Inside Miami’s Enormous Budget Airline Growth

.jpg)

Miami International Airport

- IATA/ICAO Code

- MIA/KMIA

- Country

- United States

- CEO

- Ralph Cutié

- Passenger Count

- 37,302,456 (2021)

- Runways

- 8L/26R – 2,621m (8,600ft) |8R/26L – 3,202m (10,505ft) |9/27 – 3,967m (13,015ft) |12/30 – 2,853m (9,360ft)

- Terminals

- North Terminal |Central Terminal |South Terminal

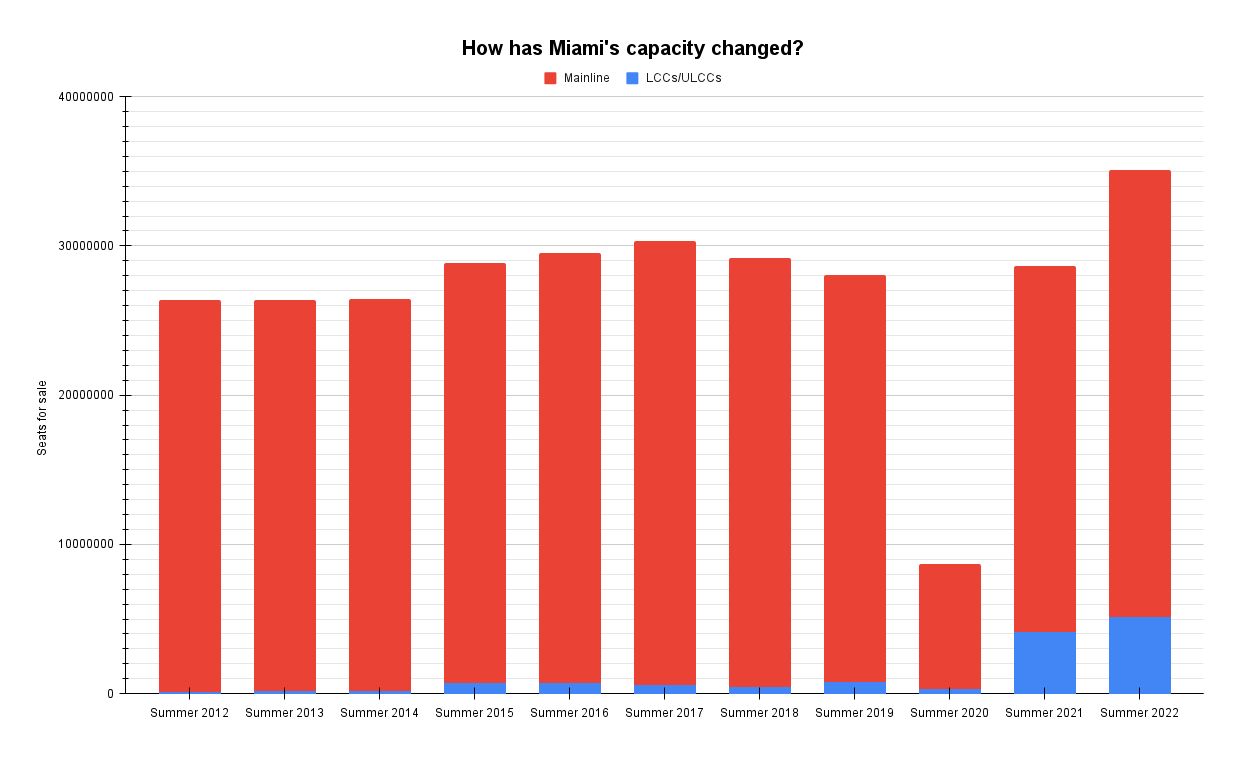

Miami International was renowned for many years as an expensive, congested airport. It was eschewed by domestic low-cost and ultra-low-cost carriers who preferred the significantly cheaper Fort Lauderdale. That changed in 2021 as Miami sought more growth. Now, LCCs/ULCCs have more than one in every seven seats at Miami, a previously unthinkable number.

Nearly 15% of Miami’s seats

To stimulate passenger traffic, a key objective for Miami, the airport lowered charges and changed gates to a preferential-use model versus the common-use model. This reduced the cost per passenger from more efficient use.

When combined with solid leisure and visiting friends and relatives demand and the popularity of Florida generally, Miami attracted Spirit, Southwest, and (hybrid carrier) JetBlue. And Frontier, which has served the airport since 2014, grew enormously. It has helped Miami to rebound faster than most other major US airports.

In summer 2019 (S19), Miami had fewer than 808,000 seats for sale by LCCs/ULCCs, according to OAG data. All were by international operators except Frontier and Sun Country. The number passed 4.1 million in S21, while it’s nearly 5.2 million this summer. It has played catch-up.

Put another way, nearly 15% of Miami’s capacity is now by them, up from barely 3% in S19, a higher proportion than many other major US airports. Miami’s percentage of LCC/ULCC capacity is around the same as Dallas Fort Worth and Atlanta but higher than Chicago O’Hare and Newark. The arrival of Sky Airline Peru, which launched Lima-Miami on June 7th, has contributed.

Source of data: OAG.

Stay aware: Sign up for my weekly new routes newsletter.

Spirit is number-one

Despite only starting Miami last October, the airport quickly became Spirit’s eighth-busiest, only very marginally behind Detroit. Spirit has almost two million Miami seats this summer. It has a higher quantity at the airport than any other ULCC/LCC.

