The US Housing Market In 2023: What To Expect

mphillips007

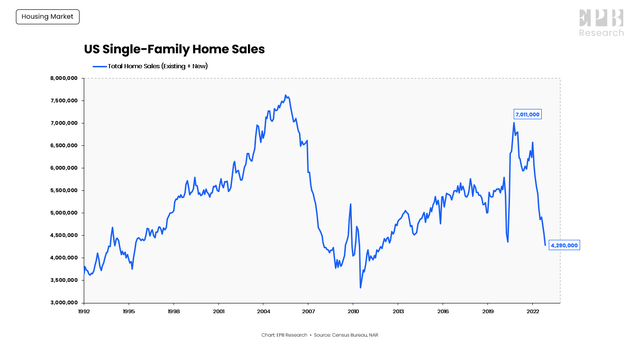

The US housing market has been facing a downturn that shows no signs of ending anytime soon. Over the last several months, we have seen a total collapse in the volume of housing transactions and the early signs of price declines throughout the country.

In this article I will update the current state of the US housing market, both volumes, and prices, and then I will provide an outlook on what to expect in 2023 based on several reliable leading indicators.

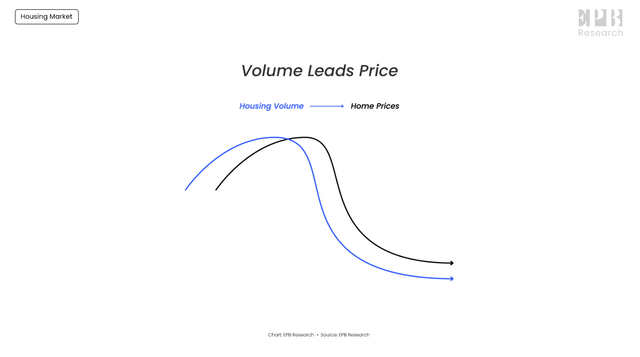

Volume leads price. Always.

First, there’s a decline in the number of transactions, and then prices decline months later. Because volume leads price, let’s look at volumes first.

EPB Research

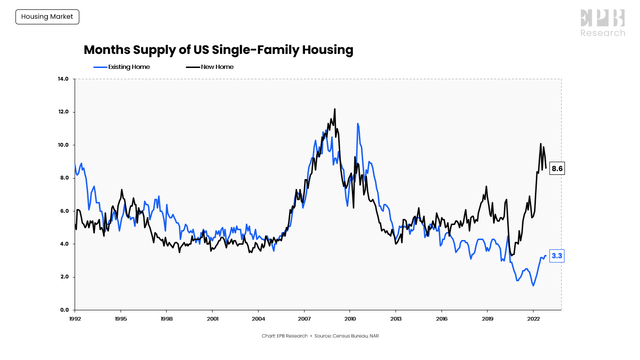

The housing market is split into two markets: Existing homes and new homes or new construction.

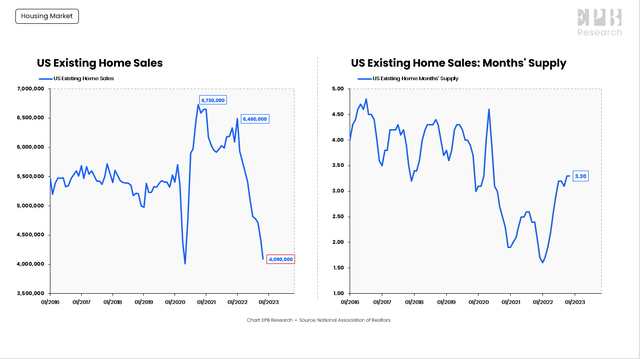

Existing home sales, which make up about 85% of total home sales, peaked in 2020 with an annual sales pace of 6.7 million. The volume of existing home sales has completely collapsed to 4.1 million, a decline of roughly 40%.

NAR, EPB Research

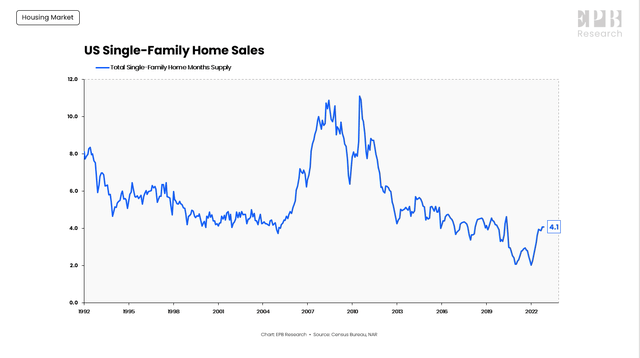

Despite the fact that existing home sales volume has collapsed, the monthly supply or the ratio of home sales to home inventory is just 3.3 in the existing home market.

