Seven Years In, East New York Rezoning Hasn’t Panned Out

Supporters of a 2016 rezoning in Brooklyn said it would produce a spate of development and lift up what had long been the borough’s poorest area.

Critics said it would fuel gentrification, replacing longtime residents and bodegas with yuppies and Starbucks.

So far, both sides have been wrong.

Seven years later, not much of the new housing, offices and retail predicted for East New York, Ocean Hill and Cypress Hills has materialized.

Approved as part of de Blasio’s larger affordable housing plan, the neighborhood rezoning was the first one subject to Mandatory Inclusionary Housing, a city law requiring at least 25 percent of new multifamily projects to be affordable.

As of March, only 1,661 affordable units had been started in the rezoned area and just a few hundred were occupied, according to the Department of Housing Preservation and Development.

Now, with interest rates having shot up and the 421a tax break for multifamily projects expired, market-rate development is likely to become even rarer.

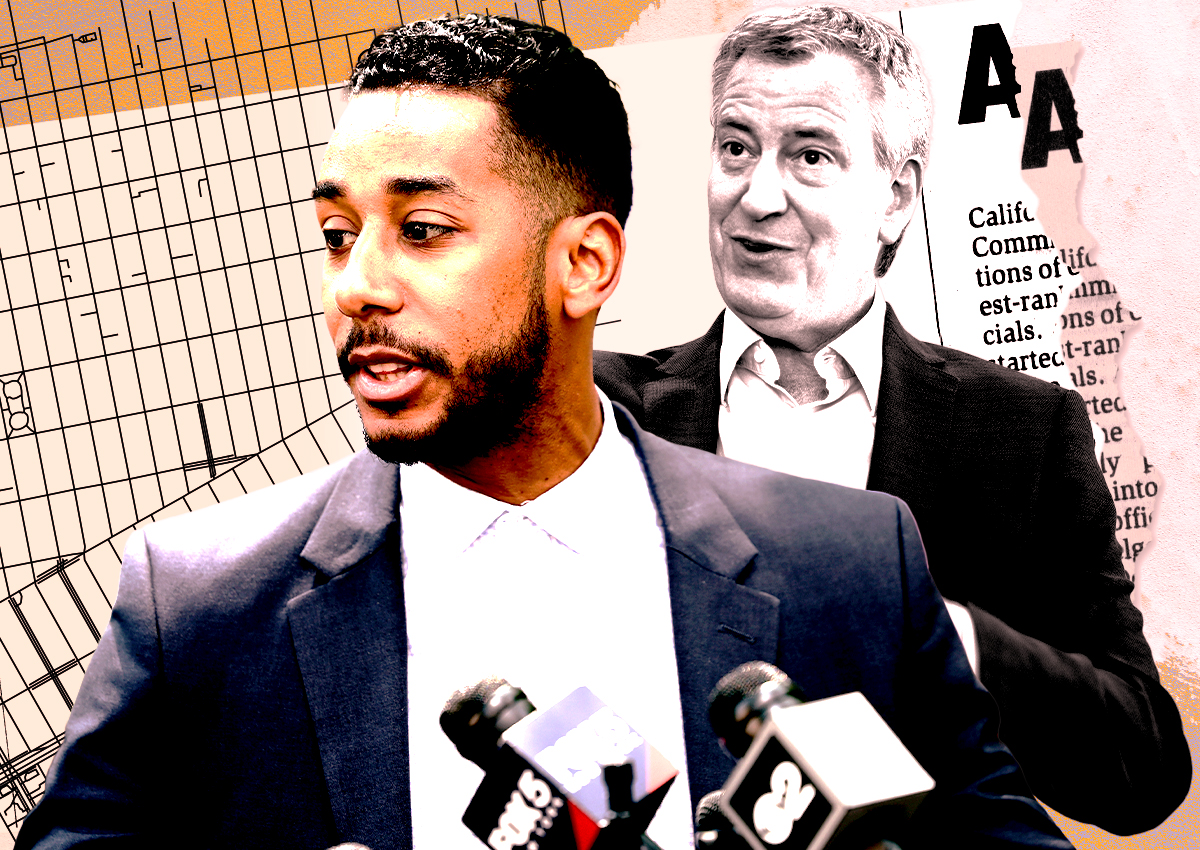

Yet a surge in private development is on the horizon in East New York, insists Brooklyn Borough President Antonio Reynoso.

The difference-maker, he believes, will be the redevelopment of Broadway Junction. One of New York’s busiest transit hubs — it carries the A,C,E, J, Z and L lines — it is getting accessibility and safety improvements, as well as two pedestrian plazas, the city announced in May.

Work isn’t expected to wrap up until 2030, however, so East New York’s metamorphosis might not take shape until then, Reynoso said in an interview. It will include a commercial and residential boom and also industrial space in an economic development hub.

“We’re going to build office space and try to bring tech or something to East New York,” Reynoso said. “It hasn’t happened yet, but Broadway Junction, I think, is going to be the pillar of that.”

The neighborhood also has a Long Island Rail Road station, which offers a two-stop ride to Downtown Brooklyn but no direct train to Manhattan. Its distance from the central business district, industrial zoning and entrenched poverty have hamstrung development for decades. The rezoning was supposed to unlock its potential, but the upgrades Reynoso mentioned might have to come first.

