Best Housing & Lumber Stocks To Buy Now

Oselote/iStock via Getty Images

Real Estate & Lumber Stocks With Buy Ratings

My colleague lives in Florida and is experiencing her first tropical storm, Hurricane Ian, and mentioned that not only are the shelves of Home Depot (HD), Lowe’s (LOW), and many other home improvement stores barren, but the path to rebuilding destruction requires lumber supplies, an industry that has experienced a substantial decline over the last year. So, I thought to myself, although lumber is a commodity with volatile price swings, it is a crucial ingredient in homebuilding and furnishings. I consider it closely related to real estate – a solid hedge against inflation with return potential. While prices can fluctuate more rapidly with lumber, as we will see with the impacts of Hurricane Ian, the need for lumber is never-ending and provides many uses.

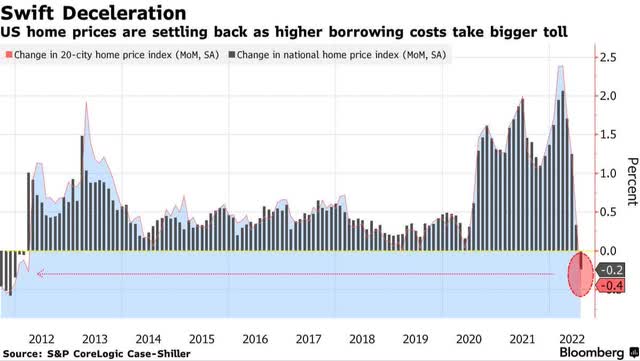

The frothy U.S. real estate market is taking a turn – a potential downturn – and home prices are falling as mortgage rates climb. With most people’s wealth in their homes and many homes built with lumber, both industries offer unique characteristics to hedge against inflation. Despite both sectors experiencing headwinds, there are fundamentally sound companies within the housing, real estate, construction, and building industries. Although mortgage rates are at 7% and inflation above 8%, stocks in the housing sector may experience more downside. However, those with solid fundamentals can offer upside over the long run.

1. Lennar Corporation (NYSE:LEN)

-

Market Capitalization: $20.91B

-

Quant Rating: Buy

-

Dividend Safety Rating: A-

-

Quant Sector Ranking (as of 9/28): 59 out of 538

-

Quant Industry Ranking (as of 9/28): 10 out of 24

Miami, Florida-based homebuilder Lennar Corporation (LEN), together with its subsidiaries, constructs and sells homes, and purchases, develops, and manages real estate. Down 30% YTD and trading near 52-week lows, LEN has experienced a moderate decrease in momentum quarterly. While investors have been less aggressive in purchasing shares of the stock on the heels of weakness in the housing market, there is plenty of demand, making this stock pick one to consider for portfolios.

U.S. Home Price Deceleration Chart (S&P CoreLogic Case-Shiller, Bloomberg)

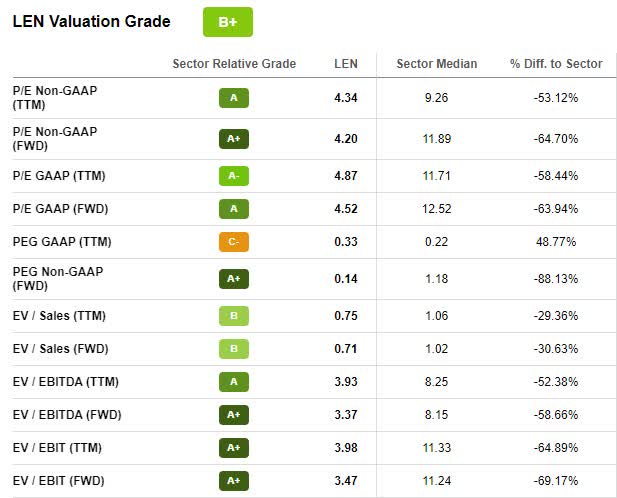

Lennar Stock Valuation

Fears of a broader economic recession are mounting, and new home sales experienced a decline in June to their lowest levels since April 2020. As the Fed continues its tightening to address inflation, the recent jump in mortgage rates makes borrowing more expensive, affecting the real estate and, subsequently, lumber market. Less inventory may allow prices to stay elevated, a potential bonus for both industries. Lennar Corporation is undervalued, with a forward P/E ratio of 4.52x, a -63.94% difference to the sector, and an A+ forward PEG of 0.14x, an -88.13% difference to the sector.

