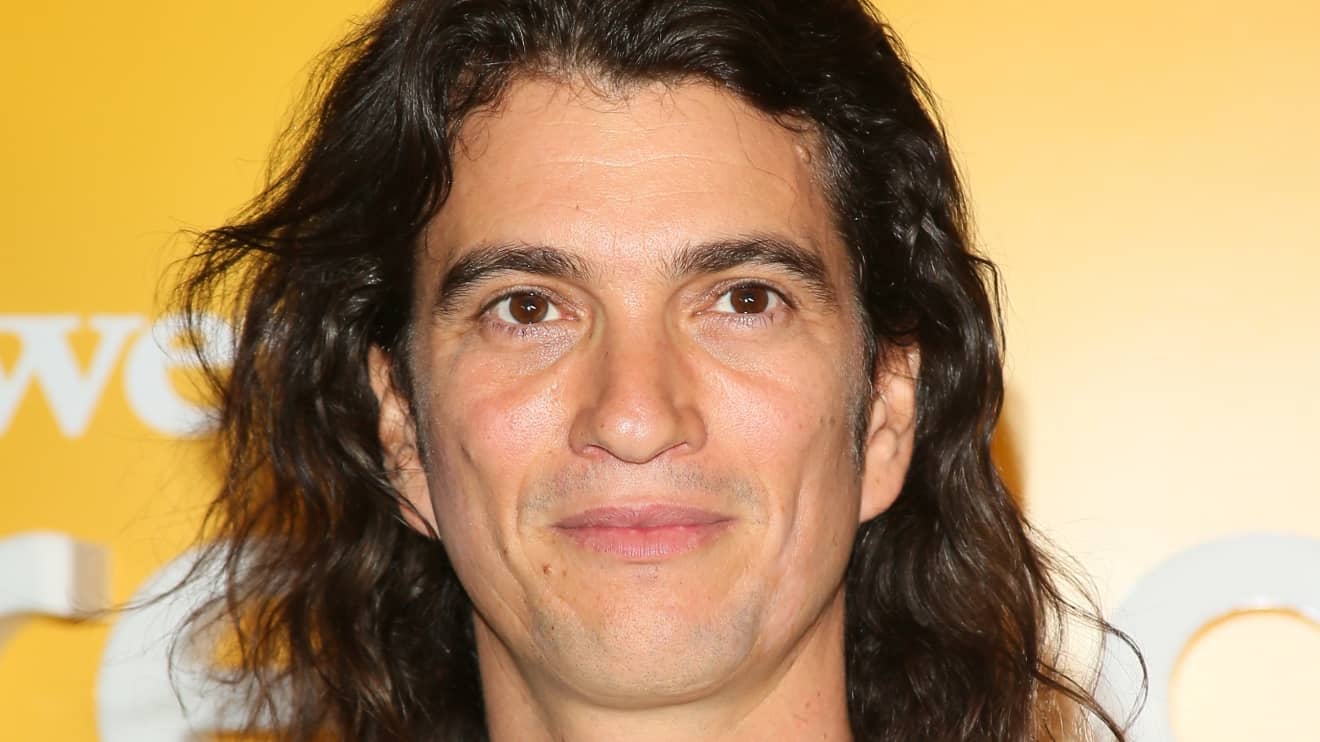

WeWork’s Adam Neumann secures millions in funding for his new company Flow

Adam Neumann is back.

The billionaire businessman who founded office-sharing company WeWork Inc.

WE,

is back with another company called Flow, a residential real estate company attempting to address the “changing dynamics” of the world’s housing issues.

Silicon Valley venture capital firm Andreessen Horowitz announced on Monday that it will be investing in Flow. The New York Times

NYT,

reported that Andreessen Horowitz is investing $350 million to Flow at a valuation of $1 billion.

“We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes,” Marc Andreessen, co-founder and general partner at Andresson Horowitz, said in a statement. “Residential real estate — the world’s largest asset class — is ready for exactly this change.”

According to court documents compiled by The Wall Street Journal, Neumann has acquired majority stakes in over 4,000 apartments in places like Miami, Nashville, Tennessee and Fort Lauderdale in recent years. These properties are valued at more than $1 billion.

See also: ‘I have committed financial infidelity’: I racked up $50,000 in debt to help my troubled son — and have not told my husband. How do I get out of this mess?

“This kind of mission is a heavy lift. Only through a seismic shift in the way industry relationships are structured and the mechanisms through which value is delivered can we hope to address the underlying problems of the current system and build the solution,” Andreessen’s statement continued.

Flow’s website does give much other information about the company, only that it is scheduled to debut in 2023. Flow did not immediately respond to MarketWatch’s request for comment on this story.

Neumann was ousted as CEO of WeWork in 2019 after SoftBank Group Corp.

9984,

and other company shareholders soured on Neuman following a major decrease in the company’s valuation. When SoftBank took control of WeWork in October 2019, the company was worth an estimated $8 billion — a fraction of the $47 billion valuation SoftBank assigned the company in its last round of financing earlier the same year.

See also: Mark Cuban says buying metaverse real estate is ‘the dumbest shit ever’

WeWork ultimately went public in 2021 through a Special Purpose Acquisition Company (SPAC) and now has a total market capitalization of $4.19 billion as of August 15.

Adam Neumann has a net worth of $1.4 billion, according to Forbes calculations, and still owns 10% of all shares of WeWork.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/QCXLNPLE25FBXBCOPXIAR43BL4.jpg)