With 6% Mortgages, The Housing Market Looks Set To Implode (BATS:ITB)

BryanLever

Investing in housing is a classic way to gradually build wealth, either as a homeowner or landlord. Generally speaking, it’s a sound strategy if your local economy’s fundamentals are decent. Of course, this is unless you’re buying into a twice-in-a-lifetime housing bubble.

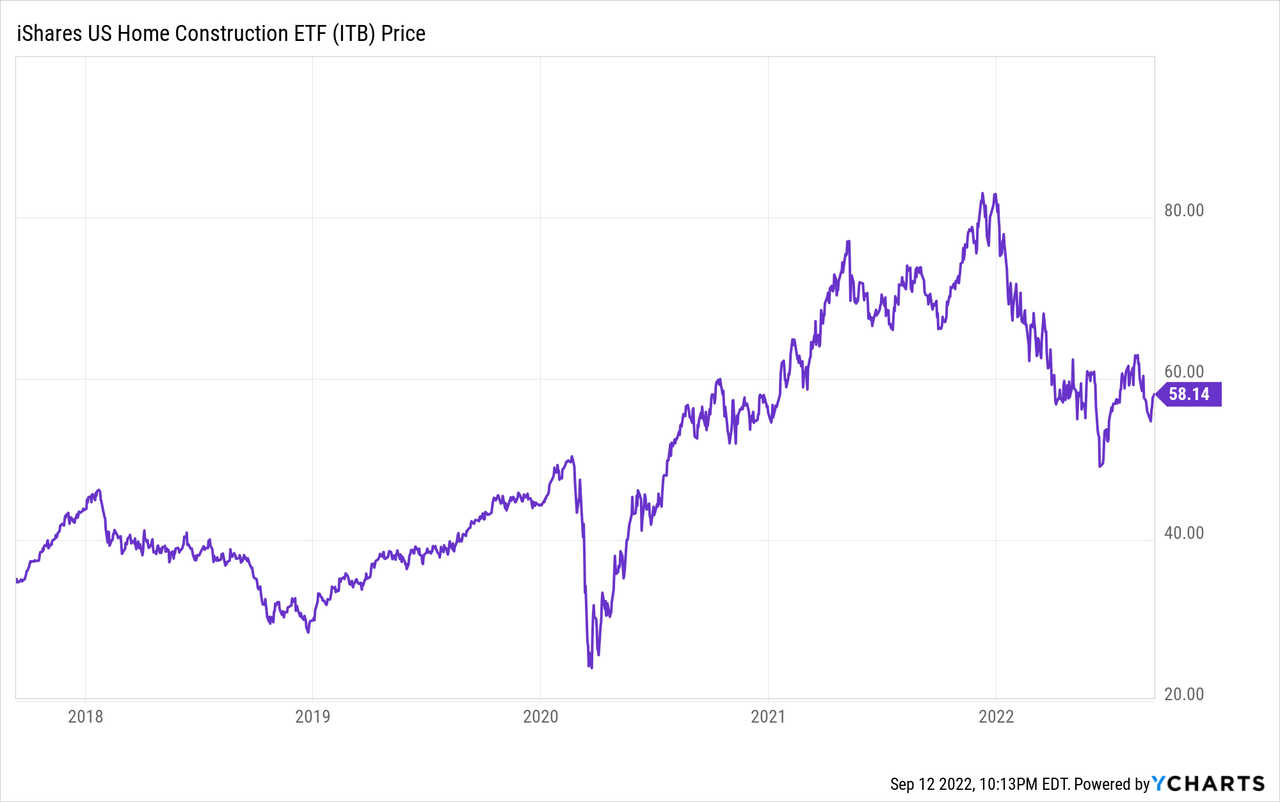

Home prices in the US skyrocketed by more than 33% since the start of the pandemic, buoyed by booming demand from homeowners and investors. Housing starts have steadily increased (until now), but population growth since the pandemic has been close to zero. Institutional investors in housing are now quietly heading for the exits, while real estate agents shout at the top of their lungs on social media not to miss out. As of my writing this, the iShares U.S. Home Construction ETF (BATS:BATS:ITB) is down roughly 28% for the year, after booming earlier in the pandemic. Housing is far and away the most interest-rate-sensitive sector of the economy, making it ground zero for global central banks’ ongoing battle with inflation.

ITB is hotly debated among bullish and bearish investors because of how insanely cheap its holdings appear on a forward price-to-earnings basis. ITB’s largest holding – D.R. Horton (DHI) – trades for 5.3x next year’s earnings estimates. Lennar (LEN) trades for 5.3x next year’s earnings as well. Homebuilder NVR (NVR) is historically a huge winner and trades for 10.8x 2023 earnings. PulteGroup (PHM) trades for 4.3x. And higher-end Toll Brothers (TOL) trades for 4.9x.

These are either the buys of the century if analyst earnings estimates are right, or they’re the value traps of the year because their price-to-earnings ratios are going to turn into “price-to-loss ratios.” I think it’s the latter.

