CoreLogic: US Annual Rent Growth Drops for the Seventh Straight Month in November

- Year-over-year single-family rental price gains fell to 7.5% in November 2022, the lowest growth recorded since May 2021

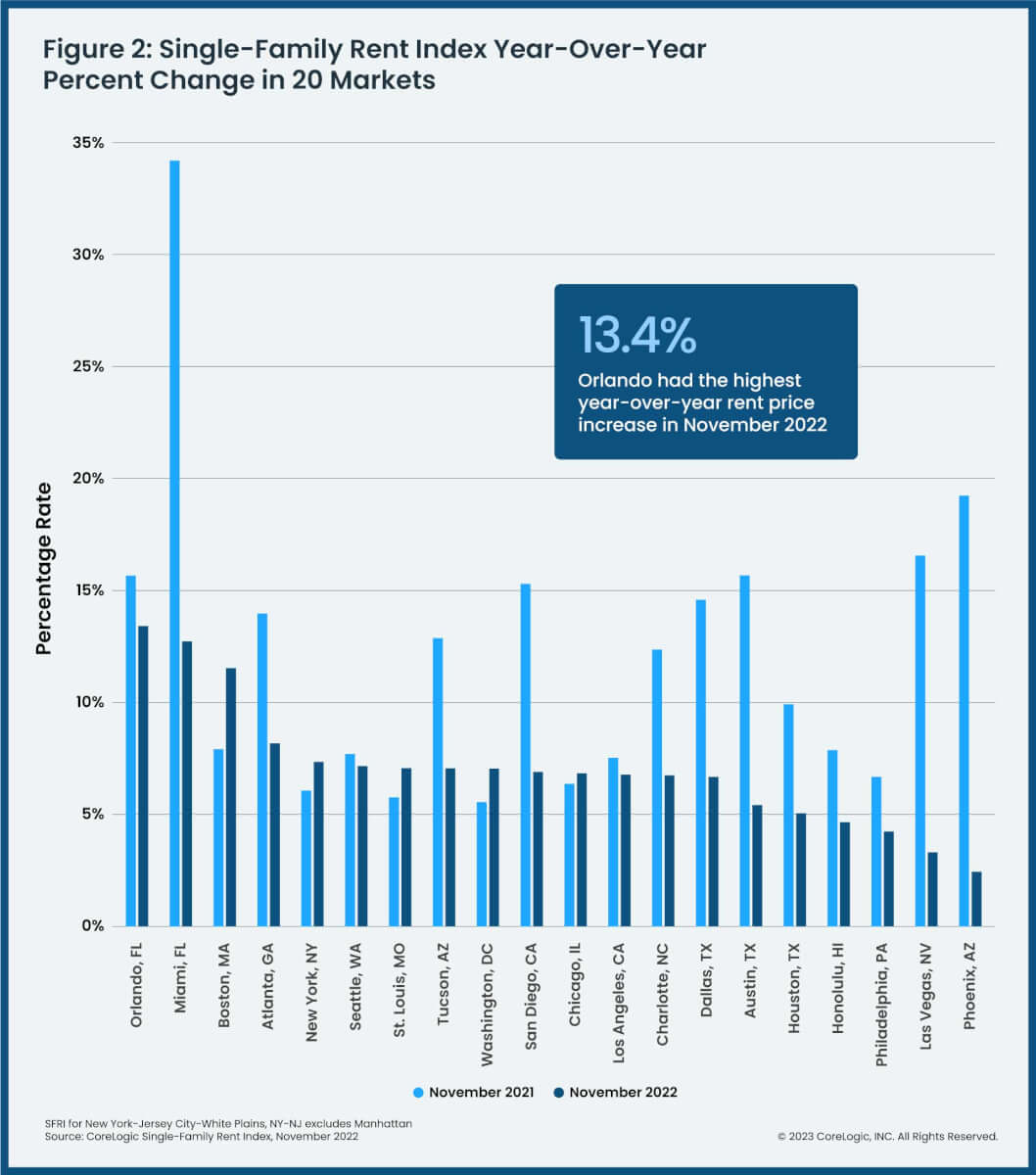

- Orlando, Florida moved into the No. 1 spot for annual rent increases, ending Miami’s 15-month streak at the top

