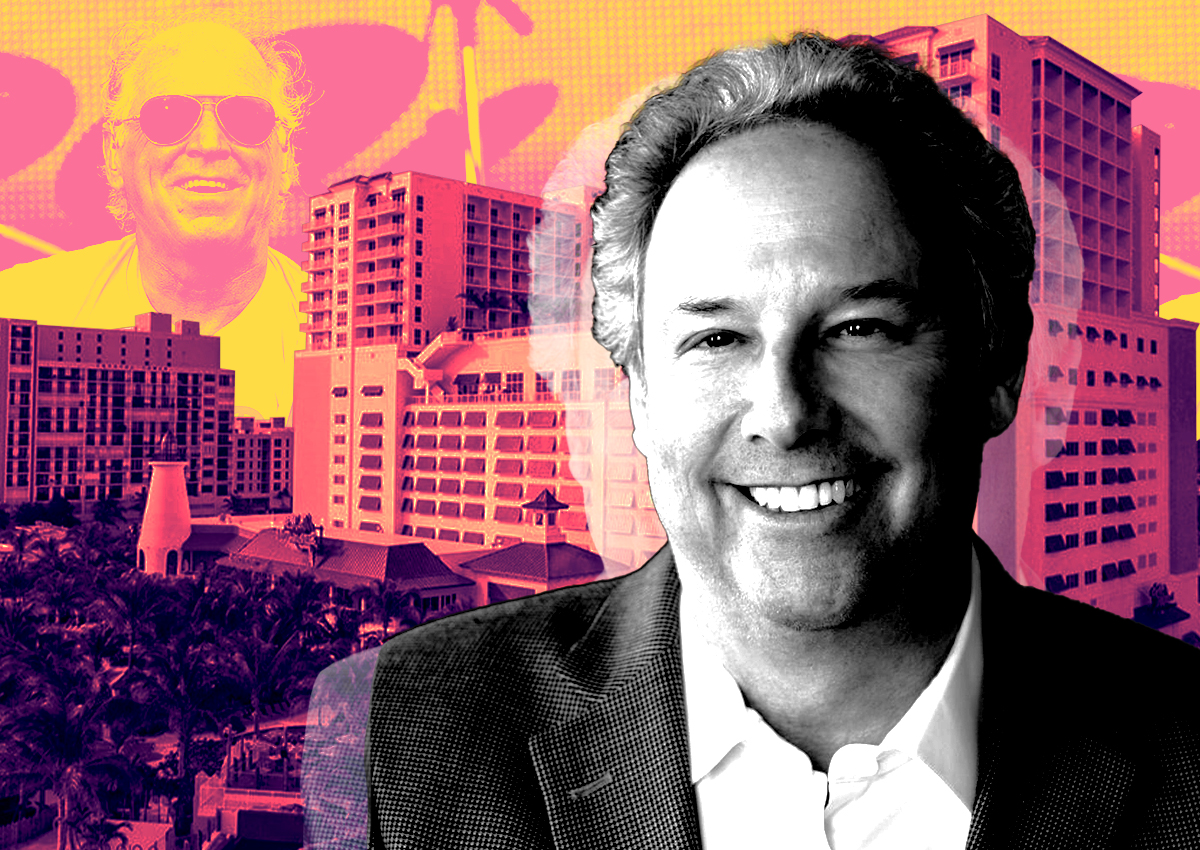

Pebblebrook Nabs Refi for Margaritaville Resort in Hollywood

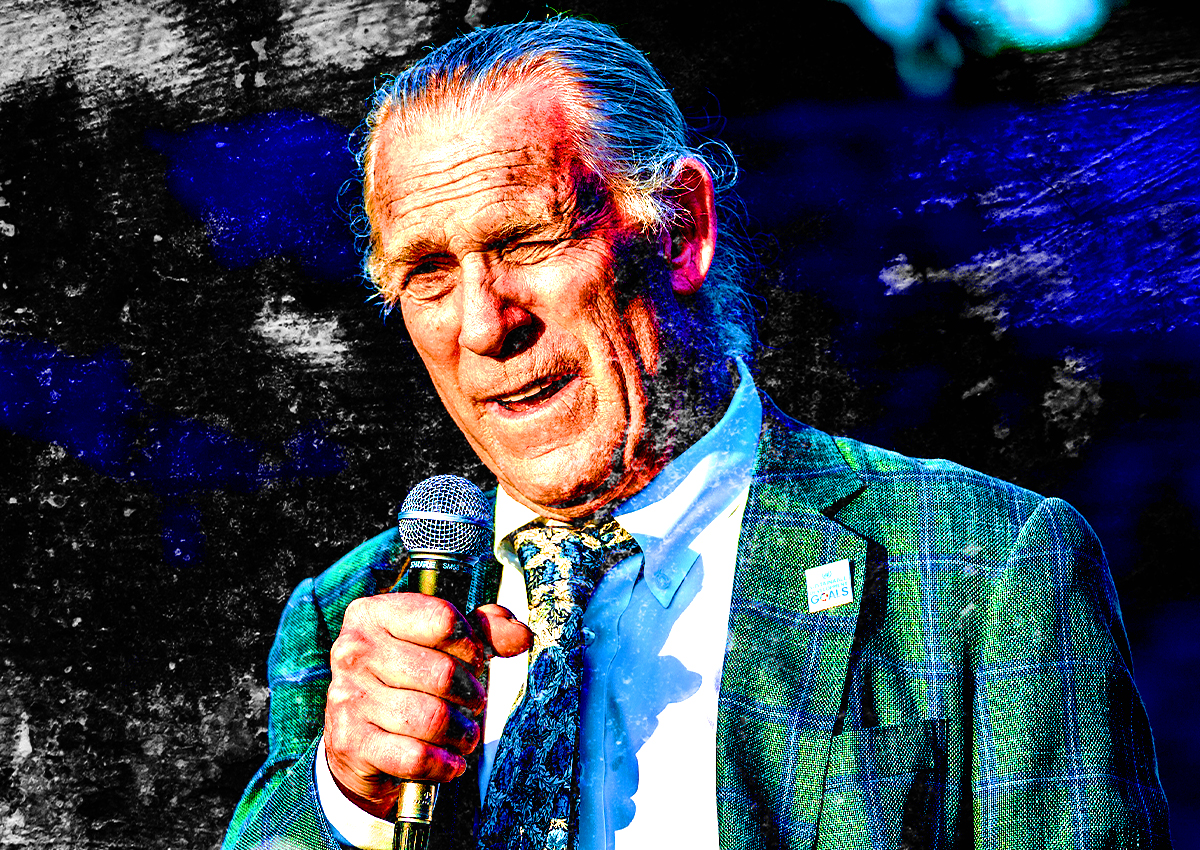

The Margaritaville resort in Hollywood, inspired by the late musician Jimmy Buffett, who died this month, scored a $140 million refinancing.

Wells Fargo, as administrative agent for itself and other co-lenders, provided the financing to Pebblebrook Hotel Trust, according to records.

The 18-story resort consists of a 369-key resort, more than 30,000 square feet of indoor and outdoor event space, an 11,000-square-foot spa, 22 cabanas, several pools and eight restaurants. It was completed in 2015 on 6.2 acres at 1111 North Ocean Boulevard.

Bethesda, Maryland-based Pebblebrook bought the resort buildings in 2021 for $270 million. It marked the biggest hotel deal of that year. Pebblebrook financed the purchase with $108.5 million in cash and assumed an existing $161.5 million loan on the property, according to a 2021 Pebblebrook news release announcing the purchase.

The city of Hollywood owns the Margaritaville land, records show.

Led by CEO Jon Bortz, Pebblebrook is a publicly traded real estate investment trust with a portfolio of 47 hotels and resorts across the U.S., according to its website. Its other Florida properties include the Southernmost Beach Resort and The Marker Key West Harbor Resort, both in Key West; as well as the LaPlaya Beach Resort & Club and the Inn on Fifth, both in Naples.

Buffett died on Sept. 1 at age 76 following complications from a rare type of skin cancer. Aside from his Margaritaville Holdings that extended its brand to hotels and resorts nationwide, Buffett also owned residences in Palm Beach, New York and St. Barts.

The refinancing comes at a time of expensive borrowing costs, following the Federal Reserve’s interest rate hikes since the spring of last year. Despite this, other South Florida real estate investors scored refinancings this year.

In August, Craig Robins’ Dacra, L Catterton Real Estate and Brookfield Properties nabbed a $250 million refinancing for the Paradise Plaza restaurant and retail complex at 151 Northeast 41st Street in the Miami Design District. Also, Kushner Companies and the Miculitzki family’s Block Capital Group took out a $91 million refinancing on their Wynd 27 and Wynd 28 apartment and retail project at 127 Northwest 27th Street and 129 Northwest 26th Street in Miami’s Wynwood.