Renting Properties to Ultrawealthy Tenants Isn’t as Glamorous (or Easy) as It Seem

If you’re a landlord, you’re no doubt aware of all the issues that can arise when you rent your property for the median monthly asking rent in the U.S., which was reported by

Redfin

to be $2,002 in May 2022.

But what about an ultraluxury home or condominium, one that rents for $50,000, $100,000 or even $130,000 per month?

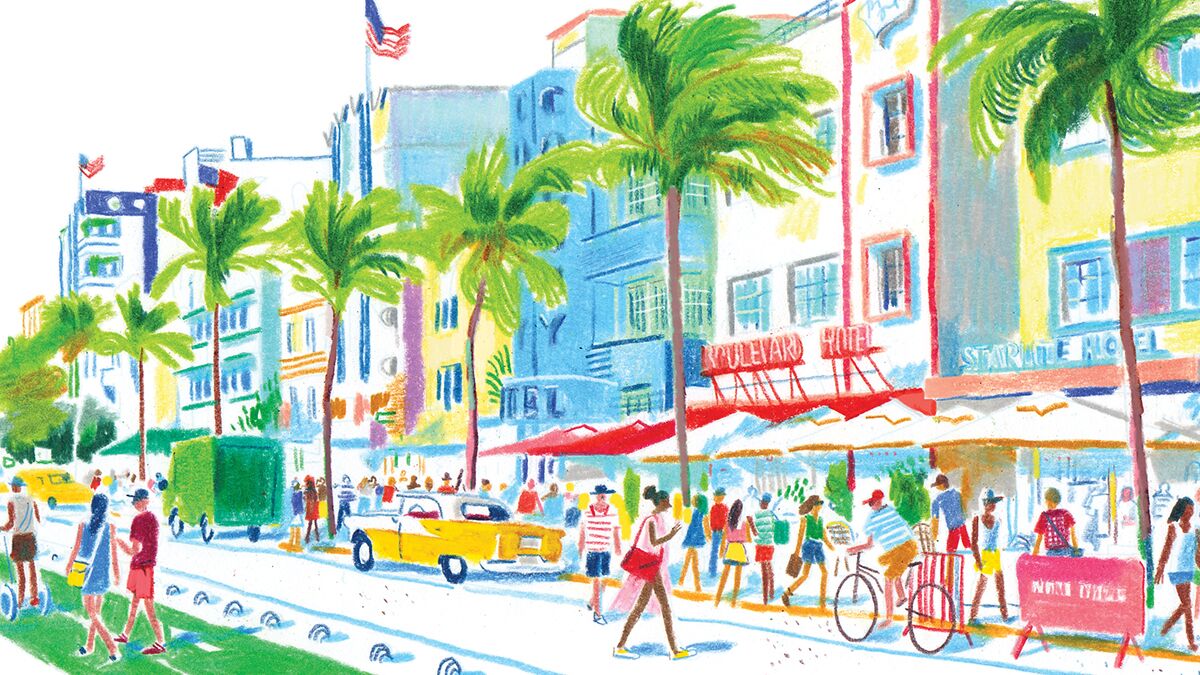

“High-end luxury rentals create unique challenges for landlords because the tenants are high-net-worth individuals, often celebrities, who have special requirements,” said Julian Johnston, a real-estate broker at The Corcoran Group in Miami Beach.

Mr. Johnston, who last year represented the owner of an 11-bedroom, 15-bath waterfront home in Miami Beach that was leased to a celebrity for $130,000 per month, recently worked on a deal where he had to sign a lease rider stating that “if I needed to go to the residence for any reason that I would not speak to, or look at, the tenant.” Another celebrity client wanted to ensure privacy at the rental home, so Mr. Johnston arranged to purchase $20,000 worth of 8-foot-high potted plants that were placed along the sea wall and on bedroom balconies so that paparazzi couldn’t shoot photographs from a boat offshore.

“ High-end luxury rentals create unique challenges for landlords because the tenants are high-net-worth individuals, often celebrities, who have special requirements. ”

The high-net-worth individuals who can afford to rent these properties often come with high expectations. Many demand almost concierge-level service from their landlords or the agents or property managers working on their behalf.

