Realty Income And Simon Property: Enjoy Your REIT Cake In 2023 (NYSE:O)

ozgurcankaya/E+ via Getty Images

Thesis

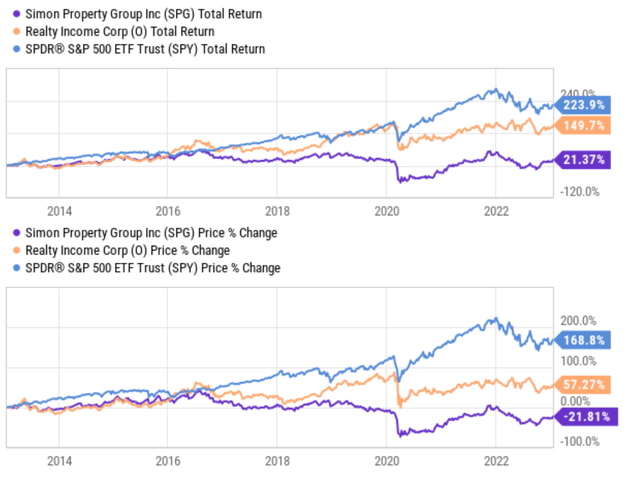

REIT investors typically get to eat the cake now as REIT stocks pay out most of their earnings as cash dividends. And historically, most of the total return from mature REIT stocks indeed came from their dividends instead of price appreciation. You can see the point clearly by comparing the price return and total returns from two leaders in the space, Realty Income (NYSE:O) and Simon Property (NYSE:SPG), as shown below. As you can see from the top panel in the chart, in the past 10 years, O delivered a total return of 149% and SPG 21%. And as seen from the bottom panel, price appreciation contributed about 57% to O’s total return, only about 1/3. In SPG’s case, the contribution from price appreciation is negative 21%. So, its dividend made up for the price declines twice over.

Source: Seeking Alpha data

This background leads me to the thesis for today. In this article, I will argue that the current conditions in the REIT sector provide many opportunities for investors to essentially enjoy the cake now and also have it (or at least a good portion of it). The price corrections in the REIT sector during 2022, combined with their earnings growth potential, have brought their valuations to an attractive level. As such, in the next few years, I see an attractive and balanced return profile consisting of both generous current dividends and also price appreciation potential.

And in the remainder of this article, I will use O and SPG to Income further illustrate this thesis.

Dividends and valuation compression

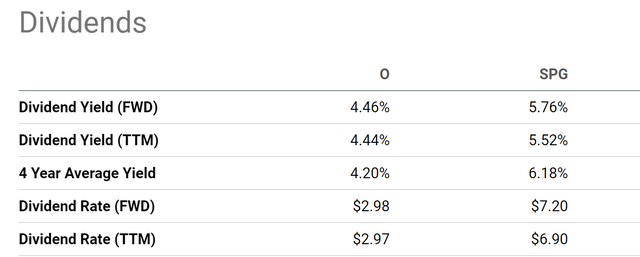

Let’s start with the elephant in the room: their dividends. O recently raised its dividend to a quarterly rate of $0.7455 per share. And also note that O investors have been enjoying a superb track record of dividend increases, with the annual payout climbing 5% on average over the last decade. SPG also announced an increase of its dividend by 2.9% in December 2022. With this raise, its dividend now stands at $1.80 per share quarterly. All told, the combination of price corrections they suffered in 2022 and their dividend increases have brought their FWD dividend yields to 4.46% for O and 5.76% for SPG as you can see from the 1st chart below.

Now, compared with its four-year average yield of 4.2%, O’s current yield is about 6% higher, signaling a valuation discount. It seems to be a minor discount on the surface. However, if you consider that O’s price has been very stable and shows below-average volatility, any discount is worth noticing in my view.

SPG’s dividend history is a bit more convoluted. Its current FWD yield of 5.76% is below its 4-year average yield of 6.18% as you can see from the first chart. However, as you can see from the second chart below, its 4-year average dividend yield is heavily biased by the dividend hikes during 2020 amid the COVID breakout. Its yield spiked to nearly 20% during that period. And if we remove those outlier data points during that period, its average dividend yield is about 5% and its current FWD yield is more than 15% above this adjusted average, again signaling a sizable valuation compression.

Source: Seeking Alpha data Source: Seeking Alpha data

Property Expansion

The price corrections they suffered in the past year are of course for good reason given the macroscopic headwinds in 2022. However, in the long term, bad times are opportunities for REITs to reinvest and expand their property portfolio. That is, for those REITs that have the financial flexibility to reinvest and expand, which is the case for both O and SPG the way I see things.

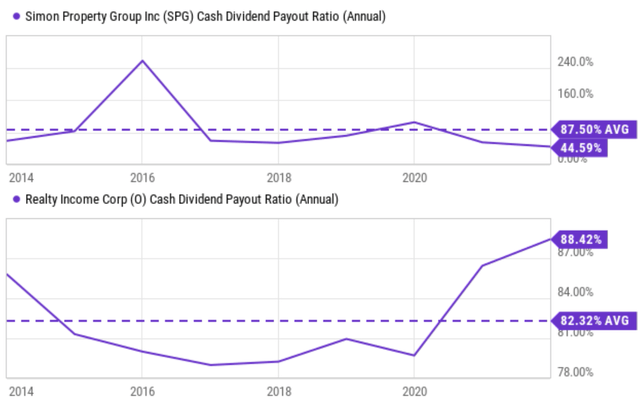

The cash dividend payout ratio for O is currently 88.4% as seen in the chart below. The ratio has been very stable in the past with an average of 82.3%. Hence, O’s current payout ratio is a bit above its average but not to any concerning degree at all.