A balanced market, or the perfect balance between supply and demand, is a monthly supply of about 5.0, so you can see how the existing home market has had tight inventory for the last six years.

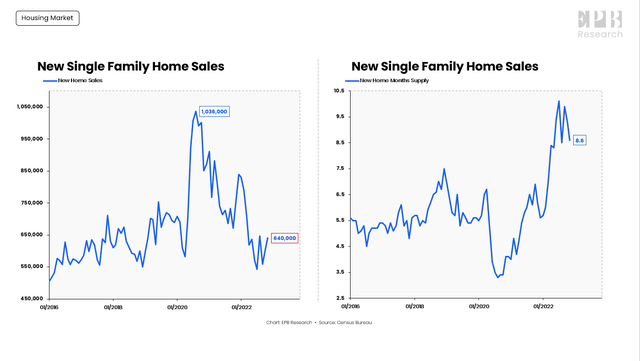

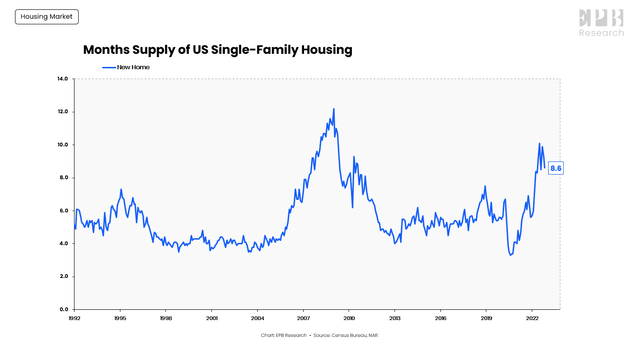

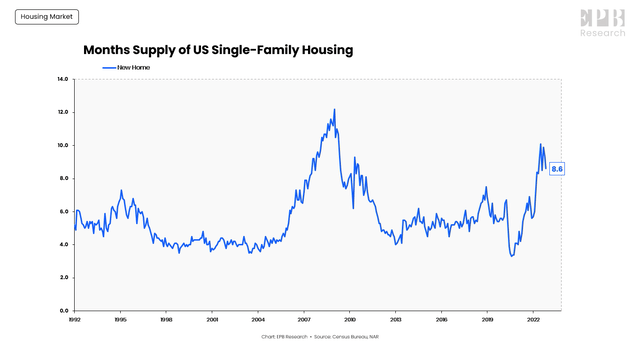

The new home market is a bit different. Home sales volume has declined a similar 40% from over 1 million annual sales to about 600,000 annual sales, but the monthly supply exploded from under 4.0 to almost 9.0.

Census Bureau, EPB Research

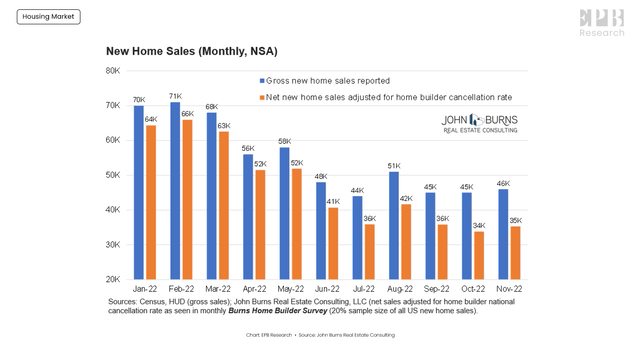

There has been a slight increase in new home sales and a corresponding decline in the monthly supply of new homes, but this is not accurate as the cancellation rate is rising.

Many people are buying new homes and then canceling the purchase. These cancellations are not captured in the Census Bureau data, so we’re likely seeing sales overstated.

John Burns Real Estate consulting gives us some better data and shows how there were 46,000 gross sales in November but about 11,000 cancellations, leading to 35,000 net sales.

This gap between gross sales and net sales has been widening in recent months, which means our new home sales data is actually worse than what’s being reported.

John Burns Real Estate Consulting

If we take the data at face value, we can see that the in the total US single-family home market, we were selling at an annual pace of 7 million in late 2020, and we’re moving closer to 4 million as we enter 2023, a decline of roughly 40%.

