South Florida Office Sublease Availability Soars at Least 30%

When Kirkland & Ellis inked the largest out-of-market lease in Miami last year, it fueled the hype that South Florida is immune to the office trouble plaguing other cities nationwide.

But this summer, the law firm quietly put nearly a quarter of its 115,000 square feet at 830 Brickell for sublease. Some in the real estate industry were stunned. Others downplayed the move, arguing that the firm likely took more space than it immediately needed and expects its business to grow.

Yet, Kirkland isn’t the only firm trying to offload office space in South Florida. The tri-county region’s sublease availability soared this year, data from two sources show, contradicting fanfare over the market.

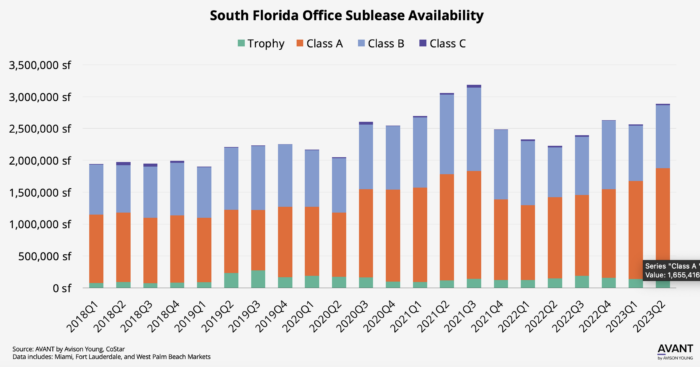

In the second quarter, nearly 2.9 million square feet were available for sublease, up 29.7 percent, year-over-year, according to data provided by Avison Young, sourced from the brokerage’s analytics platform Avant and CoStar Group. In the first quarter, nearly 2.6 million square feet were on the sublease market, a 10.3 percent jump from the same period of last year.

Colliers’ preliminary count for second quarter sublease availability reached 3.1 million square feet, up 42.6 percent, year-over-year. In the first quarter, nearly 2.8 million square feet were up for sublease, a 19.9 percent jump from the same period of last year, according to Colliers.

For the past two years, some companies shaved off space to accommodate the remote work shift. Yet, many more that had merely contemplated downsizing took the leap this year. The tipping point? Inflation and expensive capital due to interest rate hikes, which prompted firms to seek cost-cutting measures.

“Corporate America has called employees back to the office, and they are just not coming. It’s just a very delayed effect,” said Donna Abood of Avison Young in Miami. “The economy is influencing, too. The cost of money is really, really impacting these firms. … It’s possible it put a few of these [companies] over the edge.”

Case in point: London-based Cable & Wireless Communications has five years left on its 25,000-square-foot U.S. headquarters lease at The Landing at MIA, west of Miami International Airport. In recent weeks, it opted to put half the space for sublease, according to Abood, who represents the tenant.

While some experts counter that data may be augmented by various factors, such as some sublease availability doubly counted, they still agreed that generally South Florida tenants increasingly are seeking to offload offices.

“I can give you 150 examples,” said Neil Merin of NAI Merin Hunter Codman. Space is for sublease “in West Palm Beach, in Boca [Raton], in Fort Lauderdale, in Plantation, in Sunrise, in Tamarac. You name it,” he said.

Behind the tallies

In the second quarter, Palm Beach County had the least amount of sublease availability at 956,000 square feet, representing 1.8 percent of the office inventory, according to Colliers. Yet, that marked a 91.4 percent jump, year-over-year.

Broward County took second place with 963,000 square feet available, or 1.5 percent of inventory, up 14.2 percent, year-over-year. Miami-Dade County ranked first with 1.1 million square feet for sublease, or 1.1 percent of inventory, up 42.2 percent from the same period of last year.

Customer service firm Alorica put its entire 109,000-square-foot call center at 19500 South Dixie Highway in Cutler Bay for sublease in recent months, Avison’s data shows.

Motorola and law firm GrayRobinson put a combined 48,800 square feet at 401 East Las Olas Boulevard in downtown Fort Lauderdale for sublease.

The sub-sublease, a common occurrence elsewhere in the U.S. such as Texas, popped up in Fort Lauderdale, putting extra strain on South Florida’s office market.

In November, electronics company Kemet Corporation subleased 56,000 square feet of its 66,000-square-foot headquarters at Pacific Coast Capital Partners’ 1 East Broward Boulevard, according to Merin of NAI, which leases the building for the landlord. Less than a year later, sublessor West Marine, which moved its headquarters to the building, is sub-subleasing the space.

Kemet Electronics still has 10,000 square feet of the original space it leased in 2018.

“That’s an unusual one,” Merin said. South Florida is “not seeing a lot of” sub-subleases.

Because the 56,000-square-foot availability at 1 East Broward is a sub-sublease, it could be counted twice in some tallies, Merin said. This may be artificially increasing the total availability count.

Indeed, sublease tallies generally should be viewed with caution, brokers warned.

If a tenant is up for renewal in, say, six months, but hasn’t given the landlord a clear answer that it will stay, that space could be included in the sublease availability count, said Michael Falk of Colliers in West Palm Beach.

“Sometimes sublease space is being reflected as, ‘Yes, we have excess space, and yes, we will put it on the market.’” Falk said. “But not every one of those deals will end up coming up on the market.”

Another factor possibly skewing data is that many firms still are unsure about downsizing. They put offices on the sublease market, only to change their minds a few weeks or months later.

“Within the past six to 12 months, firms say they don’t need as much space, then decide that working from home isn’t working and they want everyone back in the office, Falk said. “There is a little bit of a seesaw. … But under the surface of that, there is some excess space being made available,” he said.

No building is safe

Despite a slowdown in leasing by new-to-market companies, and local firms downsizing due to remote work, some brokers still believe that trophy and Class A buildings remain safe from any dent in the market.

Yet, Avison’s data shows that’s not exactly the case.

Nearly 1.7 million square feet of Class A space and 220,500 square feet of trophy offices hit the sublease market in South Florida in the second quarter. That marks 30 percent and 50 percent increases, respectively, year-over-year.

Kirkland’s move to put some of its space on the market at OKO Group and Cain International’s 830 Brickell exemplifies a sublease at a marquee South Florida building. The 55-story building, which is nearly finished and fully leased, will be the first standalone office tower in Miami in a decade. It nabbed some of the biggest new-to-market expansions, as well as leases for Ken Griffin’s Citadel and Citadel Securities. The billionaire hedge funder moved his firms from Chicago.

Spokespeople for OKO and Cain referred calls to Kirkland, which didn’t respond to a request for comment. The brokers marketing the sublease also did not respond.

Sources familiar with 830 Brickell availability have told The Real Deal that Kirkland’s 13,100 square feet on the 14th floor and 14,400 square feet on the 15th floor are disconnected from the firm’s four other floors on higher levels in the building, creating an inefficiency at the lower-level space.

Falk, of Colliers, cites a silver lining to sublease availability at top buildings in prime locations. It allows suburban companies seeking to shave off their office space to move to South Florida’s central business districts. Although they would pay higher rent, it could be offset by leasing a smaller space, Falk said.

For now, general economic pressures on businesses aren’t ceasing — so neither will sublease availability in South Florida.

“The real issue for corporate decision making is the cost of money.… It’s really impacting these firms,” Abood said. “It’s only getting worse. There’s been no release of that stress at all.”

.jpg)