How Hines Uses a Hyperlocal Strategy To Grow Its Global Real Estate Portfolio

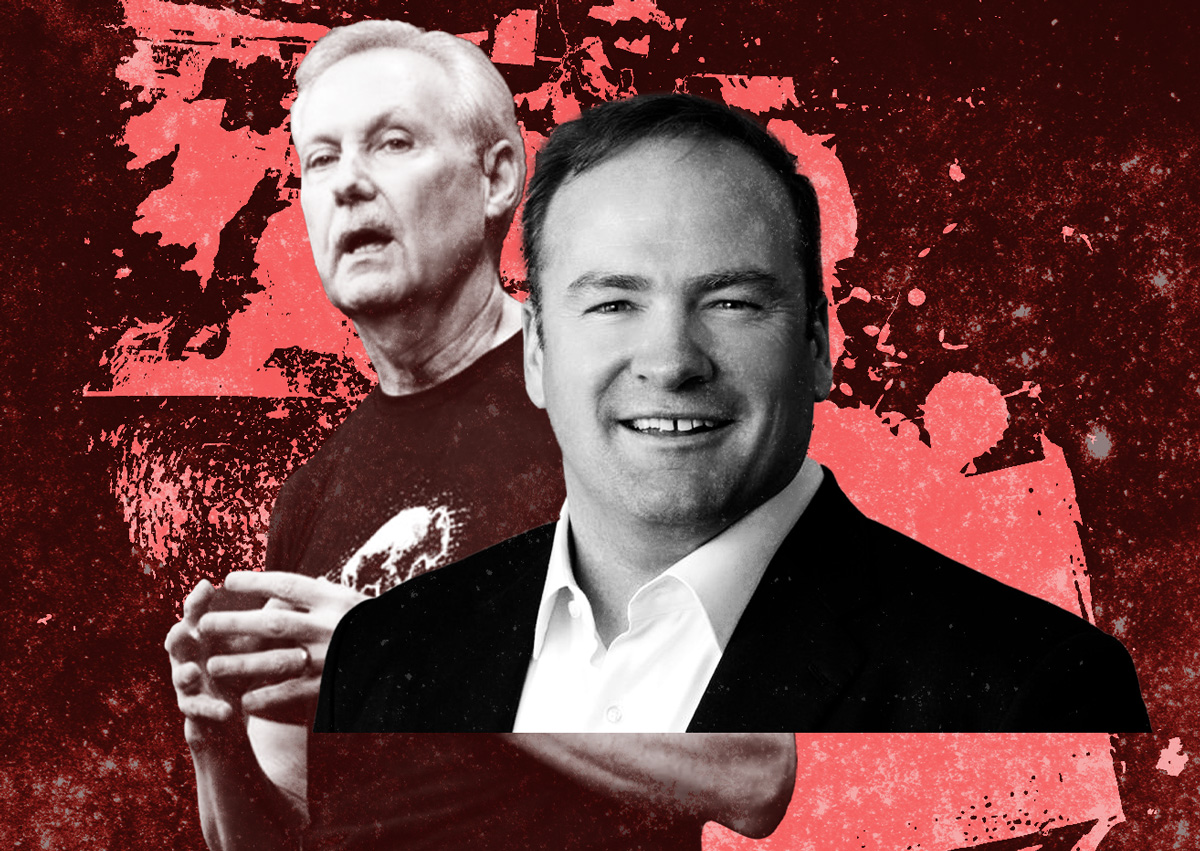

The Houston-based real estate firm Hines has developed, redeveloped, or acquired more than 511 million square feet of space in its 65-year history, and it has another 198 projects totaling 103.4 million square feet in the pipeline. It’s one of the largest commercial real estate firms in the world, with a presence in 28 countries, but that’s not the takeaway the firm wants you to have. “If you hear nothing else, what’s distinctive about us–even though we’re large—is we’re hyper-local,” said Chris Hughes, CEO of the capital markets group and co-head of investment management at Hines. And in today’s competitive real estate market, especially the office sector, it’s that local knowledge that the firm believes is helping it stand out among its competitors and thrive during volatile times in the market. The global firm is also making a big push into tech at its office projects that it hopes will better set up its buildings for what might be a turbulent future.