“In your average landlord-tenant relationship, the landlord pretty much dictates the terms, and the tenant will not have that much say,” said Zachary D. Schorr, a real-estate attorney in Los Angeles. “But when you get into these higher-priced leases, it’s not atypical for an attorney to negotiate the terms of the lease.”

Eric Rollo, a licensed broker and managing partner of the Boston office of The Agency, recently worked on a lease where the tenant was a player for the Red Sox, who was renting a townhouse in Chestnut Hill, just outside Boston, for $18,000 a month. “He was in Florida at spring training but expected to arrive at a turnkey property,” he said. “So, we had shades installed, the internet and cable hooked up and everything done on the front end to make sure the property was ready.”

Danny Hertzberg, a real-estate agent with The Jills Zeder Group at Coldwell Banker Realty in Miami Beach, also has coordinated requests from high-net-worth tenants. “I often receive the initial call with the complicated requests and then connect the tenants with the property manager, who makes all the arrangements for them,” he said. “They expect the fridge to be stocked and massage therapists, chefs and drivers to be arranged. They also want to know that the landlord has a professional management company that has the resources to respond at 4 a.m. on a Sunday morning for a leaky faucet.”

Mr. Hertzberg said many landlords even do light remodeling between tenants so their properties are in pristine condition.

Leases for high-end rentals can be complicated as well, with tenants demanding unique clauses that may adversely impact the rights of the owners.

Mr. Hertzberg was involved in the sale of a five-bedroom home on Palm Island in Miami Beach where, before signing the listing agreement, the owner rented it to a famous Reggaeton artist for over $100,000 a month. The tenant had his own security team, with multiple guards in front and in back of the property, and they were so protective that even though Mr. Hertzberg had the right to show the property to potential buyers, the guards wouldn’t let them access the premises.

“We lost a lot of buyers because they weren’t willing to jump through hoops,” said Mr. Hertzberg. The tenant only allowed access on certain days and at limited hours. Prospective buyers also had to sign a nondisclosure agreement, which prohibited them from taking photographs.

Ultimately, the parties were able to negotiate a showing when the tenant was out of town, but access for home inspections and the appraisal were a nightmare as well, he said. All inspectors needed to be approved by the tenant and were escorted around the property with the tenant’s security team.

The house was listed for about $20 million and ultimately sold for about $15 million, Mr. Hertzberg said. “The seller left millions of dollars on the table as a result of the tenant,” he added. “He took a big haircut.”

If you’re the owner of a high-end property and planning to rent it out, here are some things to consider.

Be creative when qualifying the tenant. Owners of ultraluxury properties, or their representatives, need to do more than just a basic credit check and background search on the prospective tenant. Some landlords ask for proof of funds, such as bank statements, as well as personal references from former neighbors or landlords. Others request a letter of credit or that the tenant pay six months or a full year in advance. Ethan Assouline, an agent with Compass in New York City, does all this and more. “If it’s a celebrity, you can also Google them and do your due diligence to see if they had past troubles or noise issues,” he said. “Plus, we often know who the broker is on the other side when we’re representing the landlord and the reputation of that broker and the kind of clients they work with.”

Make sure your insurance is sufficient. Landlords of high-end properties should consider securing an umbrella policy, which kicks in when the underlying limits of the landlord’s policy aren’t enough to cover the costs if the landlord is sued for an accident or injury on the property. All landlords of homes that are rented long-term—anything over six months—regardless of the rent level, should have a landlord’s policy, or rental dwelling policy, according to the Insurance Information Institute, an industry trade group. A landlord’s policy provides coverage for physical damage to the property caused by fire or other casualty, as well as coverage for personal property the landlord leaves for tenant use. It also includes liability coverage in the event a tenant or guest is injured on the property. Many landlord’s policies also cover loss of rental income in the event the property can’t be rented while it is being repaired due to damage from a covered loss. Landlord’s policies typically cost about 25% more than a standard homeowners policy for this extra protection.

Do a preoccupancy inspection. While inspections on lower-priced rentals are common when the tenant moves out so the landlord can ensure there are no damages, for high-price rentals, Mr. Schorr recommends a preoccupancy walk-through to protect both parties. “Document everything via video and photographs, and have the tenant sign off on it,” he said. “That way, if a dispute arises, you have a record.”

SHARE YOUR THOUGHTS

What has been your experience renting out a property as a homeowner? Join the conversation below.

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8