RPT Realty: Potential Upside At Reasonable Risk (NYSE:RPT)

buzbuzzer

RPT Realty (NYSE:RPT) is a REIT that owns a national portfolio of open-air shopping destinations located in top U.S. markets. At present, the company’s portfolio consists of 47 wholly-owned shopping centers and another 50 properties through their joint venture agreements.

Their geographic presence is almost entirely in the top 40 national markets in the country. In recent periods, the company has gone even further by reshaping their portfolio towards higher growth markets, such as Boston, Atlanta, Nashville, and Florida. Collectively, these regions now account for just over 50% of RPT’s total property value, with three top markets in Florida, Tampa, Miami, and Jacksonville, accounting for 28% of the total.

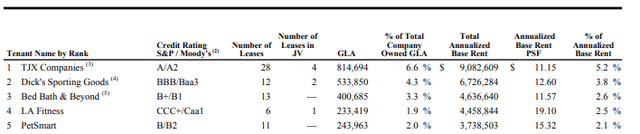

Among their top retail tenants are The TJX Companies, Inc (TJX), DICK’S Sporting Goods, Inc (DKS), and Bed Bath & Beyond, Inc (BBBY). Together, these three tenants accounted for just over 11% of total ABR at the end of March 31, 2022. TJX, alone, accounted for just over 5%. Hedging against the retail-elements of their portfolio is the grocery-anchored characteristics of their properties.

RPT Investor Supplement – Top Five Tenant Summary

At present, RPT is currently trading at the bottom of their 52-week range and is trading at just 9.2x forward FFO. That is contributing to an attractive dividend yield in excess of 5%. Following a strong earnings release and favorable revisions to guidance, shares appear to be oversold. For REIT-focused investors, RPT offers significant upside potential in addition to stable income payments that have recently grown at attractive rates.

Strongest Leasing Volumes In Over a Decade

In the most recent filing period ended March, 31, 2022, RPT reported total revenues of +$56.1M. This was 12% greater than the same period last year and slightly better than expected. Growth in revenues were attributable in part on contributions from newly acquired properties and the acceleration of below market leases from tenants who vacated prior to the original ending lease date.

Lower bad expense and minimum rent growth resulting from occupancy gains, favorable leasing spreads, and annual escalators contributed to strong same-property NOI growth of nearly 10% and OFFO/share growth of 37% during the period.

On the leasing front, RPT reported their best quarterly volumes in over a decade. In total, the company signed 82 leases totaling 716K square feet, which is more than the prior two quarters combined. Additionally, at a weighted average lease term of 7.1 years, RPT is locked in at new lease spreads that were 20% greater than the prior period and 25.7% on a trailing 12-month basis.

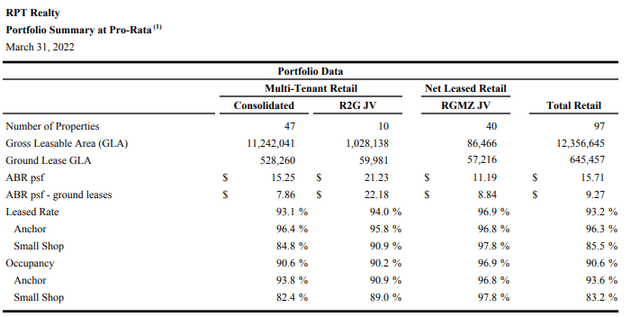

The strong leasing activity during the period pushed their leased rate to 93.2%, while overall portfolio occupancy held strong at 90.6%, with anchors at 93.6% and small shops at 83.2%. Another figure to note is the uptick in the small shop leased rate to 85.5%, which is up from the 85% reported at the end of 2021. This is notable because the rate typically dips in the first quarter following the holidays.