Texas roots, global vision

Hines has been a private firm from the beginning, and it plans to stay that way. “We’re private and still a family-owned company and we won’t be a public company,” Hughes told me. The firm was started in 1957 by Gerald Hines, an Indiana native who moved to Houston with a degree in mechanical engineering from Purdue University to work for an HVAC manufacturer. After several years of designing mechanical systems for commercial and industrial buildings, Gerald launched his namesake firm as its sole employee and by 1958, had already developed six office/warehouse developments. Gerald’s firm made a name for itself over the years through its prolific development of industrial and office projects, the latter of which became known for its striking architectural style. Nearly six decades later, Gerald’s one-man operation has grown into its current staff of 4,800 worldwide.

The company has remained in the Hines family since the beginning. In 1990, Gerald’s son Jeffrey was handed the reins to the company, and in the three decades since he took over, the firm has expanded significantly on an international level, including opening several offices in Europe and developing major projects in Mexico, Germany, and Spain. Less than two years after founder Gerald died in 2020 at the age of 95, his granddaughter, Laura Hines-Pierce, was named as Co-CEO of the firm, alongside her father Jeff. The appointment was notable for a couple of reasons, one being that Hines-Pierce joined the very small group of women leading global private real estate companies. The other is that at 38, Hines-Pierce is bringing a Millennial perspective to the firm, a fact that is sure to influence some of the company’s priorities. The new co-CEO was already involved in the firm’s D&I efforts at the time of the appointment and is putting a major focus on ESG goals and sustainability, something the firm wants to be “very purposeful” about.

Hines operates on many levels in the real estate industry. The company is active in development, acquiring and selling properties, managing real estate, and investment management. Hines owns and operates properties across the spectrum, including office, industrial, student housing, senior housing, retail, and other uses. The bulk of the company’s portfolio is in the US, where it has more than 175 million square feet. Since the early 1990s, the firm has operated several investment funds.

Hines launched an open-ended fund in 2021, Hines U.S. Property Partners (HUSPP), that targets high-quality residential (or living, as the company calls it), industrial, office, mixed-use and select niche sectors in high-performing submarkets. So far, the fund has closed on six investments within the industrial, multifamily, mixed-use and office sectors. The fund closed on an additional $600 million in February, totaling $1.4 billion in commitments. The other active US fund is Hines U.S. Property Recovery Fund, which also launched last year. Unlike HUSPP, this fund is opportunistic and targets undervalued and struggling properties. The fund has a total target of $1 billion and secured $590 million at its first closing. Hines has so far acquired two Class A logistics properties in San Jose, California for $186 million through the fund. Europe is the second largest area of investment for Hines. A big portion of the company’s total portfolio is in Europe, where the company owns around 58 million square feet of real estate.

International investments

Hines first expanded outside of the US in 1977, when the company completed a 24-unit condo project in Mexico City. Since then, the company has developed, redeveloped or acquired projects totaling more than 162 million square feet internationally, including notable buildings like EDF Tower in Paris and DZ Bank in Berlin, designed by Frank Gehry. Hines has also grown its platform with the addition of offices in more than a dozen cities including London and Berlin. The firm has investments in 60 cities in 14 countries in Europe.

Hines’ latest acquisition involved the firm’s flagship core-plus fund in the Asia Pacific region, Hines Asia Property Partners (HAPP). Through HAPP, Hines further expanded its industrial and logistics footprint in Australia with the purchase of two logistics properties from Honda Australia in Melbourne. Both properties will be redeveloped by Hines into “next-generation” facilities, according to Hines. The company’s industrial and logistics footprint is growing rapidly. As of the first quarter of 2022, Hines has invested close to $6.3 billion in the sector and completed more than 76 acquisitions. Additionally, the company has 96 development projects in various phases of completion. “Asia right now is a place of tremendous growth, and if you include India, that market has got a lot of room on the office development side,” said Hughes.

The pandemic hasn’t seemed to slow the company down over the last few years, with Hines announcing a steady stream of development projects and acquisitions since 2020. Hines’ Global Chief Investment Office David Steinbach said in a Q&A that the company’s global footprint worked in their favor during the first year of the pandemic, as employees stayed in the cities they worked in, bucking the pandemic-influenced trend of workers moving to different and/or lower-cost cities and working remotely. “We were able to transact because we have local teams there,” said Hughes of the company’s presence in more than 250 cities around the world.