Census Bureau, NAR

So the volume of transactions in the US housing market has collapsed. Undeniably.

The monthly supply of the total US single-family housing market is 4.1, which is very tight.

Remember that about 5.0 is balanced, so when the ratio of home sales to home inventory is below 5.0, that means there’s not a lot of inventory, and many people said home prices would not fall because of this tight inventory situation.

Census Bureau, NAR, EPB Research

The months’ supply of US housing at 4.1 is made up of existing home months supply of 3.3 and new home months supply of 8.6.

NAR, Census Bureau, EPB Research

There has never been a split like this in history, and this is throwing off many people who are looking at the situation without considering this nuance.

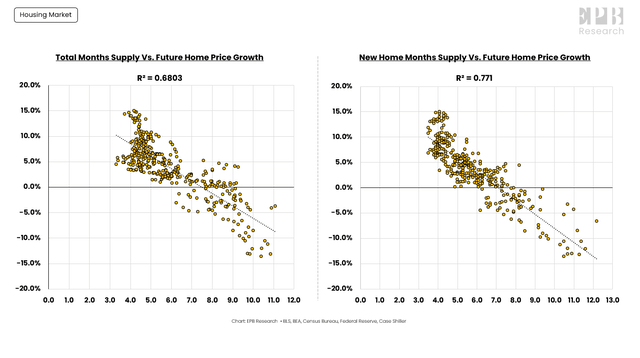

If you run an analysis between future home price growth and the monthly supply of total US housing and only new US housing, we can see that the monthly supply of new homes is a better predictor of future home prices.

Case-Shiller, NAR, Census Bureau, EPB Research

So many people are looking at the total US housing inventory and saying prices cannot fall when in reality, new home months supply is a better indicator because home-building companies tend to be price setters.

We also should remember that the monthly supply number of 8.6 for new homes is likely too low once we account for the cancellations, so the reason that home prices are falling is that the monthly supply of new homes, the best predictor of future home price growth, is at the highest level since 2008 and with sales volume collapsing, there are no signs this ratio will fall in the next several months.

NAR, Census Bureau, EPB Research

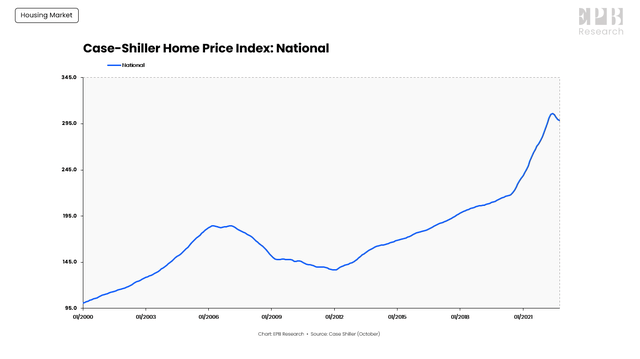

On a national level, we can see home prices have officially peaked, which many people didn’t see coming because of the false supply narrative, but in truth, the declines are not happening equally across the country.

