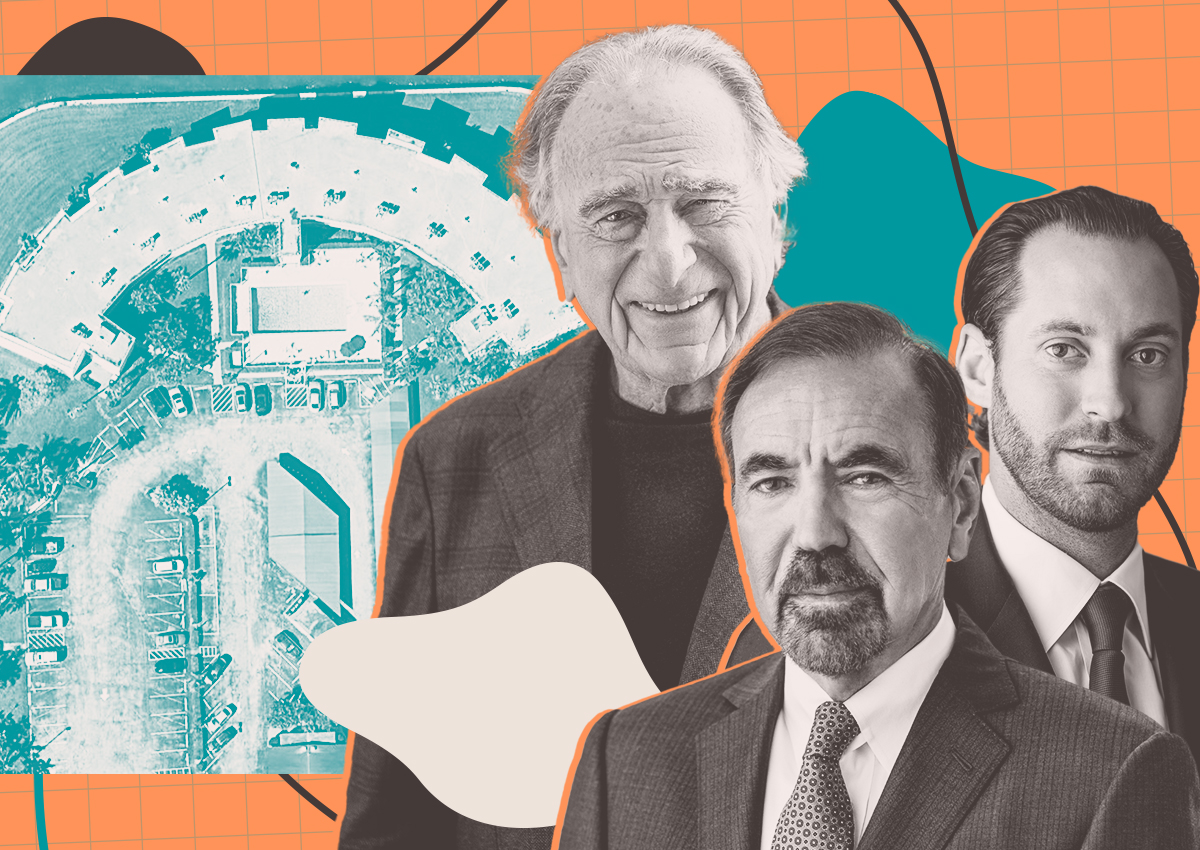

Macklowe, Related JV on Waterfront North Bay Village Project

New York developer Harry Macklowe is partnering with the Pérez family’s Related Group to acquire a waterfront co-op community in North Bay Village, with plans for redevelopment, The Real Deal has learned.

An affiliate of New York-based Macklowe Properties began closing on units last week, sellers and attorneys involved in the deal said. The purchase price totals $47.7 million.

The developers plan to build hundreds of luxury units on the 3-acre site, likely condos, according to sources. The three-story Biscayne Sea Club, built in 1955, covers the north end of Harbor Island.

Macklowe’s firm had been in contract to acquire the co-op at 8000, 8010 and 8020 East Drive for nearly two years, court records show and TRD previously reported. The deal has been at the center of a web of lawsuits, some of which are still ongoing.

A representative for Miami-based Related confirmed the firm is part of a joint venture with Macklowe. Macklowe did not immediately respond to a request for comment.

Macklowe is also acquiring units at an adjacent condo building, Majestic Isle, records show. The building was deemed unsafe by the city earlier this year. Property records show a Macklowe affiliate owns five units at the 36-unit Majestic Isle. The three-story building at 7946 East Drive was completed in 1960.

Closing dates for Biscayne Sea Club came and went, leaving co-op owners in limbo for months. Some had their furniture moved or terminated leases with their tenants, losing out on potential income, owners and residents told TRD.

In one lawsuit filed that was settled, a group of 18 owners alleged that the Biscayne Sea Club board failed to comply with the association’s bylaws when it entered into a contract to sell the property to Macklowe for $40 million, $15 million less than the price approved by the co-op’s shareholders. The property hit the market with Isaac Acevedo of BrokerNation Real Estate more than two years ago for $55 million.

Haber Law attorneys Harold Lewis, Ariella Gutman and Max Haber represented about 50 owners at Biscayne Sea Club.

“I can’t speak to why prior law firms previously representing the seller couldn’t get this to the finish line.… A lot of it also was getting the homeowners back to a place where they trusted who was representing the seller group,” Lewis said.

The Miami-based brokerage BrokerNation also sued the Macklowe affiliate seeking its commission, and ultimately secured a $1.4 million commission, said Jorge Fors Jr., BrokerNation’s attorney in the suit.

“At the end of the day, they never should have reduced the purchase price,” Fors said. “This really should have closed at $55 million.”

Macklowe is expected to acquire more land. The developer was in contract to buy the apartment building at 7941 East Drive for $10.6 million, according to a lawsuit filed by the seller last year to enforce the sale of the property. An agreement filed in January shows the deal was still active at that time.

Developers have flocked to North Bay Village. Last year, the village’s commission approved a height increase that allows up to 650 feet on the north side of the causeway, where heights were previously capped at 340 feet; and allows up to 450 feet on the south side, where heights were previously capped at 240 feet. The height increases are for land included in Sunbeam Properties’ special area plan.

Developers have increasingly targeted older condo communities across South Florida, especially after the collapse of Champlain Towers South in Surfside more than two years ago. The collapse, which killed 98 people, occurred as the building was about to undergo major repairs tied to its 40-year recertification.

With increased pressure to maintain buildings and make necessary repairs, unit owners at older properties have agreed to sell to developers in bulk buyout deals.

Macklowe entered the Miami market last year with his purchase of a development site near Dadeland Mall. His company plans a pair of apartment towers with several hundred units.

In New York, Macklowe recently failed to close a deal to acquire an office building that was a missing piece in the firm’s assemblage for a planned supertall. Despite multiple extensions, Macklowe couldn’t come up with the money, and the seller sold the property to a different buyer.