Independence Realty Trust: Undervalued Inflation Hedge (NYSE:IRT)

Taiyou Nomachi/DigitalVision via Getty Images

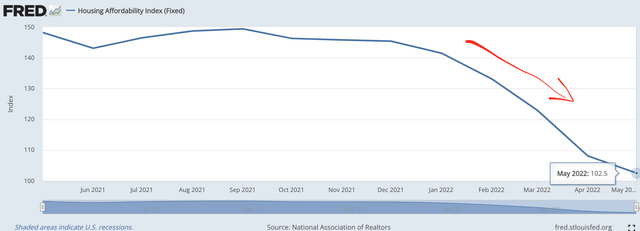

The high inflation and rising interest rate environment is set to cause an affordability crisis for those wishing to buy a home. As higher interest rates means the cost of mortgage payments go up. We can see from the chart underneath the affordability of houses has plummeted since the first quarter of 2022.

Affordability Index (Fred Economics)

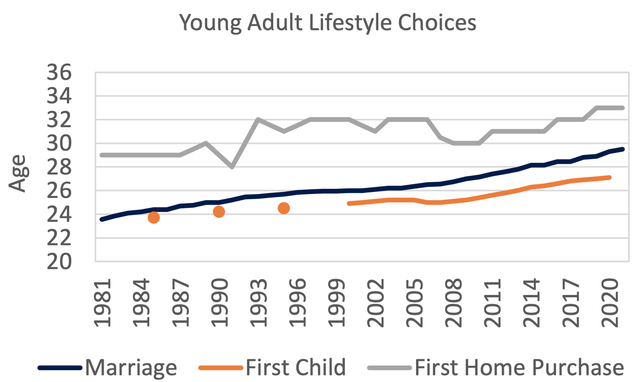

The decline in housing affordability has caused a decline in new house sales and an increase in rentals. According to a recent study, over one third (35%) of US households rent their homes. ~35% of these tenants are below the age 35 and have been dubbed “Generation Rent”. These younger tenants are getting married, starting a family and buying houses much later than prior generations, see below chart for details.

Lifestyle changes (Census)

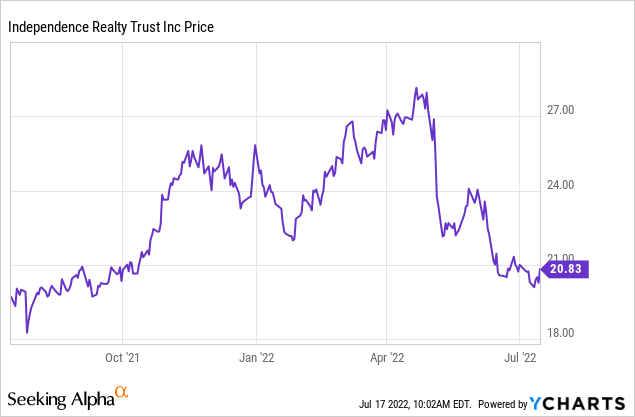

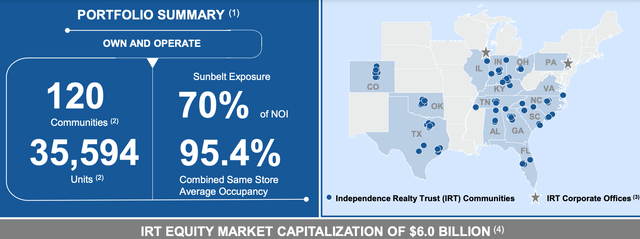

“Generation Rate” consists of many single people who have a preference to rental apartments in city locations which offer greater flexibility. Independence Realty Trust (NYSE:IRT) is a REIT which has over 35,000 units across the US with strong exposure (70%) to the high growth sunbelt region of America. The stock price has recently pulled back by 22% since April 2022. Thus, let’s dive into the Business Model, Financials and Valuation for the juicy details.

Business Model

Independence Realty Trust is a leading Real Estate Investment Trust (REIT) which has 35,594 units across 120 communities.

Independence Realty Trust 1 (Investor presentation June 2022)

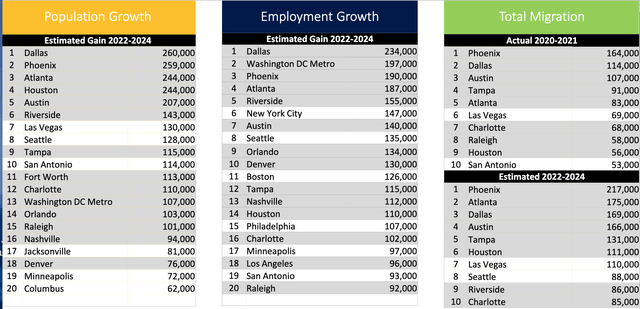

The REIT has 70% NOI exposure to the Sunbelt Region, this means they are poised to benefit from the major migration trend to the region. The high taxes and cost of living in places such as California, have caused a surge in migration to cities such as Austin, Dallas, Phoenix and Atlanta. Businesses are also getting frustrated with Californian policy and many are moving to the Sunbelt region to setup shop. For example Elon Musk moved Tesla’s Headquarters to Austin, Texas just last year. As you can see from the chart below Population Growth, Employment Growth and Total Migration are all estimated to continue growing strong across the sunbelt region.

Migration trends [IR]

Merger Background

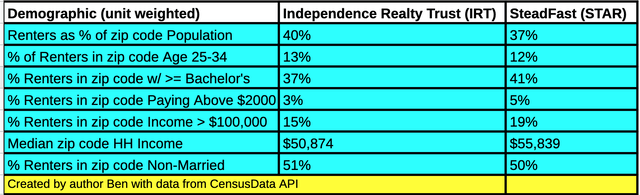

Independence Realty Trust completed its merger with SteadFast REIT (formerly STAR) in the fourth quarter of 2021. Personally I believe this was a great strategy for the company as there were many synergies across both strategy and tenant demographics. As you can see from the table below, both IRT and STAR have tenants of similar household income ($50.9k vs $55.8k) and with ~50% being non married.

IRT Merger (CensusData)

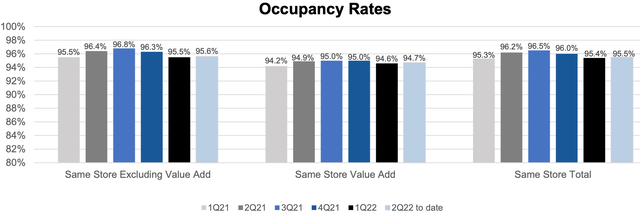

Independence Realty Trust has a strong Occupancy Rate of 95.5% (Same store total) in Q222 (ytd). The Occupancy rate did dip slightly in the fourth quarter of 2021, but is now starting to recover as an uptick was seen in the most recent data.

Occupancy Rates (June Investor report)

Growing Financials

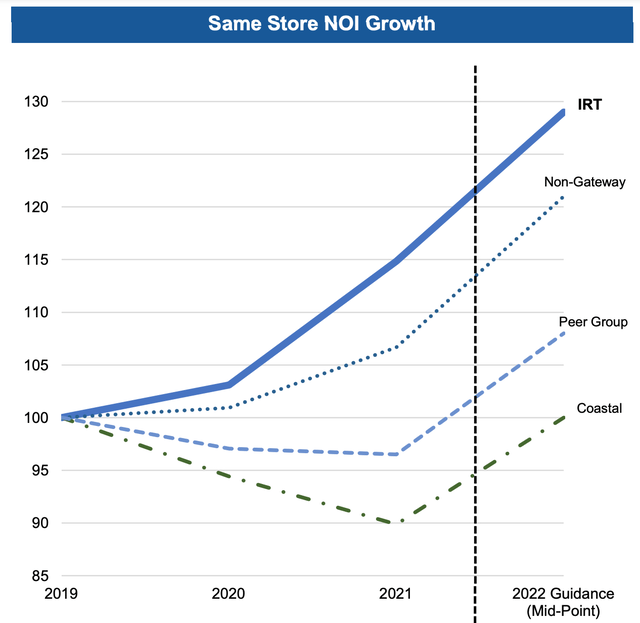

Independence Realty Trust generated strong earnings for the first quarter of 2022. Net Operating Income (NOI) (Same Store) was up 16%, to $89.1 million, up 16% from the $76.7 million in the first quarter of 2021. It’s NOI has consistently been higher than industry peers and that trend is set to continue.

Same Store NOI Growth (Investor Earnings report)

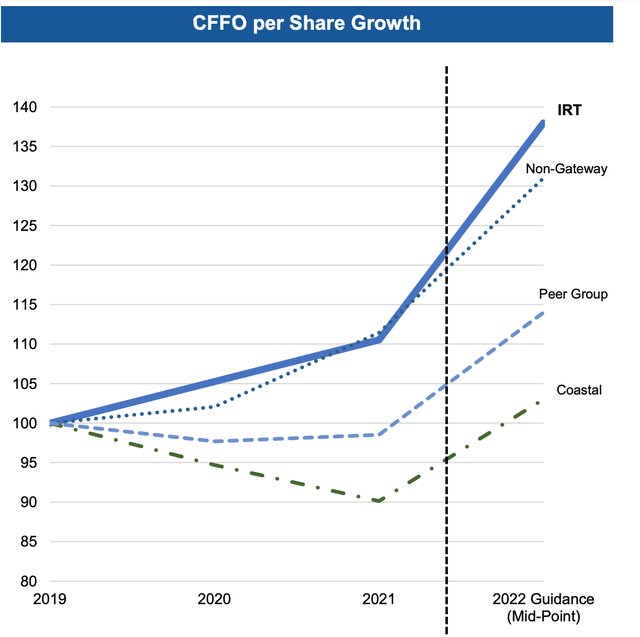

Funds from Operations (FFO) showed strong growth, with $60.1 million generated in the first quarter of 2021, up 242% from the $17.6 million seen in the first quarter of 2021. To increase the accuracy of this assessment, I will also look at the FFO per share, which was $0.26 in Q122, up 52% from $0.17 in Q121. Management is bullish on future prospects and recently increased their forecasted Core FFO per share growth from 21% to 25% for FY22, at the midpoint of their range. As you can see from the chart below, IRT has generated CFFO per share growth at a substantially faster level compared to industry peers.