RPT Investor Supplement – Portfolio Statistics as of March 31, 2022

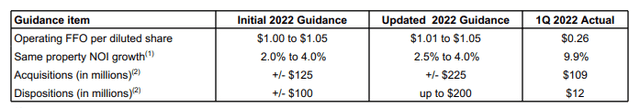

Looking ahead, management increased full-year guidance by raising the low end of their same-property NOI growth by 50 basis points. In addition, they increased their FFO/share guidance to a range of $1.01 to $1.05 from $1.00 to $1.05 previously.

Furthermore, YOY same property base rent is expected to accelerate in the back half of the year as their signed but not commenced backlog comes online. Despite the increase in expected earnings, however, management expects growth in same-property NOI to decelerate due to more challenging comparisons to prior year stemming from bad debt.

RPT Investor Supplement – 2022 Full-Year Guidance

Favorable Underlying Fundamentals

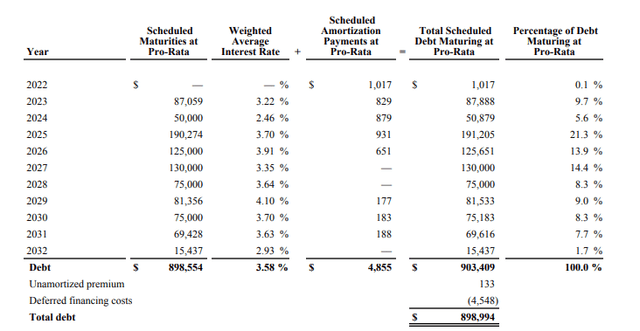

As of March 31, 2022, RPT had total assets of +$1.9B and total liabilities of +$1.0B, comprised principally of +$849M in net notes payable. Total liabilities, overall, were down +$49M sequentially and +$81M YOY.

As a multiple of adjusted EBITDA, net debt at period end was 6.8x. RPT did, however, have +$10.3M of signed but not yet commenced leases and leases under advanced negotiation. When including that in adjusted EBITDA, leverage would be about 6.3x, which would be slightly lower than the prior quarter.

While the debt load appears high, the company benefits from the fixed-rate nature of the holdings, which provides protection against the current rising rate environment. In addition, most of the debt is due in 2025 and onwards. Therefore, there are limited repayment-related risks in the near-medium term.

RPT Investor Supplement – Summary of Debt Maturities

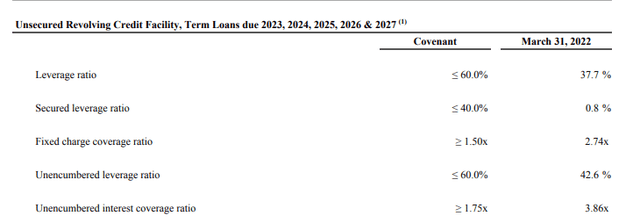

RPT is also comfortably in compliance with their covenant ratios. Total leverage, for example, is just 37.7% versus a requirement of less than 60%. Continued compliance with these ratios provides confidence that the company is capable of satisfying all their servicing obligations prior to the principal maturities of their long-term debt.

RPT Investor Supplement – Summary of Covenant Compliance

At period end, RPT had total liquidity of +$383M, consisting of funds available on their revolving facility, forward basis equity, and cash on hand. At present, these funds, together, are more than enough to cover RPT’s general and strategic purpose uses.

With net debt on the higher end at 6.8x, however, the company has opted for greater utilization of their ATM offerings. In fact, in the most recent period, RPT raised their ATM from +$100M to +$150M. With interest rates on the rise, equity and dispositions figure to be their cheapest currencies of funding, though that does come at a cost of earnings dilution in the case of equity offerings.

