income earners are looking to take advantage of more affordable areas of the country for the sake of stretching a salary significantly further.

To determine how much you can save by moving to Miami, SmartAsset compared the cost of living and tax rates to those of NYC, Chicago and San Francisco for those earning $150,000 up to $650,000.

Key findings

- High earners can save up to $200k per year by moving to Miami. Between cost of living differences and taxes, someone making $650,000 in Manhattan can save $195,000 in Miami. Meanwhile, the same high earner in San Francisco can save just over $150,000 annually.

- San Franciscans can shave up to 11 points off their tax rate in a move to Miami. The cost of living also makes a difference: While it’s about 83% higher than the U.S. average in San Francisco, Miami offers a discount 23% higher than average. New Yorkers can save around 10 points.

- Chicago residents wouldn’t gain much in a move to Miami. High earners in Chicago would save an average of four points in taxes, but the cost of living – 5 points lower than Miami’s – puts them at a disadvantage. Overall, Chicago residents will only gain about 1% of their salary from the move.

- Expect the biggest tax increase when you go from a $200k to a $250k salary. Your effective tax rate will jump more than 1% for each move from $200k to $250k and $250k to $300k, regardless of whether you’re in Miami, NYC, San Francisco or Chicago. The highest incremental increase is 1.85% between $200k and $250k in NYC. Residents in each city will experience the second largest incremental tax increase when jumping from a $250k salary to $300k.

- The cost of living in Manhattan is 137% higher than average – compared to 23% higher than average in Miami. Taxes aside, this can lead to tremendous savings over time. Comparatively, the cost of living in San Francisco is 83% higher than average, while 17% higher than average in Chicago.

![]()

SmartAsset

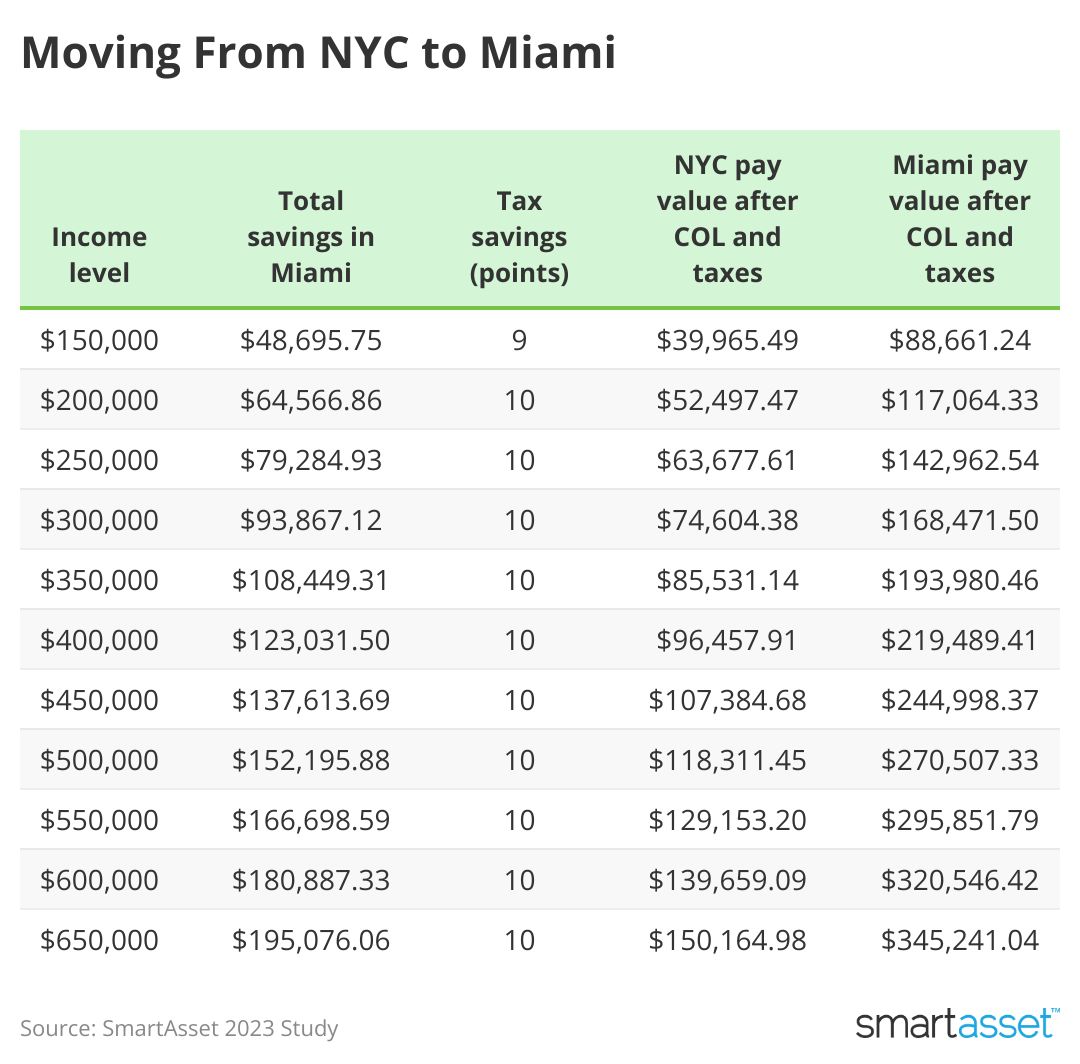

NYC → MIA

Table showing the cost and potential tax savings of moving from New York to Miami.