LEN Stock Valuation Grade (Seeking Alpha Premium)

Substantially undervalued with solid momentum, this stock also has excellent profitability. Let’s dive into Lennar’s earnings.

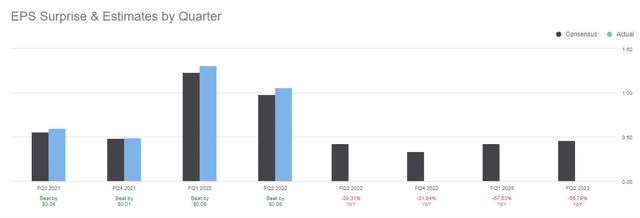

LEN Stock Growth & Profitability

Lennar Corporation reported Q3 earnings last week with an EPS of $5.18, beating by $0.32, but revenues missed by 28.71% Y/Y. Although the revenue figures seem devastating, especially considering the macroeconomic environment, Lennar Corporation is in fundamentally good shape. Looking at Lennar Corporation’s factor grades below, which rate investment characteristics on a sector relative basis, LEN’s Profitability Grade is a solid A, and Revisions are a B-, indicating the stock has a solid outlook.

LEN Stock Factor Grades (Seeking Alpha Premium)

Lennar’s 2021 fiscal year revenues were $27.13B, an increase of nearly 21% over the previous year, resulting from a higher average price of homes, sale of homes, and a rise in net income from $2.47B to $4.43B. In 2022, LEN experienced a 23.9% revenue increase for the first half of the year on the heels of higher home prices and several home deliveries, pushing up the company’s profitability.

“Deliveries continued to drive very strong cash flow and bottom-line earnings as we continue to refine our already efficient operation with SG&A of 5.8% for a 120 basis-point improvement over last year. With strong bottom-line earnings of $1.47 billion or $5.03 per diluted share, driving strong cash flow, we’ve continued to fortify our balance sheet. After paying down $575 million of maturing senior debt without replacement, we ended the quarter with $1.3 billion of cash, nothing drawn on our revolver, and a 15% debt-to-total capitalization ratio as compared to 21.2% last year. As a matter of careful capital allocation this quarter, given current market conditions, we chose not to repurchase stock in favor of early retirement of debt” – Stuart Miller, Lennar Executive Chairman.

Although we see some shifts in the housing market and homebuilder confidence, Lennar is a solid buy. The current market condition is not ideal for real estate. Yet, it still offers upside, and as the markets recover, investing in the sector at the current discounted valuations may prove very profitable. Let us dive into our next stock pick.

Investing in Lumber

Whether the price of lumber has bottomed remains to be seen, timber may be near the floor, -61% YTD! Commodities can be unpredictable, showcasing volatile price swings as we’ve seen with the soaring demand for new homes and renovation activities throughout the pandemic when the price of lumber topped $1,607 per thousand board feet in May of 2021.

Lumber Futures YTD Performance (LB1:COM)

Lumber Futures YTD Performance (LB1:COM) (Seeking Alpha Premium)

Now, lumber is trading at $430 per thousand board feet, surging interest rates and inflation are slowing the demand for single-family homes and discretionary spending that involves construction projects. And while lumber is closely linked to housing, new home sales in August unexpectedly increased positively, which is why I like the buy rating for Weyerhaeuser stock.