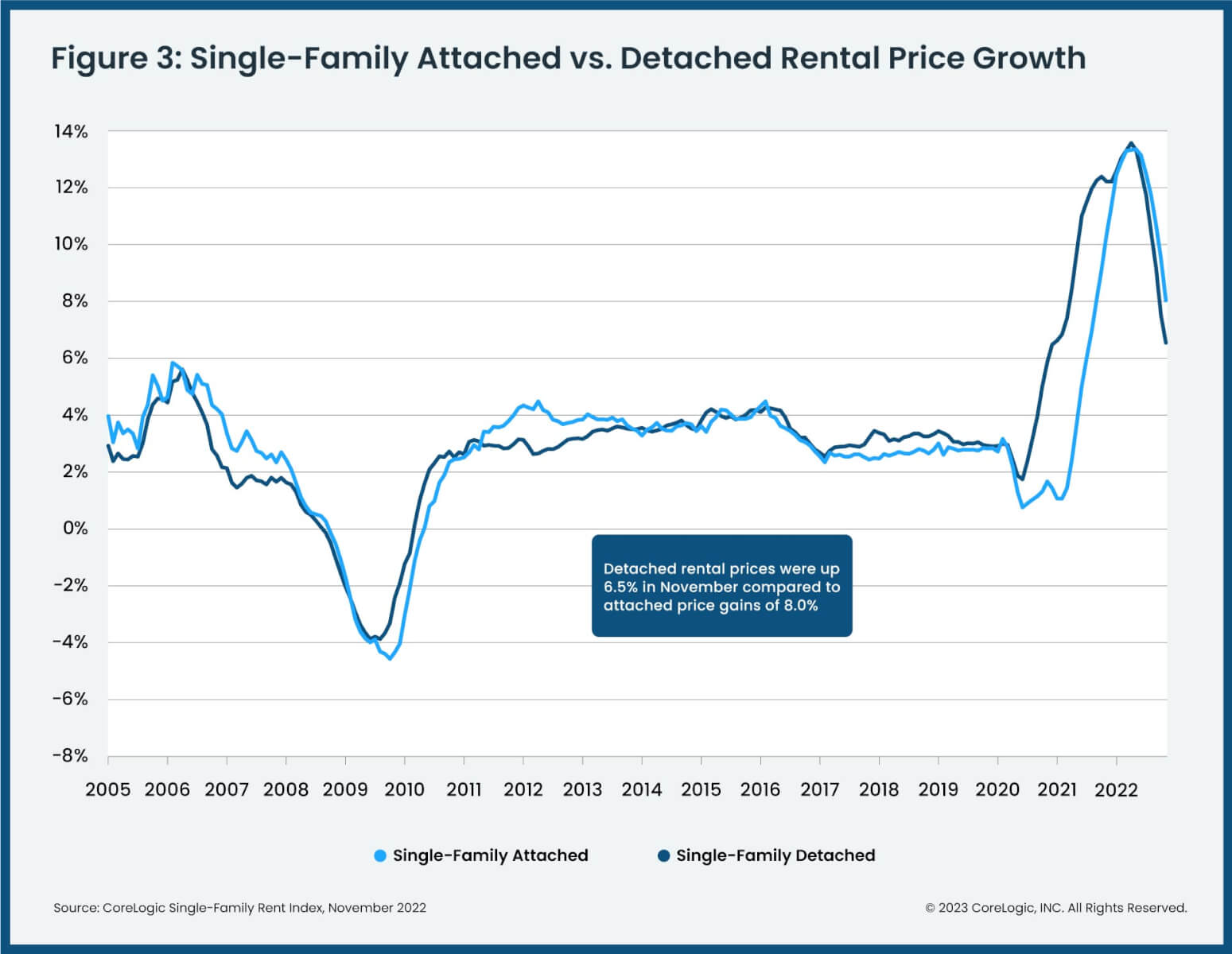

- Attached rental price growth continued to outpace detached rental price growth, a respective 8% and 6.5% compared with November 2021

IRVINE, Calif., January 17, 2023—CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