In the very early months of the pandemic, after lengthy negotiations, Hines landed a major lease deal with Microsoft at its Atlantic Yards office development in Atlanta, a joint venture Hines developed with partner Invesco Real Estate Partners. The tech firm signed a lease for the entire two-building office development, for a total of 523,000 square feet. Hines and Invesco later sold the Atlantic Yards development to Global Atlantic Financial Group, a division of KKR, for an estimated $500 million.

While Hines invests in many asset classes and has been leaning heavily into the residential and logistics sectors over the last couple of years, the company is still optimistic about the office market, a sector that the company made its name in. “It would be a mistake to short office,” said Hughes. He pointed to the role the office plays in fostering culture, collaboration, and productivity. “I think it’s undeniable that the mentoring that happens in office environments and the productivity that happens is a big part of why office is needed. And so what we’re really seeing is there is going to be a rational rethinking by a lot of employers,” he said.

Hines headed up leasing at SL Green’s megatower One Vanderbilt in New York City, the 93-story tower that opened in the fall of 2020. Hughes pointed to the tower’s success in fully leasing up during the pandemic as an example of the flight-to-quality trend that has been an overarching theme in the market as the country has moved further into a post-pandemic landscape. As long as the space is well thought-out, office is a valuable asset. “It’s got to provide something more than a place to house workers,” said Hughes.

See also

‘Creating a brain’

Over the last several years, Hines has been leaning into its investment management platform to help grow the firm. “A lot of capital has come into the real estate sector and frankly it’s still growing,” Hughes said, adding that there has been a lot of disruption as a result of high inflation around the world leading to interest rates going up and repricing of real estate. Beyond the disruption in the capital markets, Hughes and his firm are looking at what’s to come after market disruption has settled down, “the big themes to us are what’s happening on the ESG front and what is the physical product going to be after this: digitalization of real estate, data, blockchain, and what’s happening with the sectors converging.”

One of those big themes for Hines is its focus on digital innovation. Jeannie Schneider is the Chief Technology Officer at Hines and works within the company’s global digital strategy office, which is focusing on how to best use the wealth of data about people and spaces that is being collected through technology. The company has a smart building integration platform project underway that will connect data on energy use, occupancy, and more from all buildings in Hines’ portfolio. Tenants will be able to bring their own apps and easily and safely connect to the company’s platform. Hughes said the impetus to create the tech platform came from a desire to offer another kind of flexibility for tenants that would dissuade outsiders from coming in. “If we don’t do it, we’re seen to outsiders as an industry where they can come in and be disruptors and get between us and tenants and investors.”

“We’re creating an operating system for the building,” Schneider explained. “What we’re really doing is creating a brain, an OS for the building. We’re leaving behind a more tech-enabled building once we sell it.” That brain includes all of the building’s history, data, potentially digital twins, a digital footprint that will stay with the building long after it’s acquired by another company. “We wouldn’t sell a building without an elevator, we’re thinking along those lines,” she said. The company is also taking a different approach when it comes to building apps. In 2018, Hines rolled out an open platform system in partnership with Workwell that can integrate existing building systems into one app. “We’re taking that non-proprietary agnostic approach so when underlying tech changes, or it’s time to recap a building and swap one thing for another–you’re not undoing the whole stack. You can unplug and plug back in.”

Already a global company, Hines is further expanding its footprint across several real estate sectors in Europe and Asia. The company’s development pipeline has several big projects in the works, including mixed-use and logistics developments in Florida hotspots Tampa and Miami and luxury multifamily projects in Brazil and Australia. Hines has also raised hundreds of millions of dollars for its various funds in the US, Asia, and Europe. Multifamily and logistics projects make up a good amount of the company’s acquisitions and forthcoming developments, but they are working on some office developments as well, including plans for what would be the tallest office tower in the San Francisco’s area’s East Bay and a 30-story office project in Mumbai. While office is a risky bet these days, Hines is hoping that newer buildings with in-demand amenities will fare better than older properties.

The company’s diversified global portfolio and network of employees have certainly helped protect it during the tough economic times over the last few years, and it will be interesting to see what kinds of investments the company continues to make in some of the regions it is focusing closely on, like Asia. It will also be worth watching the company’s smart tech efforts, which could be a key differentiator in helping Hines stand out from its rivals in a sector where tenants are increasingly looking for cutting-edge technology. However, Europe’s economy is struggling with the ongoing war in Ukraine, lingering impacts from the pandemic, high inflation, and soaring energy costs, all of which could cause problems for the real estate market.