Until then, high construction costs will continue to tamp down investor activity, according to Jakub Nowak of Marcus & Millichap. The ebbs and flows of interest rates will also play a major role in the pace of development in the area, he said.

“Commercial values and industrial values kept climbing over the last few years, while the upzoning factor became less relevant as construction costs went up,” Nowak said. “Now, without 421a, I barely see any activity for straight-up development sites in East New York.”

Land rush

A pillar of de Blasio’s housing plan was to upzone 15 neighborhoods — most of which had been low-scale since the citywide rezoning of 1961 — and require affordability in medium-sized or larger apartment projects that benefited from the change.

Because rezonings were largely controlled by the local City Council member, before starting the public review, the administration looked for willing partners. Convinced that the East New York rezoning would pass, hopeful buyers sprung into action, and property owners demanded up to $80 per square foot for sites that had traded for one-quarter of that price.

“We saw an increase in speculators wanting to buy our sites when news of the East New York rezoning hit the wire, even before it was approved,” said Aaron Koffman, president of Hudson Properties. “Land asks went through the roof.”

He added, “Certainly I think people thought, ‘This is a real cash moment,’ to cash in or cash out.”

Hudson’s plans in East New York were long-term: It is developing a mixed-use, affordable and transitional housing complex dubbed Logan Fountain, set to be completed in 2024.

While some investors bet that development sites would jump in value, others bet on small, residential properties. A report from the Center for NYC Neighborhoods ranked East New York No. 1 in house flipping based on 246 flips of one- to four-family homes in 2017, up from 94 in 2015.

“The wave is in East New York now,” Bill Wilkins, manager of the East Brooklyn Business Improvement District, told The Real Deal in 2017, pointing to previously hot neighborhoods Dumbo, Carroll Gardens and Fort Greene.

But the wave soon petered out. Only eight privately financed projects subject to the inclusionary housing law have been built in the 190 rezoned blocks, according to data provided by the HPD. They include 439 market-rate and 157 affordable units. The rezoning was expected to yield 6,500 homes by 2030.

Reynoso, who became borough president last year after representing neighboring Bushwick in the City Council, said his office has not received complaints from locals about investors buying properties or razing homes to build projects.

Advertised rents have risen in East New York since 2016. The median asking rent for a two-bedroom apartment is $2,500, up 43 percent from $1,750, according to Streeteasy data. Koffman attributed that to the citywide problem of demand outpacing supply.

“East New York was not immune to what’s happened in the last couple of years where [new] supply has dramatically decreased,” Koffman said. “Therefore, I think the price of everything has gone up. A lot of the single-family homes, those prices have gone up year-over-year. It could be tied to the rezoning, but I think it’s just a little bit of both.”

Retail, especially mom-and-pop shops, has also been spotty since Covid, the Hudson Properties executive said. Complicating matters for East New York is that a major corridor, Atlantic Avenue, is more of a thoroughfare than a shopping district, which makes it a hard sell for commercial tenants.

“I don’t know if those challenges are unique to East New York or citywide to some degree and the outer boroughs, but we were experiencing some tough times with getting tenants or keeping tenants current,” Koffman said.

Reynoso said shops away from Fulton Street, a historic shopping district in the area, have a harder time getting foot traffic. The pandemic-fueled rise of competitors like Amazon has also changed how residents shop “indefinitely,” Reynoso said.

Industrial misfire

The decline of manufacturing in the city since the 1960s left many of its industrial areas underdeveloped, but over time most have transformed. Soho’s lofts and Dumbo’s warehouses became pricey apartments, and the 2021 Gowanus rezoning has triggered a spate of multifamily projects.

But that didn’t play out in East New York. To an extent, the rezoning’s shift from industrial to residential was ill-timed, as warehouses have since then been the hottest properties in real estate.

“Landowner in the rezoned section of East New York just texted me asking if I had any buyers for the property,” real estate professional Ben Carlos Thypin tweeted in February. “He’s been asking $150 per buildable square foot for the +5 years since the rezoning.”

No buyers have emerged, in part because the rezoning requires affordable units in a neighborhood where even 100 percent market-rate projects generally don’t pencil out. Thypin surmised that the owner might have done better had his property remained industrial.

“The East NY rezoning has arguably depressed the value of his property, [contrary to] many people’s claims that rezonings *always* boost values,” he wrote.

Reynoso is more optimistic about East New York’s rezoning than about Williamsburg’s in the mid-aughts, before affordability was mandatory.

“We didn’t have a lot of the protections that East New York had and we didn’t have the amount of affordable housing being built … and displacement happened very quickly,” Reynoso said.

He predicted eastern Brooklyn would gain higher-earning residents without losing its working-class population.

“This is going to be a place where we can talk about integration versus displacement, and the need for new people to come into East New York,” Reynoso added. “The demographics are going to change and new populations are going to be there … without having to displace long-term residents and tenants.”

But Nowak, of Marcus & Millichap, said the 2016 rezoning was not supposed to take a decade and a half to yield a bounty of new homes.

“2030 is seven years away and the city is grappling with a housing affordability crisis today,” he said.

The city’s affordability requirement was designed to work in tandem with the 421a tax break, but only the mandate remains.

As a result, Nowak said, “most new rental housing development will be impossible in New York City except in its most desirable neighborhoods. That is, until land values drop enough to make up for the lack of a tax abatement — a process that would take many years.”