What SaaS Ventures’ Collin Gutman sees in Miami’s startup scene

The seed-stage investor reflects on 200 deals, his move to Miami, and why second-tier cities are full of overlooked potential

As Miami’s startup community matures, investors from across the country keep planting deeper roots in the city.

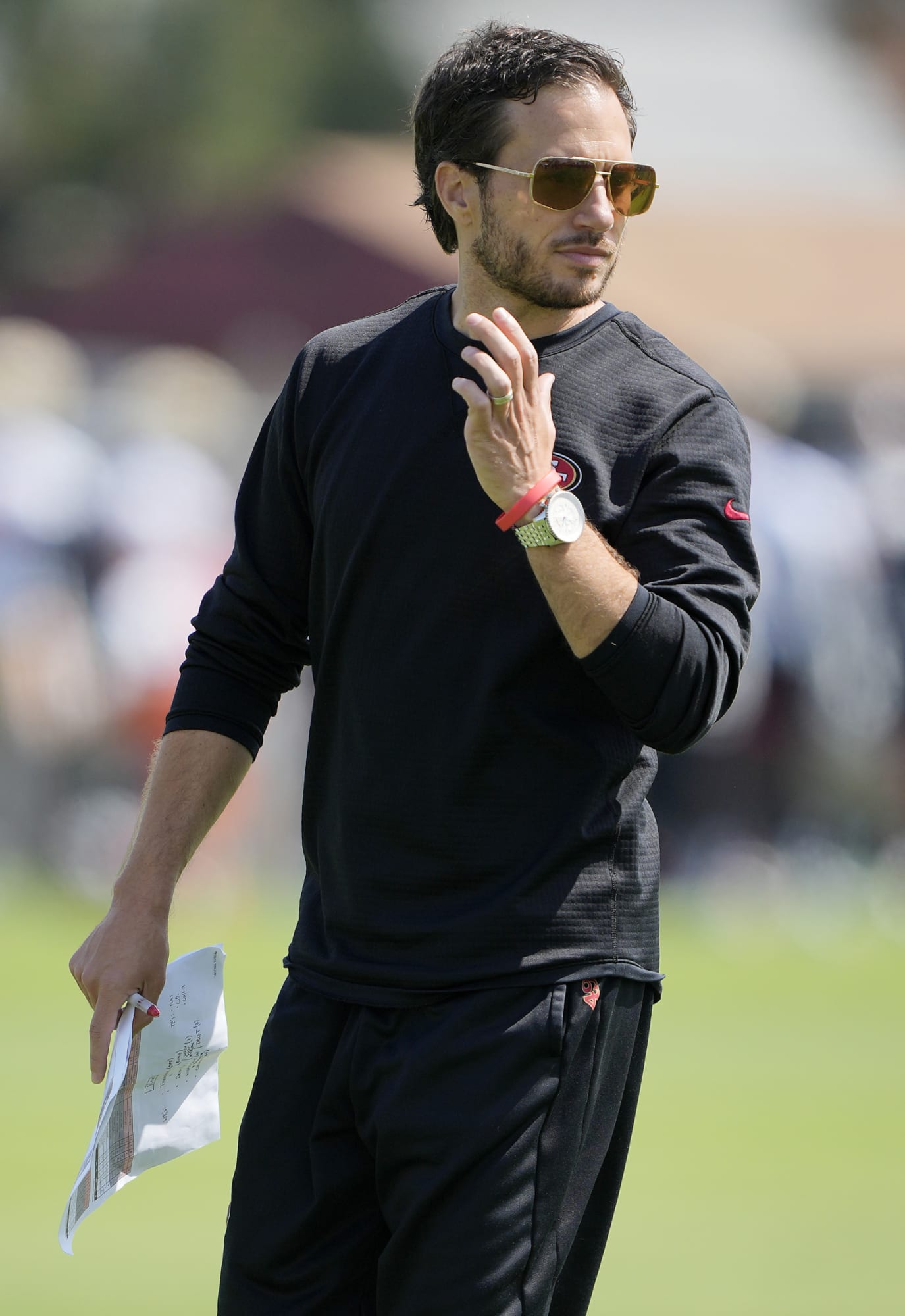

One of them is Collin Gutman, Managing Partner at SaaS Ventures.

Gutman moved to Coral Gables in late 2020, and earlier this year he logged his two-hundredth investment.

In a conversation with Refresh Miami, he reflected on Miami’s progress, explained why he keeps backing founders outside the coastal hubs, and shared practical guidance for teams looking to raise capital.

This interview has been condensed and edited for clarity.

Refresh Miami: You just marked investment number 200. How did the path start?

Collin Gutman: Fifteen years ago I launched Acceleprise (now Forum Ventures) to focus only on B2B software. After running that first accelerator fund I spun up SaaS Ventures in 2017.