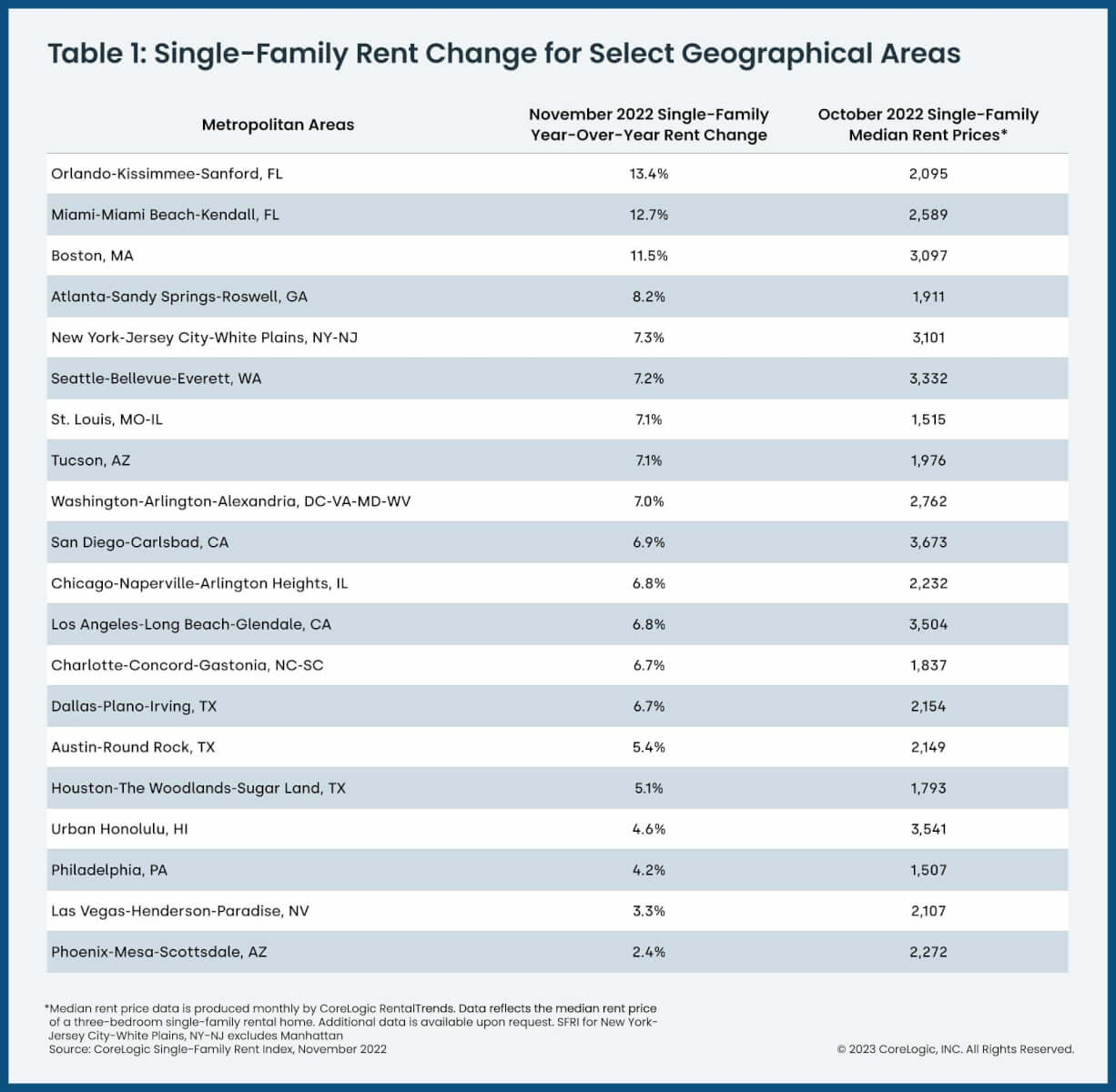

Single-family rental price increases dropped to 7.5% year over year in November, with all four tracked price tiers posting lower gains than a year earlier. November marked the seventh consecutive month of annual deceleration, and while Florida metro areas continued to post the nation’s highest rental cost gains, other Sun Belt cities such as Phoenix and Las Vegas that formerly showed the highest rent increases are now at the bottom. CoreLogic expects that rental price growth, along with home price appreciation, will continue to level off during the first part of 2023.

“An increase in single-family rental inventory is cooling price growth rapidly,” said Molly Boesel, principal economist at CoreLogic. “November’s annual U.S. rent growth was the slowest since May 2021 and two of the previously hottest markets — Phoenix and Las Vegas — posted the lowest gains among major metro areas. Looking forward, rent growth should continue to moderate and better balance market conditions.”

To gain a detailed view of single-family rental prices, CoreLogic examines four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

- Lower-priced (75% or less than the regional median): 10.1%, down from 10.9% in November 2021

- Lower-middle priced (75% to 100% of the regional median): 8.2%, down from 11.9% in November 2021

- Higher-middle priced (100% to 125% of the regional median): 7.2%, down from 12.5% inNovember 2021

- Higher-priced (125% or more than the regional median): 6.5%, down from 12.3% in November 2021

Of the 20 metro areas shown in Table 1, Orlando, Florida posted the highest year-over-year increase in single-family rents in November 2022, at 13.4%. Miami recorded the second-highest gain at 12.7%, while Boston ranked third at 11.5%. Phoenix saw the lowest annual rent price gain at 2.4%.

Differences in rent growth by property type emerged after COVID-19 took hold, as renters sought standalone properties in lower-density areas. This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate. As single-family rent prices continued growing rapidly, preferences for attached rentals began to emerge in early 2022, and by summer, they had higher increases than detached properties. Attached single-family rental prices grew 8% year over year in November compared to the 6.5% increase for detached rentals.

The next CoreLogic Single-Family Rent Index will be released on February 21, 2023, featuring data for December 2022. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. CoreLogic constructed the SFRI for close to 100 metropolitan areas — including 47 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by CoreLogic RentalTrends. RentalTrends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Robin Wachner at [email protected]. For sales inquiries, please contact [email protected]. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

© 2023 CoreLogic,Inc., All rights reserved.