It is Miami’s second-biggest passenger airline behind the world’s largest operator, American (21.8 million). While American isn’t quite so dominant at Miami to make it a fortress hub (it has 62% of capacity against the required 70%), it is nonetheless so prevalent that everyone else is dwarfed. Second-place Spirit, which will have a crew base at Miami this season, has just shy of 6%.

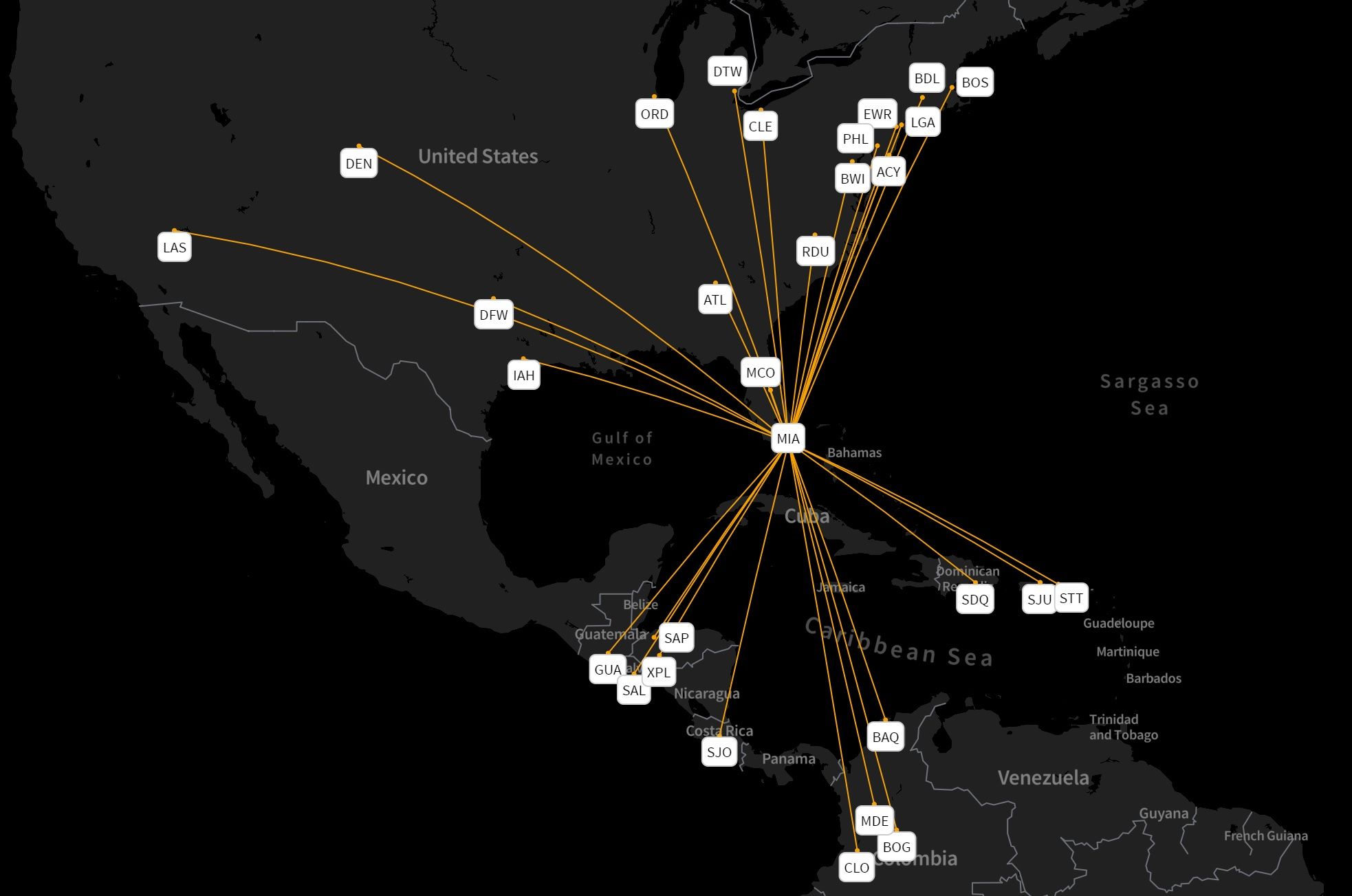

Spirit’s Miami network between June 16th and October 29th. Orlando has more seats for sale than any other route. Image: OAG.

29 Miami routes

Spirit has 29 Miami routes, of which 17 are domestic and 12 are international. Another route, Minneapolis, ended mid-April, not long into the summer season. It lasted for only four months.

In comparison, Spirit has 62 routes at nearly Fort Lauderdale, the ULCC’s top airport. Route overlap is significant: all but one from Miami is also served from Fort Lauderdale. Spirit says this doesn’t matter as they complement, rather than substitute, each other. After all, the South Florida area is large, population-wise, and the two airports are, to a certain degree, focused on separate catchments.

The sole exception is Raleigh Durham, inaugurated in November last year and served until June. It’ll return on a 1x daily basis from October 6th, a few weeks before Miami’s all-important winter starts. It is one of various Spirit routes that’ll not operate during the height of summer, given lower demand and staff shortages.

Will you be flying to Miami this summer? If so, with which airline? Let us know in the comments.

-1.jpg)