Case-Shiller, EPB Research

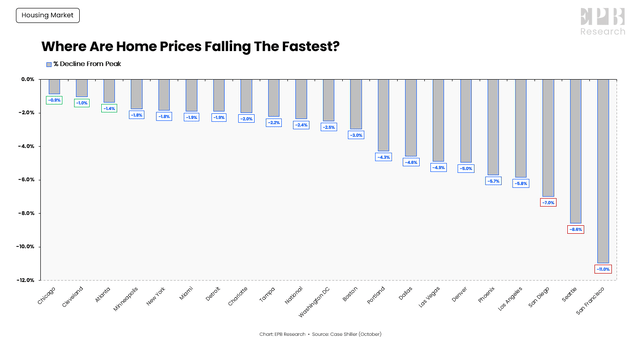

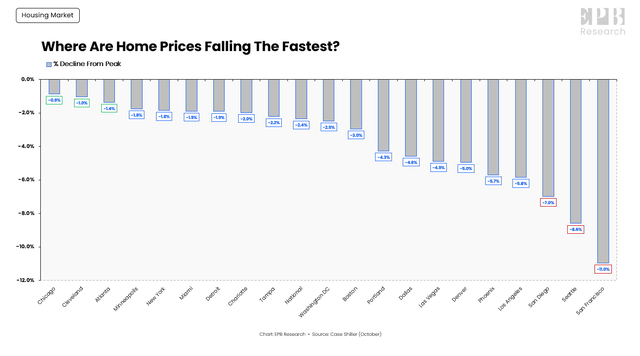

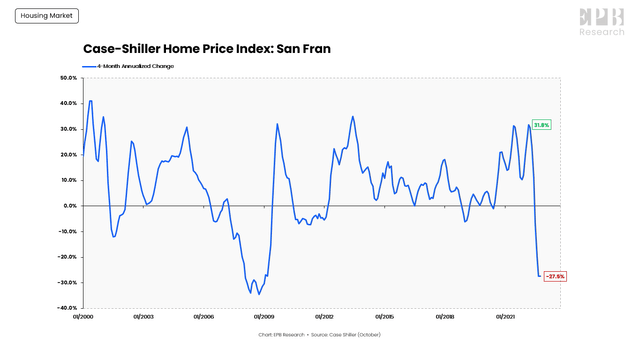

Places like Miami are barely declining while San Francisco is crashing.

Case-Shiller, EPB Research

The Case-Shiller home price index measures the 20 major cities across the United States, and this graph shows how much home prices have declined from the peak around the Spring or Summer of 2022, depending on the market.

Places like Chicago, Cleveland, Atlanta, and other parts of the East Coast like New York and Miami haven’t declined more than 2%, so many people in those markets are saying that home prices aren’t falling, and they’re correct.

Case-Shiller, EPB Research

However, when you go to the west coast and look at San Francisco, Seattle, San Diego, and Los Angeles, home prices are down 7%-10% on average in just 5-6 months which is a total crash.

That means home prices are declining at a pace of almost 20% per annum in some cities if this keeps up, and based on the leading indicators below, it’s very likely that it does keep going at this pace and maybe even get a little worse.

Case-Shiller, EPB Research

Over the summer, I wrote an article about three factors that tell us where home prices are going (leading indicators).

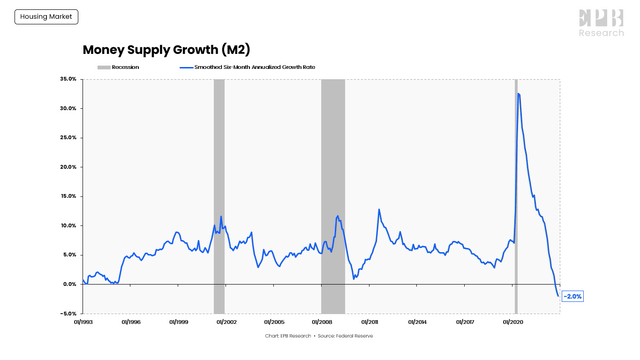

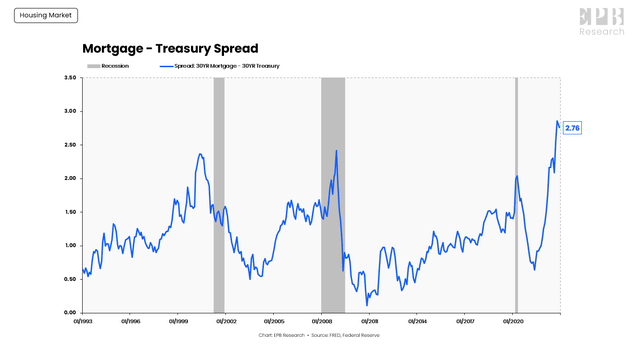

I wrote about liquidity provided by the Federal Reserve, the spread between mortgage rates and Treasury rates, and the monthly supply of newly constructed homes.

M2 growth, or money supply growth, continues to decline and is now contracting for the first time in over 30 years as the Federal Reserve is raising interest rates and slowing down credit creation in the economy.

Federal Reserve, EPB Research

Mortgage rates usually track Treasury rates, but today, the average mortgage rate is 2.76% higher than the 30-year Treasury rate, which is near the highest spread in over 30 years, a signal that there is risk in the mortgage market.

FRED, Federal Reserve, EPB Research

Lastly, as we mentioned in this article, the monthly supply of US housing is still rising, and there’s good reason to believe that the real number is actually even higher due to the cancellation rate surging, so we have a cocktail of declining liquidity, rising mortgage spreads and rising months supply of new US housing.

Census Bureau, NAR, EPB Research

This is exactly the same recipe that I called out in the summer of 2022, almost six months ago, that told us home prices would decline.

So it’s very clear that in the first half of 2023, we should see a continuation of what we saw in the second half of 2022, which is a continued decline in housing volumes and home prices that continue to decline with the normal differences across the country.