CTO Realty Stock: Attractively Valued Growth And Income Play (NYSE:CTO)

jittawit.21

CTO Realty Growth, Inc. (NYSE:CTO) does not receive the attention it deserves as a smaller REIT, but this does not have to be the case.

The real estate investment trust is a REIT that focuses on rapidly rising property markets in the United States. CTO Realty Growth provides dividend investors with a high dividend yield, rapid growth in funds from operations, and the opportunity to expand into a higher valuation over time as the trust’s growth-focused investment strategy pays off.

A Long-Term Play On The Most Attractive Real Estate Markets In The U.S.

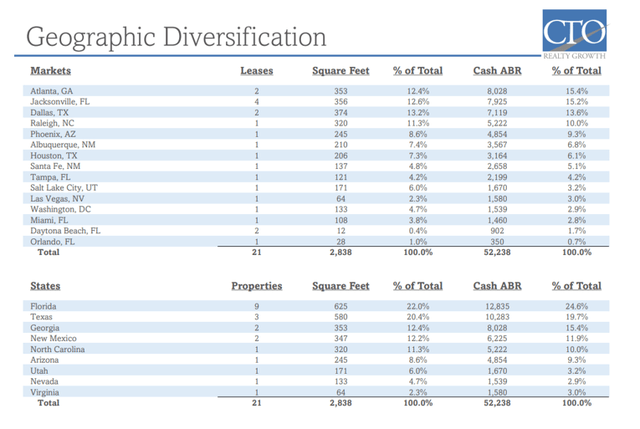

CTO Realty Growth’s equity market capitalization is only $370 million, making the REIT easy to ignore. As of 31 March, 2022, the trust’s portfolio consisted of only 21 properties totaling 2.8 million square feet.

Despite the trust’s tiny size, I believe CTO Realty Growth’s focus on rapidly expanding real estate markets will result in above-average funds from operations growth.

CTO Realty Growth is an externally managed trust that owns a portfolio of income-producing real estate as well as a 15% stake in net-lease real estate investment trust Alpine Income Property Trust, Inc. (PINE). Alpine assessed this investment at $38.6 million, and the equity position gives the trust significant valuation upside.

The 21-property portfolio that generates regular income for the trust included seven single tenant and 14 multi-tenant properties that were largely retail leasing space. The trust generated around 6% of its cash rent from retail buildings, 19% from office space leasing, and 18% from mixed-use properties.

CTO Realty Growth is a growth option in the REIT industry because the trust has economic exposure largely to markets where citizens have incomes above the national average, implying excellent long-term cash flow growth potential.

In terms of economic exposure, Florida is the largest state for CTO Realty Growth, with Floridian properties accounting for nearly a quarter (24.6%) of the trust’s total cash rent. Florida and Texas, the trust’s two largest states in terms of investments, account for 44% of CTO Realty Growth’s total cash rent.

Geographic Diversification (CTO Realty Growth)

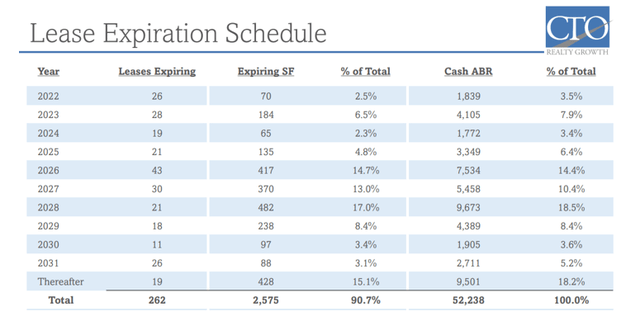

Leases for the trust have extended periods. CTO Realty Growth’s portfolio consists primarily of leases expiring in 2026 or later, with only 21.2% of leases expiring in the next four years.

Lease Expiration Schedule (CTO Realty Growth)

