Federal Realty Is The Way To Go For passive Income

JohnnyGreig

Federal Realty Investment Trust (NYSE:FRT) is a well-managed real estate investment trust that has consistently increased its dividend.

The trust’s real estate portfolio is expanding and performing well, and it is well-diversified and concentrated in promising property locations.

Federal Realty Investment Trust has promising long-term growth prospects in its core market, and the trust’s dividend is easily covered by funds from operations.

The trust’s relatively safe dividend and low pay-out ratio are the top two reasons why investors should consider Federal Realty Investment Trust’s passive income.

A Strong Trust With A Recession-Proof Profile

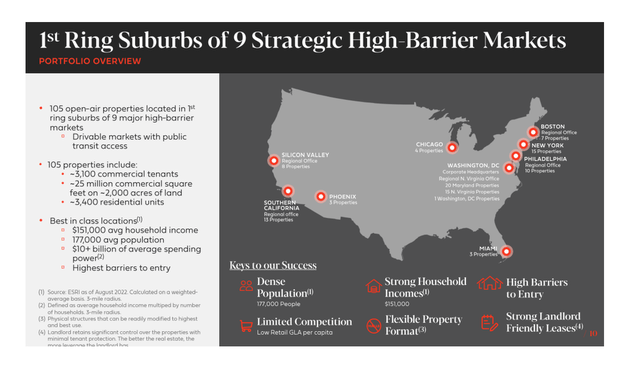

Federal Realty Investment Trust is a well-managed real estate investment trust with a growing portfolio that generates a consistent stream of income. As of June 30, 2022, the trust owned 105 properties across the United States, primarily in major metropolitan areas such as New York, Miami, Washington, Chicago, and Phoenix. In total, Federal Realty Investment Trust owned 25.2 million square feet of commercial real estate and approximately 2.9K residential property units. The commercial portfolio, which primarily consists of retail properties, was 94.1% occupied, while the residential portfolio was 98.5% occupied.

Federal Realty Investment Trust’s primary investment focus is on open-air centers with retail space leased to large retailers. Strategically, the trust focuses on communities with high entry barriers (densely populated areas with a limited supply of available retail space) and high available incomes.

Portfolio Overview (Federal Realty Investment Trust)

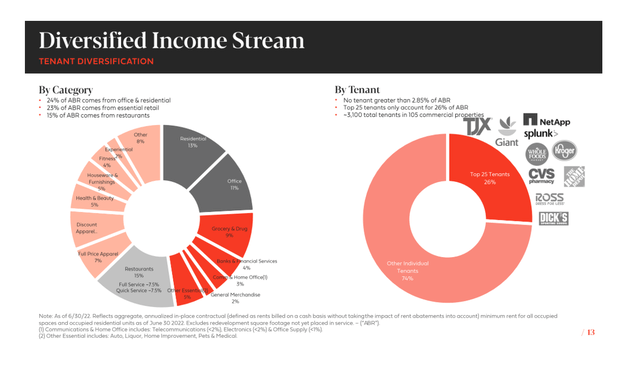

There is also some diversification for the trust within the portfolio. The portfolio’s rental contribution is 24% from offices and residential properties, 23% from essential retail properties such as drug stores, supermarkets, and banks, and 15% from restaurants.

Tenant Diversification (Federal Realty Investment Trust)

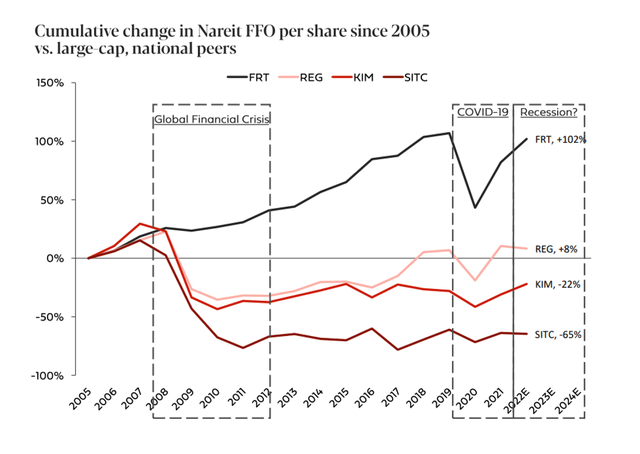

The investment strategy of Federal Realty Investment Trust has stood the test of time, and despite the fact that commercial real estate is a more vulnerable asset class than residential real estate, the REIT has recovered strongly from the Covid-19 recession.