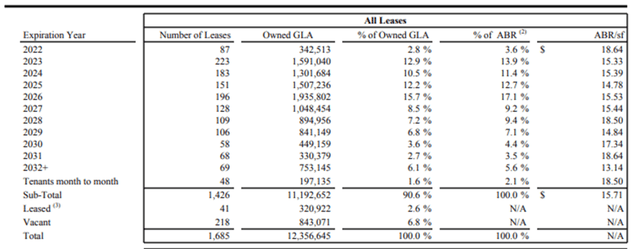

From an earnings perspective, RPT’s operations continue to improve with upper-single digit NOI growth and bad debt progressively returning to pre-pandemic levels. ABR PSF also remains strong at $15.71/PSF, which is up $0.26/PSF sequentially and $0.24 YOY.

Additionally, from 2023 through 2027, the average ABR/PSF of the expiring leases are all below their in-place portfolio average. This should enable continued growth in re-leasing spreads in the years ahead.

RPT Investor Supplement – Summary of Lease Expirations

Favorable leasing activity and earnings growth have contributed to healthy cash flows from operations. During Q1FY22, RPT generated +$13.9M in cash from operations. This was lower than the +$18.9M generated last year due primarily to working capital changes that included higher payments of A/P. Despite the decrease, cash from current period operations was still more than sufficient to cover their development activities, which totaled +$4.6M.

Currently, RPT pays an annual dividend of $0.52/share. This represents a yield of about 5.4% at current pricing. In mid-2021, the payout was increased 60% and then another 8.3% this year to its current level. With total payouts to common shareholders of +$10.2M in the current period, operating coverage stood at 1.4x, which is adequate.

Though the dividend was suspended in early 2020 due to uncertainties surrounding COVID, it is slowly returning to its pre-pandemic level of $0.88/share. With management expecting occupancy to reach 95% by 2024, a return to a $0.88/share payout is possible. That would represent a highly attractive yield of 9%.

Some Risks to Consider

RPT’s properties have heightened geographic exposure to Florida and Michigan, with each accounting for 20.7% and 16.2%, respectively, of total ABR as of December 31, 2021. While there are inherent advantages of operating in these locations, the high degree of concentration subjects RPT to risks that may arise in the local economies. If either state were to suffer significant economic deterioration, the performance or value of RPT’s properties could be adversely affected.

RPT also has significant exposure to their top 25 tenants, who accounted for 42% of ABR as of March 31, 2022. Additionally, their top three, TJX, DKS, and BBBY, represented 11.6% of ABR. With these tenants being retail-focused, the company is at greater risk in recessionary business cycles. While TJX is a company that could benefit due to their bargain offerings, DKS and BBBY are two that would be subject to greater downside risk. If any of these tenants were to experience financial difficulties such that they are unable to make rental payments, RPT’s operating results would be negatively impacted.

Since many of the company’s properties rely on anchor tenants to attract customers, RPT could be negatively affected by the loss of any one of their anchors. Not only would RPT lose the anchor tenant, but other tenants within the same shopping center could also be given the right to terminate their leases or be entitled to lease reductions pursuant to the terms of their leases. Furthermore, the loss of an anchor could result in lower customer traffic to the center, which would affect their other tenants in the center.

Upside at a Reasonable Level of Risk

RPT owns a quality portfolio of open-air shopping destinations. In recent periods, the company has increased their geographic exposure to favorable regions, such as Florida. At over 90% occupancy, the portfolio has proved resilient despite the hardships of the pandemic.

Leasing activity during the most recent quarter was the strongest in over a decade, with favorable leasing spreads expected to provide tailwinds into 2023 and 2024. Furthermore, the leases expiring from 2023 through 2027 have average annual rent PSF below the company’s in-place portfolio average. This should drive continued growth in spreads in future periods. Expected occupancy of 95% by 2024 is yet another opportunity for future earnings growth.

At 9.2x forward FFO and just above 52-week lows, shares appear to be oversold, given their outlook. With the dividend being steadily increased over the last two years, there is the possibility the payout could reach a yield in the upper single digits at current pricing. At even a modest multiple of 12x forward FFO, shares, excluding the dividend, would have upside of over 20%. For REIT investors seeking a bargain addition to their portfolios, RPT provides quality at a reasonable level of risk.