The cost of living difference between Manhattan and Miami is most drastic. Costs are 137.6% higher than the U.S. average in Manhattan, while they’re 22.8% higher than the average in Miami. Miami also offers more favorable tax rates: While high earners are taxed at an effective rate between 36% and 45%, they range from 27% to 35% for the same income levels in Miami – a difference influenced by the lack of state income taxes in the Sunshine State.

SmartAsset

SFO → MIA

Table showing the cost and potential tax savings of moving from San Francisco to Miami.

San Franciscans won’t reap as much benefit as New Yorkers, but high earners making the move to Miami will still experience significant increases in the value of their pay. The cost of living difference is smaller, with San Francisco costing 82.8% more than average in the U.S. when compared with Miami’s 22.8% premium. Meanwhile, taxes will eat up between 36% and 46% of an income that ranges from $150k to $650k in San Francisco, but only 27% to 35% in Miami. Overall, a move from San Francisco to Miami can save high earners roughly 24% of their salaries.

SmartAsset

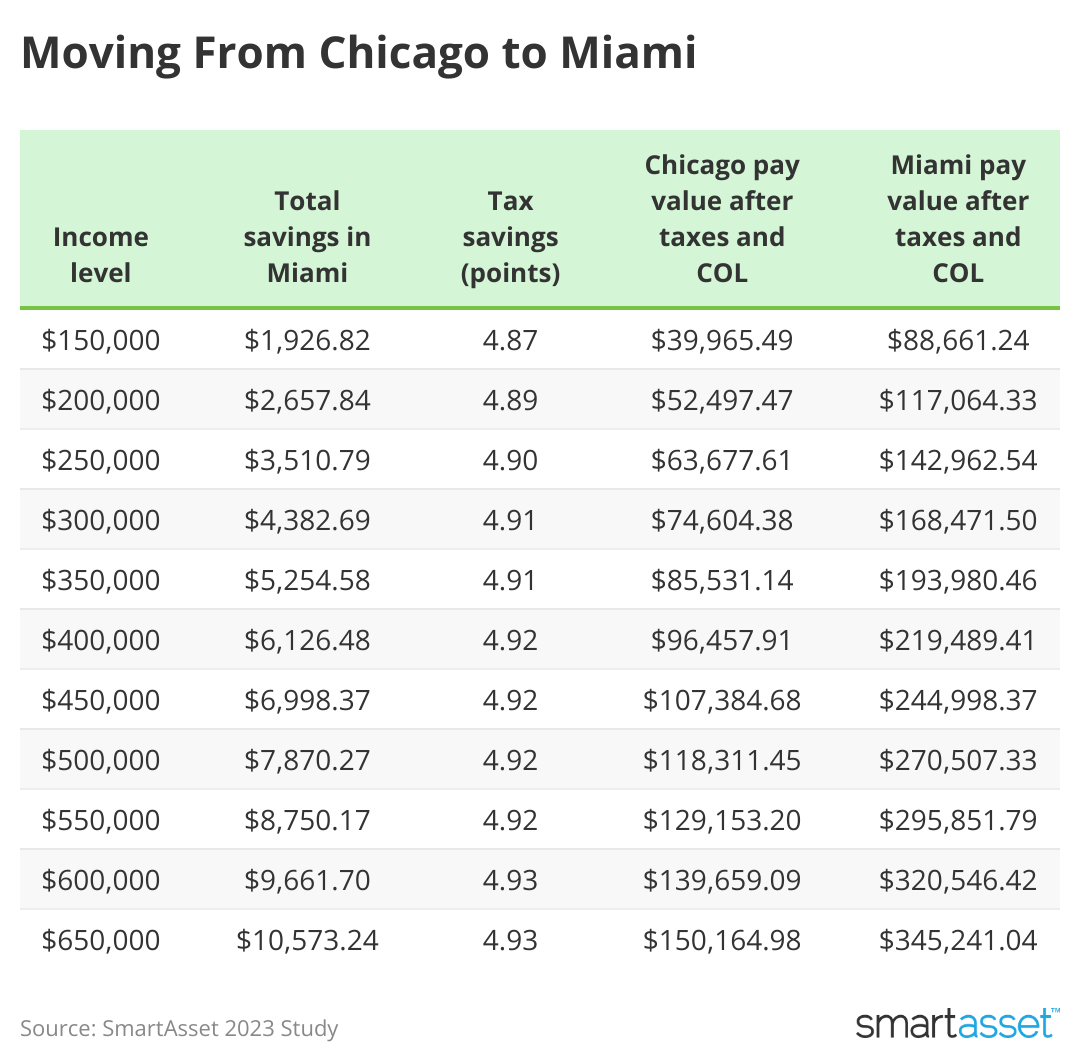

CHI → MIA

Table showing the cost and potential tax savings of moving from Chicago to Miami.

The move from Chicago to Miami will be least impactful financially for high earners. While Chicago’s cost of living is cheaper than Miami’s, cheaper tax rates in the Magic City nearly cancel out the benefit. Living in Chicago costs 17.1% more than average, while Miami costs 22.8% more than average. Between federal, state and local taxes, a Chicago resident will be charged 32% to 40% when making between $150k and $650k. Miami residents will only pay 27% to 35%, comparatively. Overall, a high earner moving from Chicago to Miami will only gain 1% to 2% of their annual income in purchasing power.

Data and methodology

Tax data comes from SmartAsset’s paycheck calculator and accounts for federal, state and local taxes. Base assumptions were used for a single tax filer. Zip codes were based on the downtown area of each subject city. Cost of living premiums come from the Council for Community and Economic Research’s Q3 2022 data and includes necessities pricing, including housing, transportation, utilities, groceries, healthcare and miscellaneous goods.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.