With a total funds from operations growth rate of 102% since 2005, FRT has outperformed other retail-focused real estate investment trusts.

Cumulative Change In Nareit FFO Per Share (Federal Realty Investment Trust)

FRT Offers High Quality, Covered Passive Dividend Income

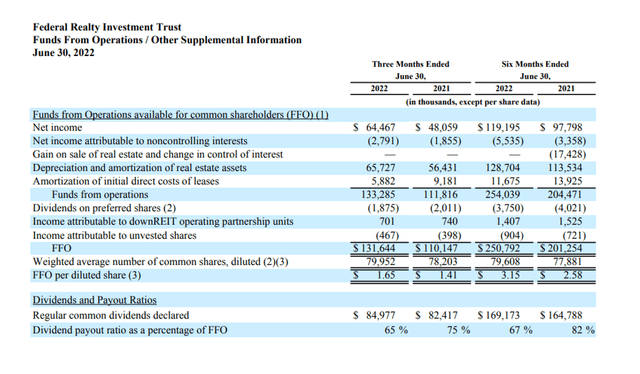

Federal Realty Income Trust is covering its dividend payments with funds from operations, and the payout ratio has improved noticeably in 1H-22 compared to the same period last year, owing to a broad market recovery following Covid-19.

The REIT distributed 65% of its 2Q-22 funds from operations and 67% of its 1H-22 FFO.

With such a low payout ratio, Federal Realty Income Trust’s dividend has a high safety score, and so investors probably need not worry too much about the dividend’s sustainability.

Funds From Operations (Federal Realty Investment Trust)

Guidance for 2022

Federal Realty Investment Trust expects NAREIT FFO to be $6.10-$6.25 per share in 2022, up from the previous range of $5.85-$6.05. Federal Realty Investment Trust’s stock is currently trading at $99.65, implying an FFO multiple of 16.1x.

Dividend Growth And Yield

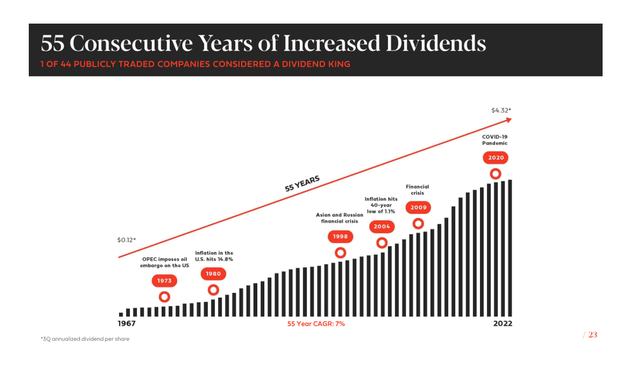

Federal Realty Investment Trust has delivered 55 years of consistent dividend growth, and there are few reasons to believe that this streak will be broken.

Federal Realty Investment Trust has increased its dividend at an annual average rate of 7% over the trust’s 55-year dividend history. The current dividend payment is $4.32 per share per year ($1.08 per share quarterly), for a dividend yield of 4.31%.

Given the trust’s low payout ratio, the dividend is very secure and was increased by 1% in the second quarter.

55 Years Of Increased Dividends (Federal Realty Investment Trust)

Why Federal Realty Investment Trust Could See A Lower Valuation

Federal Realty Investment Trust is well-managed, but it is exposed to the more volatile, and thus less predictable, commercial segment of the United States real estate market.

Recessions in this segment may be more severe than those in the residential market, resulting in higher FFO risks.

Since FRT has consistently increased its dividend over time, I don’t see why the dividend would be jeopardized even if the U.S. market experienced a recession.

My Conclusion

Federal Realty Investment Trust is a well-managed retail-focused real estate investment trust that I see as a core holding in a portfolio of passive income investments.

The trust’s portfolio metrics are very healthy, and its focus on large metropolitan areas ensures that the trust will be able to continue to grow its funds from operations.

A plus is the recently raised funds from operations guidance. With a 4.3% covered yield and a 16x FFO multiple, I believe passive income investors should take advantage of the recent market opportunity and purchase the trust’s stock.