Madison Realty Capital Lends $114M on Southeast Mobile Home Portfolio – Commercial Observer

Parakeet Communities has landed a $114 million debt package to refinance a portfolio of 12 mobile home communities in Florida and North Carolina, while also positioning itself for future expansion in the Southeast, Commercial Observer has learned.

Madison Realty Capital originated the financing for Parakeet’s portfolio of 1,100 total pad sites situated primarily along the east coast of Florida. An initial loan of $50.9 million will finance closing costs, repay corporate debt and create light capital improvements. It will be upsized to as much as $114 million to fund future acquisitions when Parakeet identifies additional strategic investments that fit the same profile as the portfolio’s initial assets.

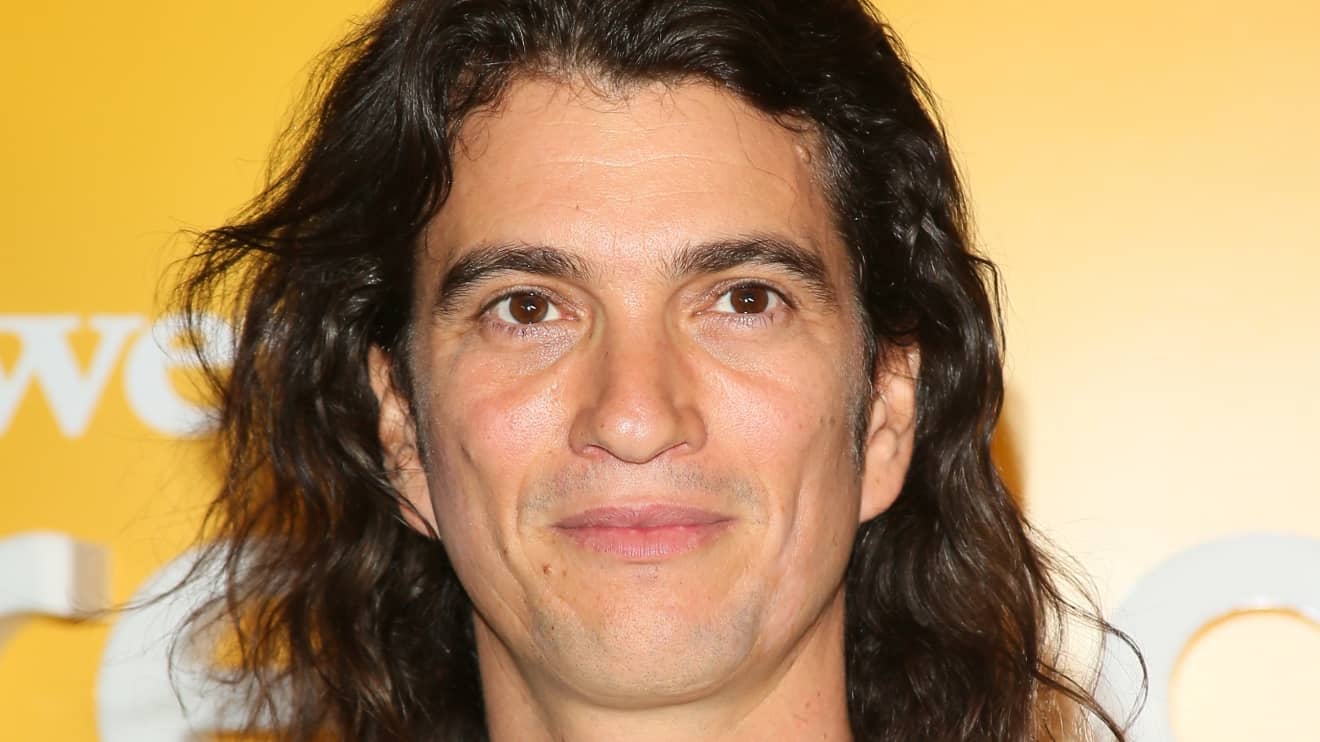

“The institutional approach and operational efficiencies of scale that Parakeet brings to a typically disaggregated rental market will provide under managed parks with much-needed capital improvements to maximize their growth potential and improve quality of living for residents,” Josh Zegen, managing principal and co-founder of Madison Realty Capital, said in a statement. “As demand for low-cost rental housing continues to grow across the Southeast, Madison Realty Capital is pleased to provide a flexible financing solution to an experienced group with an eight-year track record investing in MHCs for the continued expansion of their well-leased portfolio of mobile home communities throughout the region.”

Washington, D.C.-based Parakeet Communities is an owner and operator of manufactured homes, recreation vehicles and marina properties nationwide.

The portfolio currently includes a small percentage of park-owned homes in the Florida communities of Miami, West Palm Beach, Panama City, Cape Canaveral, Ruskin, DeLand, Cocoa and Mount Dora, as well as Atlantic Beach, N.C. Collectively, the sites are currently 88 percent occupied.

The day-to-day operations of the mobile home parks are managed by a Parakeet affiliate, which is focused on capturing positive mark-to-market in rents from targeted low-cost capital initiatives such as road paving, landscaping and utility installation.

“We are incredibly excited to be partnering with Madison Realty Capital on this financing solution to support the accelerated growth of our asset base throughout the Southeastern U.S,” Jonathan Wyss, co-founder and chief investment officer of Parakeet, said in a statement. “Their team and platform were great to work with throughout the whole transaction process, and we look forward to expanding our relationship with them into the future.”

Andrew Coen can be reached at [email protected].

/cloudfront-us-east-1.images.arcpublishing.com/pmn/2RUV7FA7UQHNYYMVFOW4XSQZYQ.jpg)