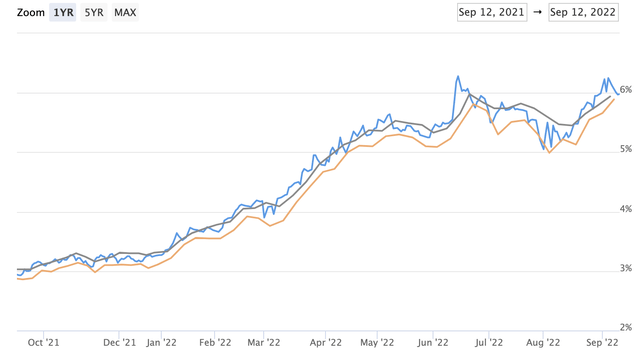

Mortgage Rates Are Skyrocketing

Instead of a “housing shortage,” or the myth of people moving en masse, the real issue was that from the start of the pandemic in 2020 until earlier this year, the Fed essentially fixed mortgage rates at 3% by buying almost all of the mortgages issued in America. This was instead of letting the market decide interest rates. Classic economic theory tells you that government price-fixing inevitably leads to shortages. It did here too, as everyone who had ever wanted to buy a house took advantage of cheap mortgage rates to buy the biggest house they could afford. Then some crowd psychology set in, and it was all about YOLO (you only live once!) and FOMO (fear of missing out!). This also was completely unsustainable because the only thing keeping mortgage rates that low was the government actively buying all of the mortgages. Earlier this year, when the Fed finally stopped doing this, mortgage rates went from 3% to 6% in a matter of months. Huge price gains plus huge interest rate increases mean that the number of buyers who can qualify melted like an ice cube, working to reverse price increases by brute force.

Mortgage Rates

30-Year Fixed Mortgage (Mortgage News Daily)

Now, inflation hitting 9% earlier this year has taken away the Fed’s QE ammo. The resulting tsunami of rising rates has quelled the housing market rebellion.

Basic math: With a 3% fixed mortgage rate, a 20% down payment, and a 36% debt-to-income ratio, a household with $100,000 in annual income can qualify for a $721,000 house. This was November and December.

At 4%, they can qualify for a $649,000 house. This was March.

At 5%, they can qualify for a $587,000 house. This was April and May.

At 6%, they can qualify for a $533,000 house. That’s now.

For the roughly 75% of American home buyers who use mortgage financing, that’s a 26% drop in purchasing power since the start of the year. Unless wages come up or interest rates come down, home prices will need to fall a lot. And why not? If they can rise 33% in two years, they can fall 25% or more in two years as well.

Prices Are Falling And Will Fall More

Sales prices in San Francisco are down 17% from the peak. Southern California is faring better but still down about 4% from the peak. Texas is down about the same. And what’s going on in America doesn’t hold a candle to what’s going on in other English-speaking countries like Canada, Australia, and New Zealand. The widely quoted Case-Shiller index has a lag of several months in its methodology, so by the time you see price declines in Case-Shiller you’re too late. Some markets like Miami are still up, but in all likelihood not for long. They’ll all come down in price as rates stay high and inventory rises.

When you step back and think about it, it’s lunacy. We have hundreds of thousands of amateur buyers borrowing money at 6% to bet 5-7x their annual earnings on the housing market. They’re buying from amateur sellers, who in many cases are assisted by amateur real estate agents. And of course, their loans are being insured by taxpayers.

Many of these buyers are dual income and absolutely need both incomes to qualify and service debt, so if either partner loses their job they’ll have to sell at a who-knows-what price. And with electricity prices rising 50% or more here year over year in Texas, it’s a cruel joke for many who stretched as far as they could to get into a house. This is especially true if they bought new construction and their closings (and thus, mortgage rate locks) were delayed by supply chain chaos deep into 2022, forcing them headlong into higher interest rates. Property tax assessors similarly smell blood in the water, hitting young families with brutal property taxes increases to pay for “inflation.” As such, active listings here went from crazy low levels to almost where they were in 2019. Your market may not look like ours. But the factors affecting interest rates are national – even global.

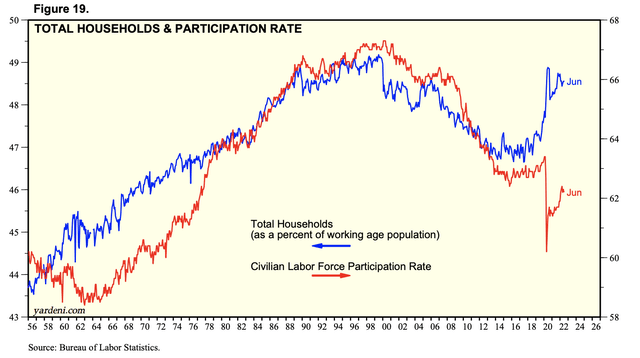

Here’s an update on the craziest graph in America.

Those Who Work (Red) Vs. Those Who Own or Rent a Home (Blue) (Yardeni Research)

About 49% of Americans own or rent a home, while labor force participation is stuck around 62%. The ratio is important, but the trend is key here. Labor force participation is down since COVID while housing demand is up. This correlation was about 1-1 from World War II until the pandemic. These have to converge, because if you don’t work, how will you pay rent or your mortgage? You won’t unless you’re getting a ton of stimulus, are making the money in stocks/crypto, or can benefit from eviction and foreclosure moratoriums.

Interesting times indeed…

Bottom Line

The housing market went completely out of control during the pandemic, and without the Fed pouring gasoline on the fire, there’s going to be a steep correction to restore sanity to the market. This has a slew of implications for anyone looking to buy or sell a house, and for investors in housing-related stocks like homebuilders.