Between one accelerator vehicle, three core SaaS Ventures funds, our growth fund and a few angel checks, I recently crossed the two-hundred-investment line. Very few people have written that many early-stage checks, so it feels good to join that club.

What drew you and your wife to Miami?

We were living in Washington, D.C., wanted better weather, more diversity and a city that isn’t wrapped up in politics. Staying on the East Coast mattered because our families are there, so Miami made sense. Friends told us to try a full year, hurricane season included, then decide. We rented in December 2020, lived through the first summer and bought a house in Coral Gables the next fall. Now we’re here for good.

How does Miami’s tech scene look from your seat?

Miami in 2025 reminds me of D.C. in 2011. Back then D.C. had LivingSocial as an anchor, a flow of transplants and a sense that something new was forming. Miami now has its own anchor companies, a steady stream of talent from New York, Israel and elsewhere, and pockets of deep expertise – cybersecurity comes to mind. Folks sometimes complain that Miami isn’t Silicon Valley, yet the density of repeat founders and real venture funds here beats many other cities. That mix is perfect for a seed investor.

Has relocating boosted your fundraising?

Surprisingly, no. Some limited partners live in South Florida, but most of our LP base predates the move. The ultra-high-net-worth circles here already know each other, and they don’t mingle much with new GPs. So VCs aren’t moving for money, they’re moving because they want to live here, and that outlook shapes the community in a positive way.

SaaS Ventures now manages several vehicles. Walk us through the lineup.

Our first flagship fund in 2017 was $20 million. Fund II closed in 2020 at $50 million. We then raised a small growth fund in 2023 to participate in Series B through D rounds. Fund III, our latest flagship, hit the same $50 million range at the turn of 2024. We aim for measured growth because our thesis – enterprise software outside the biggest tech hubs – works best with lean funds.

Why double down on what you call ‘second-tier’ geographies?

Three reasons. First, competition is lighter at the pre-seed and seed stage, so pricing is sane and local investors are glad to syndicate. Second, companies in places like St. Louis or Grand Rapids focus on revenue early instead of chasing headlines. Third, the founders often have a different mindset: they want to build a lasting business, not hop on a valuation treadmill. We have invested in 32 states so far, and that reach helps us spot talent others miss.”

Which stages and ticket sizes fit the fund best?

We write checks that give us 3% to 4% ownership. On the low end that can be $100K at a $2 million pre-money valuation. On the high end it’s roughly $700k at the mid-teens pre. Most rounds we join are $6 million to $10 million post-money, so our typical check lands between $250K and $400K. Today we see two sweet spots: very early rounds at about $5 million post, and ‘mini-A’ rounds where companies sit at $11 million to $20 million of ARR yet are still priced in the high-teens.

How active are you in Miami-based startups?

We’ve backed three teams with founders here. Two have their entire founding teams in Miami; one is split. FirmPilot is the standout: we led the pre-seed, Blumberg Capital did the Series A, and LegalTech Fund also came in. They’ve reached mid-single-digit revenue in about thirty months and employ staff across Tennessee, New York and Florida. Another fun detail: two companies on the same floor of their Wynwood building have already become nine-figure businesses.

For founders trying to reach you, what is the most effective approach?

Be targeted. I read every inbound message, and it’s clear when someone has run a mail-merge tool. If I see consumer, crypto or anything outside enterprise software, I delete it. A short, fully customized note that shows you’ve studied our thesis almost always gets a reply. You only need one or two checks, so quality beats volume every time.

What advantages – and limits – does Miami offer operating companies?

If your culture requires every employee in one physical office, Miami will be tough because the talent pool for some roles is thin. But that’s true almost everywhere outside three or four mega markets, and those places are far more expensive. For hybrid or remote firms, Miami shines. I can introduce a founder to ten other VCs and ten entrepreneurs with exits north of nine figures, and they’ll usually take the meeting. The community is tight-knit, and newcomers who add value get welcomed fast.

What comes next for SaaS Ventures?

Our focus stays the same: early-stage enterprise software away from the coastal hotspots. We’ll likely open Fund IV around late 2026. At the same time, we’re refining the growth strategy we started in 2023. That vehicle follows a simple rule: when a top-tier firm – Sequoia, Accel and others – leads a Series B, C or D, we invest alongside them. It lets our LPs ride with proven lead investors while our flagship fund keeps hunting for overlooked innovators. You’ll hear more about the next growth vehicle as we get closer to 2026.

Gutman closed the call with one final point on scale:

If we ever got too big, we’d have to chase deals in markets we don’t know or start leading crowded rounds. Keeping the fund right-sized lets us stay close to founders, stay nimble and keep the returns where they need to be.

Pictured at top: SaaS Ventures Managing Partner Collin Gutman makes a presentation at the firm’s Founders Day in Miami.

READ MORE IN REFRESH MIAMI: