Miami Real Estate Market Forecast 2024: Will it Crash?

South Florida & Miami’s housing market is strong. The current trends suggest a shift towards a buyer-friendly environment in the Miami housing market due to declining mortgage rates and an increase in new listings. However, the market remains competitive, particularly in certain price points.

Home prices in Miami-Dade County are not dropping. Median prices for single-family homes and existing condos have increased by 11.8% and 6.3%, respectively, year-over-year in November. There is no indication of an impending market crash in Miami. Despite some challenges such as inventory shortages, the market shows resilience, reflected in the low percentage of distressed sales and consistent home price appreciation.

How is the Miami housing market doing currently?

The Miami-Dade County mid-market condominium sales are experiencing a notable surge, with transactions in the range of $400,000 to $600,000 witnessing an 8.8% year-over-year increase in November 2023, according to the data released by the MIAMI Association of Realtors (MIAMI) Notably, all-cash deals constituted a substantial 50.2% of Miami condo sales, nearly double the national average.

Impact of Falling Mortgage Rates

The decline in mortgage rates by more than 1% since October’s peak is anticipated to have a significant impact on the Miami real estate market. According to Ines Hegedus-Garcia, Chairman of the Board at MIAMI, this development is major news for a high-demand market like Miami, with expectations of visible effects on sales numbers in early 2024. The trend is attributed to the shift towards a buyer-friendly environment due to the decline in mortgage rates.

Shifts in Total Miami-Dade Sales

Total Miami-Dade sales experienced a 7.8% decrease in November 2023, dropping from 1,791 to 1,651 transactions. This decline is attributed to elevated mortgage rates and limited inventory in crucial price points. It’s important to note that these statistics do not include South Florida’s robust developer new construction market and volume.

Single-Family Home and Condo Sales Trends

In November 2023, Miami single-family home sales decreased by 1.5% year-over-year, while existing condo sales witnessed a more substantial decline of 12%. The lack of inventory at key price points and the impact of elevated mortgage rates are cited as significant factors influencing these trends.

Positive Trends in New Listings

Miami experienced a positive trend in new listings, with a 7.7% year-over-year increase in November 2023, reaching 3,211. This influx of fresh listings is expected to provide buyers with more options, addressing the issue of low inventory in the market.

Inventory Challenges in Miami-Dade County

The Miami-Dade inventory remains a challenge, down by 42.9% from the historical average. Despite a 3.6% year-over-year increase in total active listings at the end of November, inventory for single-family homes decreased by 10.1%, while condominium inventory increased by 12% during the same period in 2022.

Median Prices and Market Trends

Miami-Dade County single-family home median prices increased by 11.8% year-over-year in November 2023, while existing condo median prices rose by 6.3%. Miami is tied for No. 3 in the U.S. for annual home price appreciation, according to the latest US CoreLogic S&P Case-Shiller Index.

Economic Impact of Real Estate Sales

Every home sale in Miami has a substantial economic impact, contributing to income generated from real estate industries, expenditures related to home purchase, multiplier effects on housing-related expenditures, and new construction. The total economic impact of a typical Florida home sale is reported to be $122,000, with Miami-Dade achieving a local economic impact of $201 million from the sale of 1,651 homes in November 2023.

Distressed Sales and Market Health

Miami’s distressed sales remain low, comprising only 0.9% of all closed residential sales in November 2023. This reflects a healthy market condition, especially when compared to the distressed sales figure of 70% in 2009. Short sales and REOs accounted for minimal percentages year-over-year, indicating a robust and stable market.

Market Dynamics and Cash Sales

The median percent of original list price received for single-family homes and existing condominiums in Miami was 97% and 96%, respectively, in November 2023. Cash sales represented 40.9% of all Miami closed sales, reflecting the city’s position as a top real estate market for foreign buyers and those moving from more expensive U.S. markets who can leverage profits from real estate sales.

With falling mortgage rates and an increase in new listings, now could be considered a good time to buy a house in Miami. However, buyers should remain mindful of the competitive nature of the market, particularly in key price points.

Miami Housing Market Predictions for 2024

The Miami metropolitan area is the seventh-largest metropolitan area in the United States and the 72nd-largest metropolitan area in the world. The metropolitan area includes the City of Miami (the financial and cultural core of the metropolis), Miami-Dade, Broward, and Palm Beach counties which are the first, second, and third most populous counties in Florida. Greater Miami includes a larger area defined by the United States Census Bureau as the Miami-Port St. Lucie-Fort Lauderdale Combined statistical area.

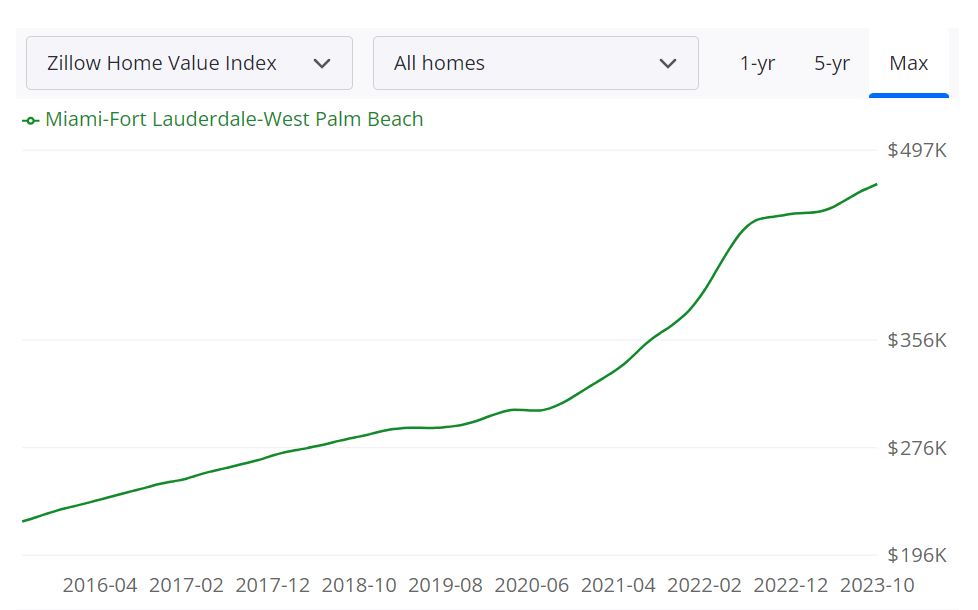

This larger area includes Martin, Saint Lucie, and Indian River counties to the north of Palm Beach County. What are the Miami real estate market predictions for 2024? According to Zillow, the Miami-Fort Lauderdale-West Palm Beach housing market continues to exhibit strength, with the average home value standing at $473,096, reflecting a 5.9% increase over the past year.

Notably, properties are going pending in approximately 25 days, emphasizing the robust demand in the region. This data is based on information available through November 30, 2023, sourced from Zillow, a reputable real estate analytics platform.

Miami Market Forecast for the Next Year

Zillow’s one-year market forecast for Miami, as of November 30, 2023, projects a positive trend with a forecasted increase of 1.9%. This suggests a continued upward trajectory in the housing market, aligning with the current growth trend observed in home values.

Key Metrics Reflecting Market Dynamics

- For Sale Inventory: As of November 30, 2023, the market has 33,860 properties available for sale, providing potential buyers with a range of options to explore.

- New Listings: In November 2023, there were 9,160 new listings, contributing to the overall inventory and potentially meeting the demand in the market.

- Median Sale to List Ratio: The median sale to list ratio, as of October 31, 2023, stands at 0.976, indicating a healthy balance between listing prices and actual sale prices.

- Median Sale Price: The median sale price, reported on October 31, 2023, is $442,833, reflecting the average transaction value in the market.

- Median List Price: As of November 30, 2023, the median list price is $550,000, providing insights into the expectations of sellers in the current market.

- Percent of Sales Over and Under List Price: In October 2023, 17.2% of sales were conducted over the list price, while 67.2% were under the list price. These figures offer a glimpse into the negotiation dynamics between buyers and sellers.

Market Stability: Will the Miami Housing Market Crash?

Given the current market indicators and Zillow’s one-year forecast, there is no immediate indication of a housing market crash in Miami. The positive growth in home values, coupled with a reasonable inventory and balanced sale-to-list ratios, suggests a stable market environment. However, it’s essential to monitor trends and external factors that could impact the real estate landscape.

Should You Invest in the Miami Real Estate Market?

Population Growth and Trends

When considering investment in the Miami real estate market, population growth and trends play a pivotal role. Miami’s population has been steadily growing over the years, driven by both domestic and international migration. Here’s why this matters for investors:

- Population Growth: Miami’s population has been on an upward trajectory, attracting residents from all over the United States and abroad. This influx of people creates a consistent demand for housing, making it an attractive market for real estate investors.

- International Appeal: Miami’s international appeal is a significant driver of population growth. The city’s vibrant culture, pleasant climate, and international business connections make it a magnet for individuals from around the world. For investors, this diverse population presents opportunities in various real estate sectors, including residential and commercial properties.

Economy and Jobs

Examining the economy and job market is critical for real estate investment decisions:

- Economic Strength: Miami boasts a diverse and robust economy. It’s a hub for international trade, tourism, finance, and technology. A strong and diversified economy helps ensure a stable demand for real estate, both for commercial and residential purposes.

- Job Opportunities: The availability of job opportunities in Miami is a key factor for real estate investors. A thriving job market attracts professionals, and this, in turn, leads to higher demand for rental properties, as many newcomers prefer renting initially.

Strong International Market

Miami’s real estate market benefits from a strong international presence:

- Global Investment: Miami is a favored destination for international investors. Buyers from South America, Europe, and other regions consider Miami a safe and attractive place to invest in real estate. As an investor, you can tap into this global demand for properties.

- Foreign Investment: Foreign investors often seek properties in Miami for various purposes, including vacation homes, second residences, and income-generating rental properties. This international interest adds stability and growth potential to the local market.

Livability and Other Factors

Livability and lifestyle factors contribute to the city’s attractiveness:

- Lifestyle Appeal: Miami’s lifestyle, with its beautiful beaches, cultural attractions, and vibrant nightlife, makes it an appealing place to live. This lifestyle appeal increases demand for both residential properties and rental units.

- Weather and Climate: Miami’s tropical climate is a major draw for residents and tourists alike. The city’s pleasant weather encourages year-round tourism and can contribute to the demand for rental properties.

Big Rental Property Market Size and Its Growth for Investors

Miami offers a thriving rental market:

- Rental Demand: The city’s diverse population, strong job market, and international appeal create a substantial demand for rental properties. This is advantageous for real estate investors, as it means a steady stream of potential tenants.

- Rental Income Potential: Miami’s rental market has significant income potential. Depending on the neighborhood and property type, investors can generate attractive rental income. High rental rates can translate into favorable cash flow for property owners.

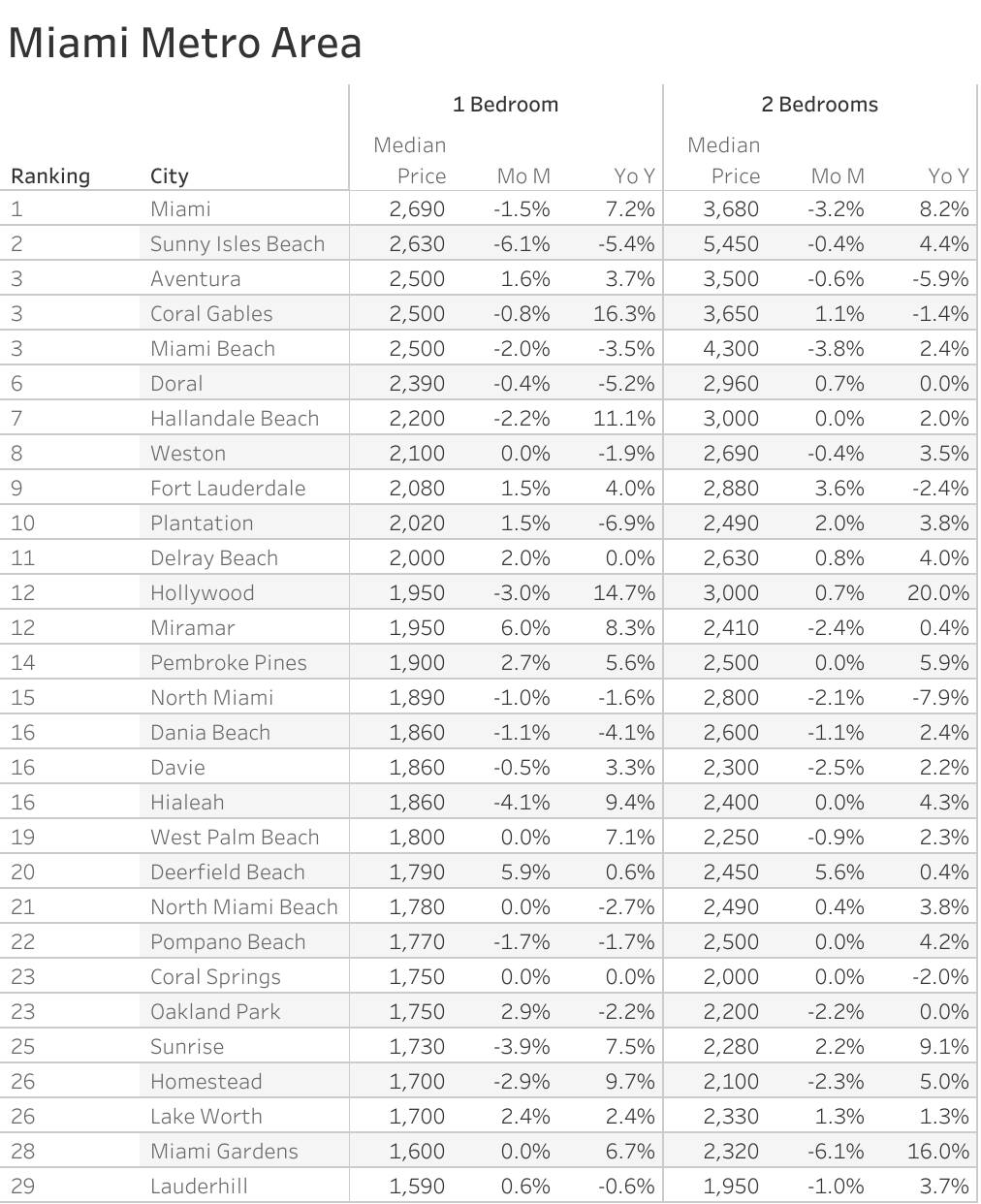

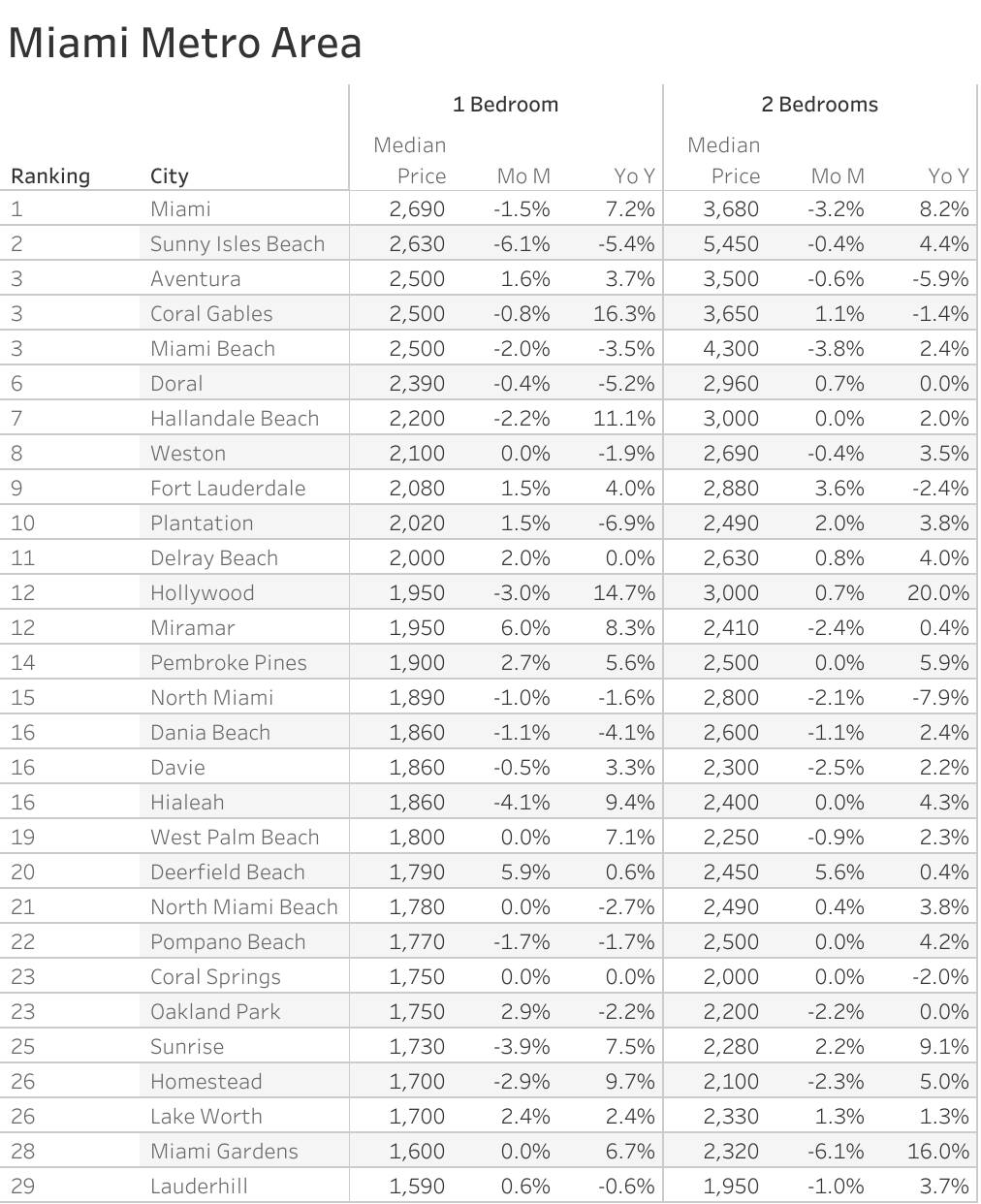

The Zumper Miami Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Florida one bedroom median rent was $1,668 last month. Miami was the most expensive city with one-bedrooms priced at $2,690. Lauderhill ranked as the least expensive city with rent at $1,590.

Here are the top cities in the metro area where rents are increasing. You can think of investing in these places because they have strong growth and demand for rental properties. You can also use their historical annual growth in rents to help predict future increases or decreases.

The Fastest Growing Cities in Miami Metro Area For Rents (Y/Y%)

- Coral Gables had the fastest growing rent, up 16.3% since this time last year.

- Hollywood saw rent climb 14.7%, making it second.

- Hallandale Beach ranked as third with rent jumping 11.1%.

The Fastest Growing Cities in Miami Metro Area For Rents (M/M%)

- Miramar had the largest monthly rental growth rate, up 6%.

- Deerfield Beach rent increased 5.9% last month, making it second.

- Oakland Park was third with rent climbing 2.9%.

Other Factors Related to Real Estate Investing

When contemplating investment in the Miami real estate market, it’s essential to consider these additional factors:

- Market Trends: Staying informed about market trends, such as price appreciation, rental rates, and property supply, is crucial. These trends can influence your investment strategy.

- Local Regulations: Understanding local real estate regulations, property taxes, and zoning laws is vital for investors to navigate the market effectively.

- Property Management: Whether you plan to manage properties yourself or hire a management company, efficient property management is key to successful real estate investments.

- Diversification: Consider diversifying your real estate portfolio in Miami by exploring different property types, from single-family homes to commercial properties.

Highest Appreciating Miami Neighborhoods

When considering real estate investments, it’s crucial to evaluate the historical performance of neighborhoods. The following Miami neighborhoods have demonstrated significant appreciation since 2000, making them noteworthy areas for potential investors:

Downtown North

- **Appreciation**: Downtown North has experienced substantial appreciation in real estate values over the past two decades. This makes it an attractive prospect for investors seeking long-term growth.