Core FFO Growth (Investor Earnings Report)

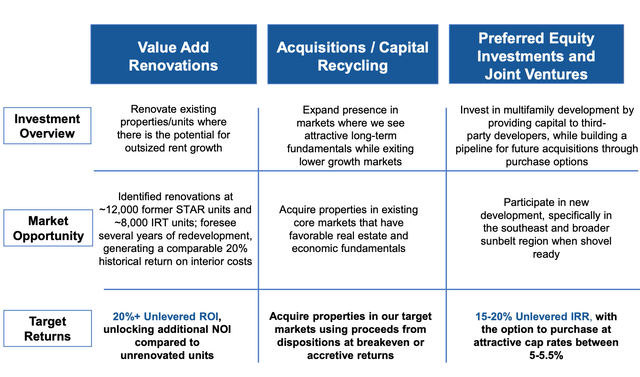

A secret weapon of IRT is its three pronged approach to extra growth. The first is “Value Add Renovations”, which they are targeting a fantastic 20%+ unlevered ROI on. The 2nd is “Acquisitions and Capital Recycling”, which enables rapid expansion into target markets (Sunbelt region), while exiting lower growth markets (California). In addition, management has a series of investments and Joint Ventures which are on track for a 15% to 20% Unlevered IRR (Internal Rate of Return).

Management also has a track record of solid execution and projects to date have generated an 19.4% unlevered return on investment with an average rental increase of 21.4%, which is fantastic.

Investment Strategy (Investor Presentation June 2022)

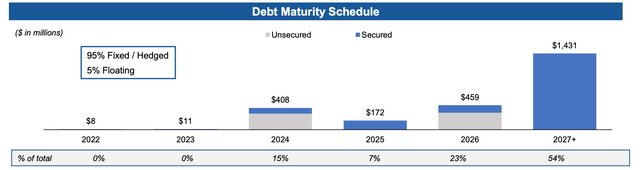

IRT has a strong balance sheet (for a REIT), with $6.2 billion in Real Estate Asset Value and $2.5 billion in debt. A high debt level is common for a REIT but the good news is 95% is fixed, which should act as a hedge against rising interest rates. In addition, the Debt Maturities are staggered with over half of the debt not due till after 2027.

Debt Maturities (Investor presentation 2022)

The company also pays a dividend of 2.69%, which is not the highest in the real estate industry but well covered and safe.

Valuation

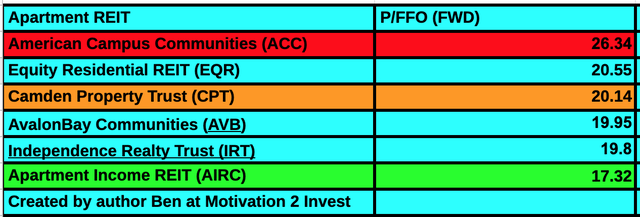

In order to value Independence Realty Trust, I have compared the Price to Funds from Operations (P/FFO)(fwd) multiple across a few Apartment focused residential REITs. As you can see in the table below, Independence Realty Trust has a P/FFO = 19.8, which is the 2nd cheapest relative to peers. The most expensive REIT is American Campus Communities (ACC) with a P/FFO = 26.34.

The cheapest is Apartment Income REIT (AIRC) which has a P/FFO = 17.32. Thus this is still my number one pick for Apartment REITs, I recently did a full analysis here of that stock.

Valuation Apartment REIT (created by author Ben )

Risks

Apartment Rent Increases Slowing

According to a recent report rent for two bedroom apartments dropped by a substantial 2.9% in June. Redfin also reported that the Median asking price for a home fell by 1.5%, thus this could urge more renters back into the buying market. The good news for IRT is the most major declines in rent occurred in legacy markets such as Miami, Florida and San Diego, California. As mentioned prior IRT has a strong focus on Sunbelt areas of growth such as Texas and Arizona.

Recession

The annual inflation rate in the US accelerated to 9.1% in June of 2022, the highest since November of 1981. This was mainly driven by large increases in energy and food. As the cost of living increases, tenants get squeezed and may find it increasingly difficult to make rent. Analysts are forecasting a “shallow but long” recession, which is predicted to start in the fourth quarter of 2022. If businesses have their input costs squeezed then this may result in having to fire workers to reduce costs, thus this will mean rent payments may be hard to make for some.

Final Thoughts

Independence Realty Trust is a large REIT which has over 35,000 units across the US. Its strong exposure (70%) to the sunbelt regions means it is in a prime position to take advantage of the growing migration trend. Net Operating Income and FFO growth has also been higher than the sector and that trend is set to continue. Given these facts, the recent pullback in the stock price now means the stock is the second cheapest in my comparison of Apartment focused REITs. Thus this looks to be a great stock for the long term income investor.