2. Weyerhaeuser (NYSE:WY)

-

Market Capitalization: $20.88B

-

Quant Rating: Buy

-

Dividend Safety Rating: A+

-

Quant Sector Ranking (as of 9/28): 27 out of 179

-

Quant Industry Ranking (as of 9/28): 6 out of 25

With diversified offerings and a long-standing focus on sustainability, Seattle-based Weyerhaeuser Company (WY) owns more than 11 million acres of diverse timberland. Continuing to thrive in an inflationary environment as one of the world’s biggest forest product companies, WY operates in the United States and manages millions of publicly owned land in Canada under long-term licenses and has grown significantly via acquisitions. Despite rising prices and slowing demand leading to weakening wood production and a Bank of America downgrade, Seeking Alpha’s quant ratings and Citi say buy WY, a quality stock with tremendous profitability and solid momentum.

WY Profitability & Growth

Weyerhaeuser has a solid balance sheet and cash flow and crushed 2022 Q1 and Q2 earnings. EPS of Q1 was up 44% Y/Y, and recent EPS of $1.06 beat by $0.08, and revenue of $2.97B beat by $138.01M.

WY Stock EPS (Seeking Alpha Premium)

The overall picture is solid when I see Weyerhaeuser’s dividend grades below. As indicated by WY’s A+ dividend safety grade, it is highly likely that the company will continue paying a dividend. Although WY made a dividend cut a few years ago, its strong financials and growth produce a 2.59% forward dividend yield, and Weyerhaeuser saw its strongest adjusted EBITDA of $2.7B YTD, despite shipping challenges in Europe as a result of the Russia-Ukraine conflict.

WY Stock Dividend Grades (Seeking Alpha Premium)

Sales volumes for Western nations and Japan remained high. “Notwithstanding the recent macroeconomic headwinds, we continue to capitalize on favorable demand for HBU properties, as buyers seek the safety of hard assets in an inflationary environment, resulting in high-value transactions with significant premiums to timber value,” said Devin Stockfish, Weyerhaeuser CEO. As momentum drives the company, WY continues to experience a gradual quarterly price improvement and is trading at a discount.

WY Valuation

WY has a great valuation. With a B- overall grade and a forward P/E ratio of 8.88x, the stock is trading more than 66% below its sector average while maintaining an excellent Price/Sales ratio, -57% difference to the sector.

WY Valuation Grade (Seeking Alpha Premium)

With the degree of discount, profitability, and overall fundamentals we see from both stocks, investors should feel confident considering these companies for portfolios. Although rising interest rates have led to a slowdown in the real estate market and increased prices have sidelined many lumber companies, the diversified segments of each of our company’s operations provide them a moat that not many others in the industry have. Each of these companies has healthy growth and consistent earnings results and will hopefully see and capitalize in the long term.

Consider building a portfolio with lumber and housing stocks

In times of volatility, investors seek safe-haven investments or those that will offer some upside when the markets fall. In times like we currently have when inflation is eating away at gains, “It’s not about timing the market, it’s about time in the market.” Stocks are getting hammered. Lumber prices are down more than 60%. And while it may still seem like catching a falling knife because my two stock picks, Lennar and Weyerhaeuser, may not have reached the bottom, there is an opportunity in the sector.

Trading near 52-week lows, LEN and WY may be down, they’re not out and have solid fundamentals and buy ratings. Historically, the real estate industry has proven recession-resilient, and my stock picks are tied to real estate and home building. Trading at discounts with substantial profitability to help shield from declines in income caused by the Fed tightening and strong dividend safety grades, both stocks are very attractive. Despite rising mortgage rates and a slowdown in real estate and building activities, consider these two stock picks for a portfolio if you’re looking to invest in the long term.

We have many Top Rated Stocks to choose from and tools to ensure you are furnished with the best resources to make informed investment decisions. Finding knowledgeable investment resources is also a great way to be a successful investor in volatile or rallying markets.