As such, the company has plenty of financial flexibility to expand its property holdings. Through the first three quarters, Realty added 766 properties, containing 21.5 million square feet of space, to its real estate portfolio. It concluded the September interim with 11,733 facilities and 225.7 million square feet, versus 7,018 properties and 125.0 million squares in 2021. Such expansion translates into an almost doubling of its properties in terms of square footage.

The case for SPG is very similar, probably even stronger as seen from the bottom panel of the following plot. SPG’s current cash payout ratio is only about 45%, not only far below O’s but also far below its own historical average of 87.5%. As a result, SPG also has plenty of financial bandwidth to reinvest and expand. It has construction projects ongoing at various sites around the globe. To name a few examples, its international projects include South Korea (the Busan Premium Outlets) and France (Paris-Giverny Designer Outlet). And its domestic projects include those in Miami, Seattle, and Atlanta.

Source: Seeking Alpha data

Growth prospects and projected returns

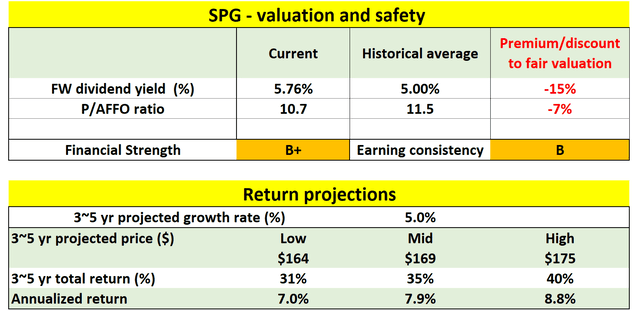

With the above expansion and growth potential, I see an attractive return profile consisting of a balanced mix of current dividends and also price appreciation potential in the next 3~5 years as shown in the tables below.

In SPG’s case, as aforementioned, my dividend analysis suggests that it is currently discounted by about 15%. And in terms of P/AFFO multiple, its current FW ratio sits at ~10.7x, which also suggests a sizable discount from its historical average of 11.5x.

Combining the valuation discount and growth potential, an attractive return profile can be projected even with an assumption of a modest growth rate (for example, ~5%). As shown, for the next 3~5 years, the total return can be up to 40%, translating into an annual return of 8.8%. And note that in this case, the current dividend yield of 5.76% would make up about 1/3 of the total return potential, in contrast to the dominating role its dividends played in its total return profile in the past decade.

Source: Author based on Seeking Alpha data

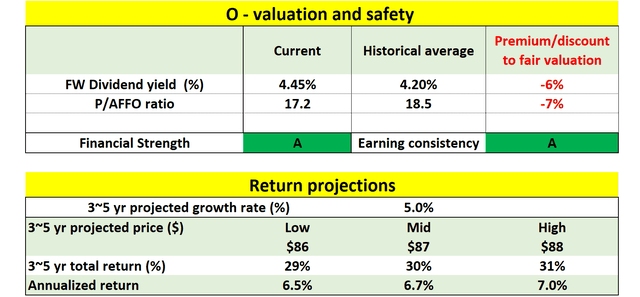

In O’s case, its valuation discounted is about 6% measured by dividend yield as we analyzed earlier. And in terms of P/AFFO multiple, its current ratio is ~17.2x, also about 7% discounted from its historical average of ~18.5x. And again, the combination of valuation discount and growth potential offers an attractive return profile too. Assuming the same 5% modest growth rate as SPG, its total return is projected to be up to 31% in the next 3~5 years, translating into an annual CAGR of 7.0%.

Source: Author based on Seeking Alpha data

Risks and final thoughts

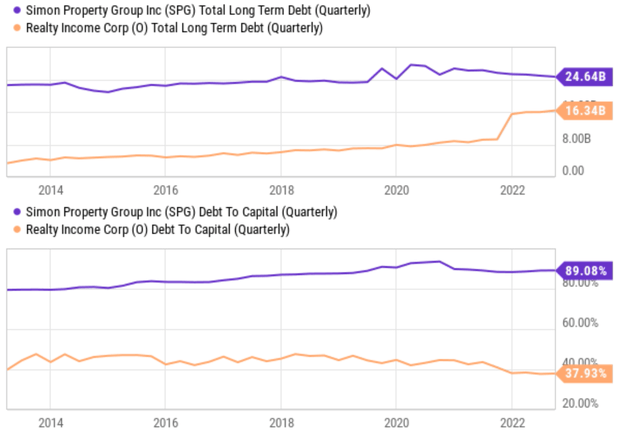

Investments in either O or SPG entail risks. On the top of my list is leverage. The balance sheet is quite leveraged at both companies. In SPG’s case, even though its total debt declined 4% in Q3 of 2022 from a year ago. Its total debt is still a sizable $24.64 billion. And the debt-to-total capital ratio is at an elevated level of 89% with stock prices as of this writing. In O’s case, its debt load has grown substantially due to the acquisition of VEREIT in late 2021. As of the September 2022 interim, its total debt hovers around $16.34 billion, versus $9.25 billion a year ago. period. Although its debt-to-total capital ratio is at a much lower level of 37.9%.

Source: Seeking Alpha data

To conclude, historically, most of the total returns from mature REIT stocks like O and SPG have come from their dividends instead of price appreciation. However, the combination of price corrections in the past year and AFFO growth potential has offered a situation for SPG and O investors to both enjoy both generous dividend yields and also an attractive price appreciation in the next few years. So, in this sense, investors can enjoy their cake in 2023 and also get to keep a good portion of it.