- **Location**: Situated in the heart of Miami’s downtown area, Downtown North offers proximity to key amenities, cultural attractions, and business centers.

- **Potential**: With its central location and upward trend in property values, Downtown North presents opportunities for investors interested in urban real estate.

Little Haiti South

- **Appreciation**: Little Haiti South has seen remarkable appreciation since 2000. This neighborhood’s transformation has been driven by its cultural vibrancy and proximity to downtown Miami.

- **Cultural Hub**: Little Haiti South has become a cultural hub, attracting artists, creatives, and entrepreneurs. This cultural renaissance has boosted its real estate market.

- **Investment Appeal**: Investors seeking neighborhoods with both historical significance and growth potential should consider Little Haiti South.

Overtown North

- **Appreciation**: Overtown North’s appreciation over the years highlights its potential for real estate investment. This historic neighborhood has witnessed resurgence.

- **Revitalization**: Overtown North has been a focus of revitalization efforts, leading to improved property values and a growing sense of community.

- **Investor Opportunities**: For those interested in contributing to the revitalization of a historic neighborhood while realizing financial gains, Overtown North is a compelling choice.

Overtown West

- **Appreciation**: Overtown West has undergone a transformation, with appreciating real estate values. This neighborhood showcases the potential for investors in areas undergoing positive change.

- **Community Development**: Overtown West’s development initiatives have contributed to its growth. Investors can participate in community development projects while benefiting from rising property values.

- **Future Prospects**: Overtown West is a neighborhood to watch for those interested in urban redevelopment and investment in emerging areas.

Downtown Southeast

- **Appreciation**: Downtown Southeast’s real estate market has shown consistent appreciation over the years. Its location and urban development make it an appealing choice for investors.

- **Urban Development**: Downtown Southeast has witnessed significant urban development, including new residential and commercial projects. This development has boosted property values.

- **Investment Potential**: With its ongoing urban transformation, Downtown Southeast presents promising investment opportunities for those looking to capitalize on urban growth.

Downtown Northwest

- **Appreciation**: Downtown Northwest has experienced notable appreciation in real estate values since 2000. Its proximity to downtown Miami and growth in infrastructure contribute to its appeal.

- **Proximity to Downtown**: The neighborhood’s location near downtown Miami is a key factor driving appreciation. Residents enjoy easy access to the city’s business and entertainment districts.

- **Investor Advantages**: Downtown Northwest offers advantages for investors seeking a strategic location and potential for long-term appreciation.

Downtown

- **Appreciation**: The central Downtown area of Miami has consistently appreciated in real estate values. Its status as the city’s core business and cultural district contributes to this growth.

- **Economic Hub**: Downtown Miami is an economic hub, home to numerous businesses, cultural institutions, and entertainment venues. This dynamic environment supports property value growth.

- **Investment Opportunities**: Investors looking for real estate in the heart of the city should consider Downtown Miami, given its appreciation potential and urban vibrancy.

Downtown East

- **Appreciation**: Downtown East has seen substantial appreciation, benefiting from its location within Miami’s thriving downtown district.

- **Urban Growth**: Downtown East has experienced growth in both residential and commercial developments. This urban expansion has contributed to property value appreciation.

- **Investment Appeal**: Investors interested in neighborhoods within the urban core of Miami should explore Downtown East’s potential for investment and growth.

Town Square

- **Appreciation**: Town Square’s appreciation since 2000 makes it a noteworthy area for real estate investors seeking long-term gains.

- **Location**: The neighborhood’s location offers accessibility to key amenities and is situated in a dynamic urban environment that supports property value growth.

- **Investment Prospects**: Town Square provides investment prospects in a vibrant urban setting, making it a compelling choice for real estate investors.

Park West

- **Appreciation**: Park West has demonstrated significant appreciation over the years, positioning it as an attractive area for investors.

- **Urban Development**: Park West has witnessed urban development, including entertainment venues and commercial establishments. This development has enhanced property values.

- **Investor Opportunities**: Park West offers investment opportunities in a growing urban district with the potential for long-term appreciation.

References:

- category/news-releases/