Strong AFFO Growth Leaves Room For Dividend Growth

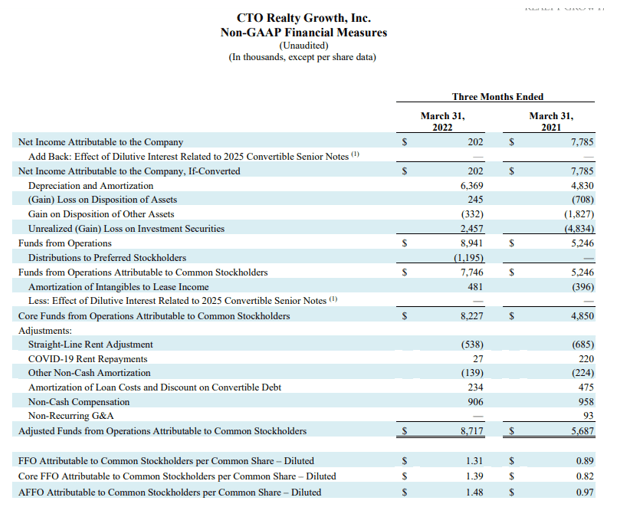

CTO Realty Trust’s 1Q-22 adjusted funds from operations were $1.48 per share, up 52.6% YoY, as leasing activity and net operating income recovered in 2022. The trust benefits from a strong rebound in real estate markets. The $1.08 per share dividend declared for the first quarter was readily covered by strong growth in adjusted cash from operations. In 1Q-22, the implied funds from operations payout ratio was 73%.

Non-GAAP (CTO Realty Growth)

Strong Balance Sheet Provides Foundation For Further Acquisitions

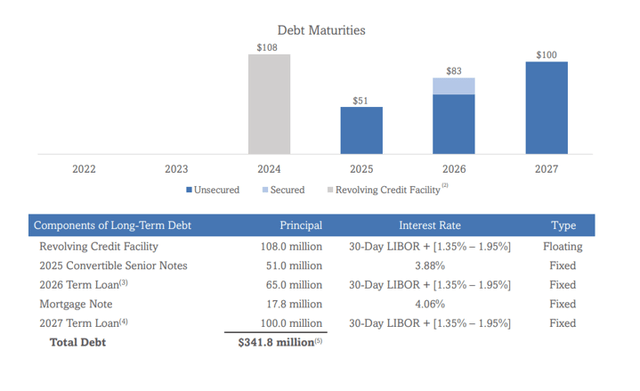

Acquisitions are obviously vital for CTO Realty Growth, which conducts frequent transactions in its primary areas. A robust balance sheet is required for the ability to make acquisitions, which CTO Realty Growth possesses.

The trust has $135 million in cash available to acquire additional properties or a portfolio of properties, and its financial liabilities are structured in such a way that it has no near-term liabilities.

Debt Maturities (CTO Realty Growth)

Stock Split And Yield Play

In July, CTO Realty Growth completed a three-for-one stock split. Aside from its appealing growth potential as a result of its focus on high-growth regions, the trust also provides compelling passive income that dividend investors will appreciate.

In 2Q-22, the business paid $1.12 per share, and dividend rates going forward will be adjusted for the split. CTO Realty Growth has a current stock yield of 7.3% based on a $1.12 dividend per share (before split). The new quarterly cash dividend will be $0.37 per share following the split.

Raised Funds From Operations Guidance

CTO Realty Growth predicted adjusted funds from operations of $4.90-$5.15 per share in 2022, however, the trust has now raised its forecast for the year due to robust cash flow growth in its main geographies. The projection is based on the trust’s ability to make $200-250 million in new investments and $40-70 million in dispositions. CTO Realty Growth now forecasts adjusted funds from operations of $4.95-$5.20 per share, giving the trust’s stock an AFFO multiple of 12.1x.

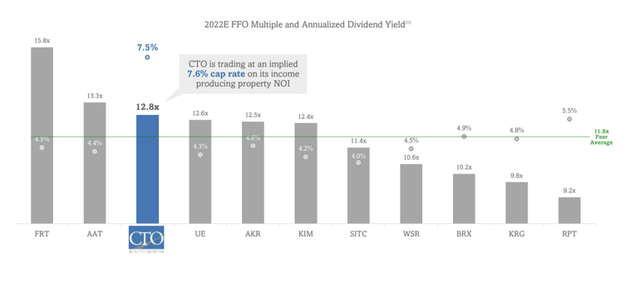

There are other retail-focused REITs with lower valuations based on 2022E FFO multiples, but the valuation + yield combination for CTO Realty Growth is appealing: The trust has one of the best yields in the market for growth-oriented REITs (7.3%).

2022E FFO And Annualized Dividend Yield (CTO Realty Growth)

Why CTO Realty Growth’s Stock Could See A Lower Valuation

CTO Realty Growth is, as the name implies, a growth-oriented real estate investment trust. The concentration of the trust’s income-producing properties in high-growth cities such as Dallas, Houston, and Miami generates cash flow upside for the trust while also raising the trust’s risk profile. If there is a real estate slump, CTO Realty Growth’s concentrate on only a few states may result in negative appreciation in the future.

My Conclusion

CTO Realty Growth upped its projection by $0.05 per share in the most recent quarter, and the trust just underwent a three-for-one stock split.

Following the split, the new dividend will be $0.37 per share, translating to 7.3% passive income, while the trust’s real estate portfolio concentration may support future valuation development.